Shares of First Au Limited (ASX:FAU) rallied 7.1% to AU$0.0075 after the company announced a significant update on its Gimlet gold project in Western Australia. The gold exploration company has been conducting further test work on the Gimlet project to make progress at the project by showcasing its economic potential.

The test work has showcased high recovery rate from the processing of gold ores at Gimlet. The testing so far has resulted in a recovery rate of 87.99%.

Read Here: Here’s latest update on First Au’s (ASX:FAU) Talga Project JV and Farm-In

The test work phase had been initiated to determine different metallurgical parameters for gold extraction and followed up the previous testwork conducted by IMO Metallurgy in 2019. FAU has involved Upside Metallurgy to monitor the current metallurgical test work phase, which was conducted by ALS Metallurgy to explore appropriate beneficiation routes for the Gimlet project.

Diamond cores were used to create a master composite sample, which was split into two composites, one of which was used for comminution phase while the other one was used for recovery test work. The Abrasion and the bond ball work index tests were included in the comminution phase of test work.

Important Read: First Au (ASX:FAU) concludes maiden drilling at Dogwood, records gold grades up to 135g/t at Haunted Stream

The recovery testwork was assess the potential recovery utilising a flotation and oxidative leach processing route. The samples were initially subjected to flotation to produce a flotation concentrate, which was later subjected to oxidative leaching and ultimately cyanide leaching. The flotation tail underwent gravity concentration and later cyanide leaching to evaluate if the flotation tail increased the recovery rates.

Some of the major findings were –

- Comminution test work demonstrated the soft nature of Gimlet ore (13.3kWh/t) with a very low Bond abrasion index (0.0129).

- Feed grade of the composite was recorded to be 4.85g/t.

- Flotation of the ore produced a concentrate gold grade of 33.16g/t, with a recovery of 91.93%.

- The oxidative and subsequent cyanide leach stage recovery was 93.0%.

- The combined overall recovery (Flotation + Oxidative Leach + Flotation tailings cyanide leach) was 87.99%.

FAU will consider additional metallurgical testing to find the optimal gold recovery processing route. Apart from the metallurgical test works, FAU has also assessed other sections of the project. First Au has involved consultants to conduct initial modelling of open-pit design and underground mining options.

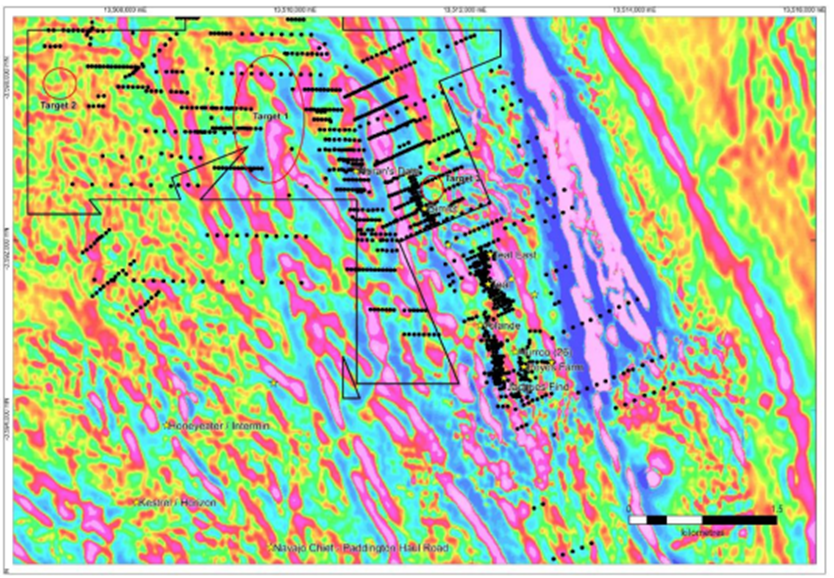

Airborne magnetic image at the Gimlet project Source: CPM Announcement 22 August 2022

As part of the preliminary optimization works, FAU has also undertaken a review of the existing resource model. The review has highlighted areas of potential upside to the existing resource, particularly to the north end of the resource where FAU believes it is open at depth below 90m.

Under the preliminary optimization works, First Au conducted a reassessment of the current resource model. The review highlighted zones with potential upside for the existing resource, especially the zone to the north end of the existing resource.

Must Read: First Au (ASX:FAU) boosts project portfolio through rigorous exploration programs

The company believes further opportunity for exploration success at Gimlet and believes that the recent exploration success of Horizon Minerals along strike within the Binduli-Teal area bolsters the opportunity at the Gimlet gold project. The company has already delineated target zones for future aircore drilling program.