Spotless Group Holdings Limited (ASX: SPO), headquartered in Melbourne, Australia, provides a plethora of outsourced integrated services under multiple brands comprising AE Smith, Alliance, Ensign, EPICURE, Clean Event, Clean Domain, Mustard, Nuvo, Skilltech, Taylors, TGS and UASG, to clients across Australia and New Zealand. Downer EDI Limited (ASX:DOW) owns a major interest of 88% in Spotless.

The services offered comprise of technical, engineering and construction services; asset maintenance and management; catering and hospitality; cleaning maintenance program; facilities management; laundry management; security and electronic solutions; sustainability services; and utility support.

The company, founded in 1946, caters to the markets including business, defence, government, healthcare, power, stadia, senior living, public private partnerships, education, venues & leisure, resources, transportation and water.

Some of the key clients include Adelaide Town Hall, retail sites at Auckland Airport in New Zealand, Australian National University (ANU) in Canberra, Ballarat Convention & Exhibition Centre, Bendigo Hospital and BlueScope Steel (ASX:BSL) amongst many others.

Application for Delisting: On 25 June 2019, Spotless Group Holdings announced to the market that it had submitted a formal application its removal from the Australian Securities Exchange (ASX) Official List, pursuant to ASX Listing Rule 17.11 (Delisting) and has released the Notice of Meeting of Spotless shareholders being convened to consider, and if thought fit, to approve the Delisting.

There are a few reasons put forth by the Spotless Board as they consider delisting to be in the best interests of Spotless and its shareholders. These are summarised below-

- Costs: According to Spotless, continuing listing requires the company to incur considerable corporate and administrative expenses, including listing fees. Spotless is seeking to minimise its expenditure and getting removed from the official list of ASX would help in eliminating such costs. The Board of Spotless has determined that the costs of remaining listed on the ASX outweigh any benefits of listing for Spotless.

- Liquidity and shareholder spread: Trading in the ordinary shares of Spotless has had a low level of liquidity over a significant period on the ASX, which has led to low trading volumes and an erratic share price. Two shareholders in Spotless collectively hold 99.44% of the ordinary shares in Spotless (Shares).

Spotless has received in-principle advice from ASX that it is likely to remove the company from the official list, on a date to be determined by ASX in consultation with the company, subject to compliance of certain conditions.

The General Meeting of Shareholders to consider and, if thought fit, approve the delisting will be held on Friday, 26 July 2019. Spotless will announce the outcome of the vote at the general meeting as soon as practicable after the close of that meeting.

If the delisting is approved by a special majority at that meeting, then the company will be removed from the official list of ASX on 30 August 2019. Trading in its shares will be suspended from 7.00pm on 27 August 2019.

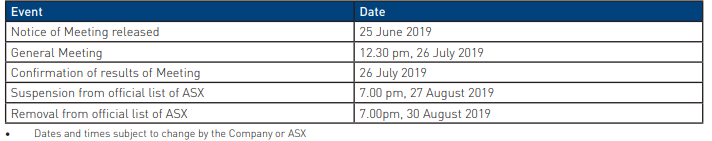

The proposed timetable for the removal of the company from the official list of ASX (and assuming the special resolution is passed by shareholders) is given below.

Source: Companyâs announcement dated 25 June 2019

New Contract Secured: On 18 April 2019, Spotless Group Holdings secured a contract to join the North Queensland Stadium team as the official caterer for the new venue, for a period of five years, marking the continuation of the 10-year relationship with the North Queensland region.

Under the terms of the contract, Spotless will cater to food outlets, corporate hospitality suites and bars with its hot and cold food & beverage services. The Townsville-based stadium, which will have a seating capacity of 25,000 people, is due to be built in time for the National Rugby League season in 2020.

Ingham Road Seafood owners Mark Partland and Louise Partland will work with the company, aiding it in its new order for the stadium. Moreover, Spotless will continue to work with other local subcontractors in order to cater its clients with varied food offerings.

Spotless Group Holdings has a corporate expertise of servicing major stadia and entertainment venues. The company has served Melbourne Cricket Ground and hbf Park in Perth.

Envar Acquisition: In March 2019, Spotless Group Holdings announced that it had completed the acquisition of Envar Group, a Western Australia-based market leading provider of mechanical contracting and maintenance services to clients. The group includes Envar Service, Envar Engineers and Contractors, and Airparts Fabrication.

Financial Information: In February 2019, SPO declared its financial performance for the first half of financial year 2019 ended 31 December 2018. The sales revenue from ordinary activities amounted to ~ $ 1.46 billion, down 2.7% as compared to the prior corresponding period (pcp), reflecting the impact of contracts exited in the first half of 2018 (1H18), partially offset by newly mobilised contracts. Spotless had revenue of as large as $ 3 billion for the financial year ended 30 June 2018.

The reported net profit from ordinary activities after tax grew stupendously by more than 100% to $ 39.0 million.

The EBITDA of $ 121.6 million for the concerned period grew by $ 107.9 million relative to 1H18 due to the comparative period being significantly impacted by $ 109.3 million of individually significant items recorded as a result of the Downer takeover and contract rationalisation and restructure.

Operating cash flows of $ 75.9 million increased by $ 35.4 million on pcp. The improvement was driven by further continued focus on cash management and a reduction in the cash losses incurred on the new Royal Adelaide Hospital contract.

As of 31 December 2018, the net debt stood at $ 701.7 million, decreasing by $ 104.0 million on pcp.

Stock Performance: Spotless Group Holdings has a market capitalisation of around AUD 1.82 billion with approximately 1.1 billion shares traded. Today, on 26 June 2019, the SPO stock last traded at AUD 1.680, up 1.818% by AUD 0.030. Its 52-week high is AUD 1.815.

Recently, Coltrane Group increased its shareholding in the company upon purchase of additional ordinary shares, which now total 128,317,06, representing a voting power of 11.64%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.