Highlights

- Allup Silica has provided an update on the Inferred Mineral Resource of the Sparkler A Project.

- 37 million inferred tonnes at 99.66% SiO2 and 0.02% (200ppm) Fe2O3 in fine sand fraction (0.106mm – 0.6mm).

- 25 million inferred tonnes at 99.67% SiO2 and 0.03% (300ppm) Fe2O3 in fine sand fraction (0.106mm – 0.6mm).

- Sand fraction of 0.106mm – 0.6mm is suitable for high-quality glass manufacturing.

- The latest resource update reclassified the resource in three fractions based on sand particle size. The updated mineral resource has boosted the company’s confidence in the project as it progresses ahead with the exploration of Sparkler B and Sparkler C projects.

In a major boost to the Sparkler A Silica Sand Project, Allup Silica Limited (ASX:APS) announced that the Inferred Mineral Resource Estimate of the project has been updated by an independent geologist. The latest estimates are the result of recent metallurgical tests.

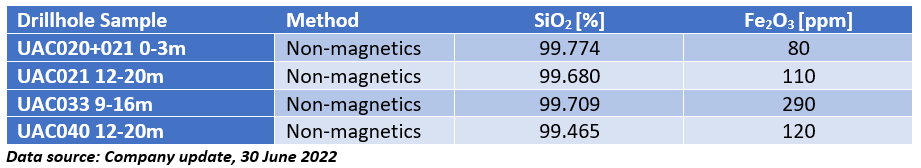

Samples from four drill holes were sent to a lab in Perth for metallurgical test work. Sizing analysis was carried out by the lab, followed by wet screening. Additional test work, including attrition analysis, heavy liquid separation and magnetic separation was conducted on the sand fraction 0.106-0.6mm.

The results of the metallurgical tests demonstrated that the resource at the Sparkler A Project has the potential to produce high-grade silica sand products.

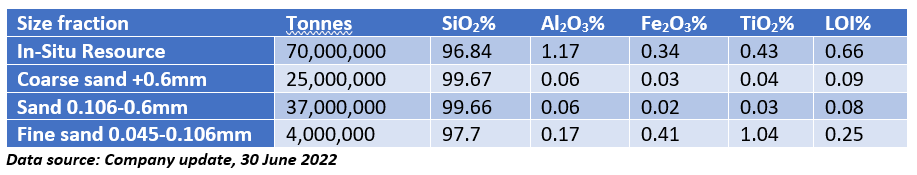

The updated Inferred Mineral Resource estimates reclassifies the resources into three sand fraction characterisations based on the sand particle size. The latest results are shown below:

The previous mineral resource estimate for the project was 73Mt @ 96.6% SiO2 and 0.41% Fe2O3.

The previous mineral resource estimate for the project was 73Mt @ 96.6% SiO2 and 0.41% Fe2O3.

Metallurgical testwork shows that the following magnetic separation samples yielded a 99.465% to 99.774% SiO2 and 80ppm to 290ppm Fe2O3 across the four samples, as shown below.

This test work demonstrates that the sand fraction of 0.106-0.6mm is suitable for high-quality glass manufacturing and applications.

This test work demonstrates that the sand fraction of 0.106-0.6mm is suitable for high-quality glass manufacturing and applications.

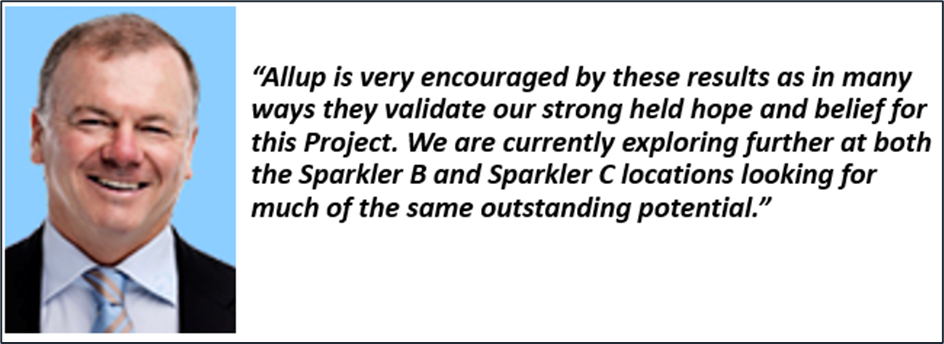

Commenting on the latest resource update, Allup’s Chairperson, Mr Andrew Haythorpe, said:

Data source: Company update; Image source: Company website

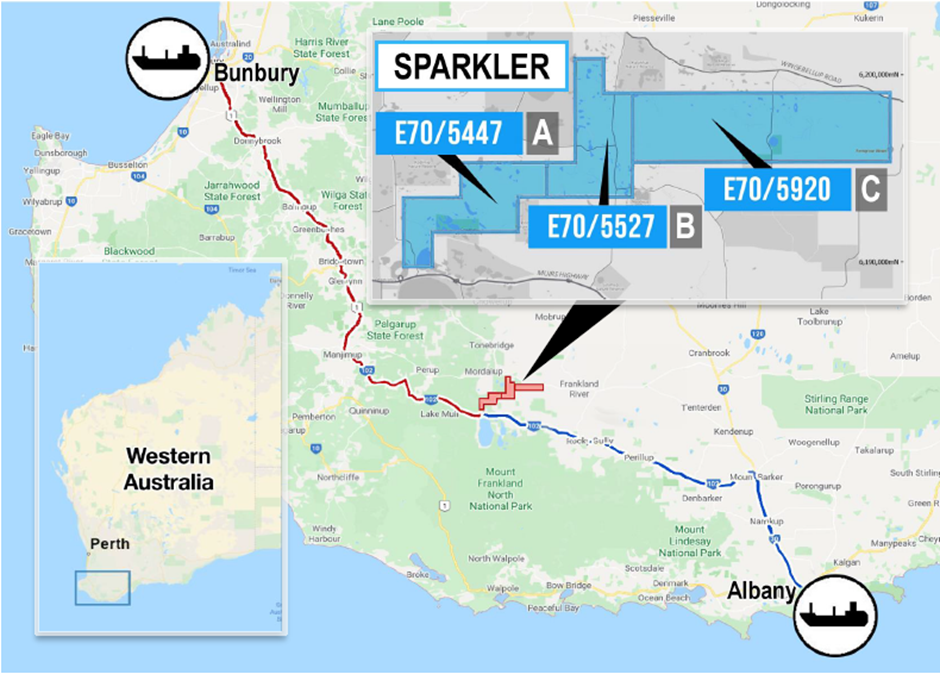

Sparkler Silica Sand Exploration Project

The Sparkler Sand Project includes three granted exploration licences – Sparkler A (E70/5447), Sparkler B (E70/5527) and Sparkler C (E70/5920). Located around 300km from Perth in Western Australia, the Sparkler Project boasts of well-established infrastructure.

The project is close to two ports Bunbury Port (200km west) and Albany Port (150km south-east).

Sparkler Project location map (Image source: Company update, 30 June 2022)

Sparkler Silica Sand Project is generally located on a private land. The land was typically used for pastoral farming or commercial plantation forest, which has since been cleared.

Allup currently has a number of high-grade silica sand projects in its portfolio. Allup has set its eyes on becoming a market leader in silica sand exports. Its primary focus is on the development of its Projects towards a potential for commercialisation, where it aims to carry out continuous exploration and increase the mineral resource estimates to higher JORC compliance levels.

Share price movement: APS is trading at AU$0.098 with an uptick of 2% at around 12:00 PM (AEST). The Company has a market cap of AU$8.11 million as of 30 June 2022.