Highlights

- The steel and alloy industries account for nearly 90% of the current demand for vanadium.

- Vanadium Redox Flow Batteries’ (VRFB) growth is expected to drive further demand for vanadium as focus shifts to storage of renewable energy.

- With global economic recovery on track, demand for vanadium from sectors like aerospace and chemicals is expected to grow.

- Vanadium Resources operates as one of the largest and highest grade vanadium projects in the world.

- The PFS study has delivered encouraging financial metrics on only 12% of the resource for the project.

- VR8 is currently advancing DFS on the project, which has a mineral resource of 662 [email protected]% V2O5.

- There is lots of talk now about countries looking to become energy self-sufficient and this will further grow the demand for VRFBs.

Vanadium has become a strategic metal in most parts of the world. Nearly 90% of the current demand for vanadium arises from the steel and alloy industries.

For a long time, vanadium has been seen as an alloy metal that increases the strength of rebar used in the construction industry. The metal provides enormous strength to alloys used in the construction of airplanes, jet engines and cars. Studies suggest that manufacturers are increasing the percentage of vanadium in automobiles to make them lighter without compromising the strength.

Moreover, the use of vanadium redox flow batteries (VRFB) is an emerging market for vanadium. The increasing use of renewable energy and advancing work to develop batteries using vanadium as a core metal are leading to surging demand for vanadium.

With this backdrop, let us explore how mineral explorer Vanadium Resources Limited (ASX:VR8) fits in the current context.

Latest update: Vanadium Resources (ASX:VR8) advances on pilot plant test work post bulk sampling completion

Vanadium Resources holds one of the largest and highest grade deposits of vanadium in the world. The Company has been making some eye-catching progress, with notable developments across its Tier 1 Steelpoortdrift Vanadium Project in South Africa.

The Company has been advancing a Definitive Feasibility Study (DFS) on the project, to undertake mining operations and construct a concentrator and salt roast plant. The facility is expected to have an initial production of 12,500tpa of vanadium oxide flakes.

Related read: Vanadium Resource (ASX:VR8) upbeat about its progress on DFS study

Steelpoortdrift Project: one of the largest and highest grade known vanadium deposits,

the world-class Steelpoortdrift Project boasts a mineral resource of 662 Mt @ 0.77% V2O5. The project sits within the Bushveld Complex, which is home to several major mining projects in the region, including primary Vanadium producers like Bushveld Minerals and Glencore.

Early in the year, the Company increased its stake in the project from 50% to 73.95%. The Company incurred no additional costs to increase its ownership of the project. The Tier 1 Steelpoortdrift Project is now effectively under VR8's authority.

Related read: A closer look at Vanadium Resources’ (ASX:VR8) proprietary ESG Technology

Vanadium Resources is committed to becoming one of the world's largest and highest-grade vanadium producers. The project ownership increase makes it possible for the Company to confidently prepare the required runway towards securing construction finance and attracting the right mix of financial partners and stakeholders.

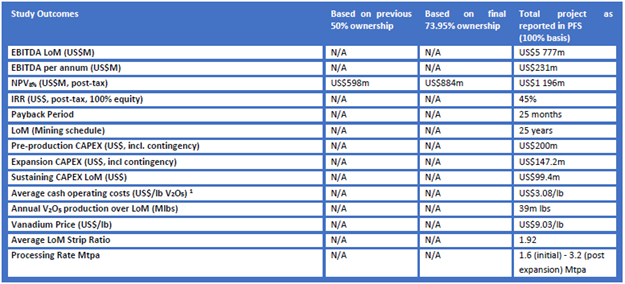

Data for the financial metrics for a base case of 73.95% ownership was included in the Prefeasibility Study report published last year.

With the increased project ownership, the net present value (NPV) at an 8% rate is US$884 million attributable to VR8. The figure was roughly 48% lower when the Company owned 50% of the project.

PFS Study outcomes (Image source: Company update, 19 January 2022)

Related read: Is VR8 a potential Tier 1 Vanadium producer?

According to the PFS, the project will have a pre-production CAPEX of US$200 million.

By looking at the size of the project and the current vanadium market, it could be said that the project has significant potential. The Pre-feasibility Study (PFS) has already indicated excellent project finance metrics.

Stock Performance: Vanadium Resources has a market cap of AU$47.31 million, as of 4 April 2022. VR8 shares were trading 15% higher to AU$0.115 midday on 4 April 2022. In the last one year, the stock has delivered a return of over 91%.

Related read: Vanadium Resources makes giant strides at Steelpoortdrift in December quarter