- An updated Inferred JORC Mineral Resource Estimate (MRE) represented a 560% increase in Lithium resources.

- Orebody at surface from 0.2 m to 12 m and open to depth.

- Mineral Resource Area represents only 19% of 14 exposed pans.

- The Li2CO3 (Lithium Carbonate Equivalent, LCE) content of Mineral Resource increased by 430%.

- The company is working with the Chemical Engineering department of The University of Stellenbosch on various lixiviants and processes to investigate the best recovery processes.

- Leaching test work to date has shown potential for an organic acid to recover 82% of Lithium from the clays, outperforming sulphuric acid.

- large scale test work underway to investigate best recovery processes to possibly produce a Battery Grade Lithium carbonate product.

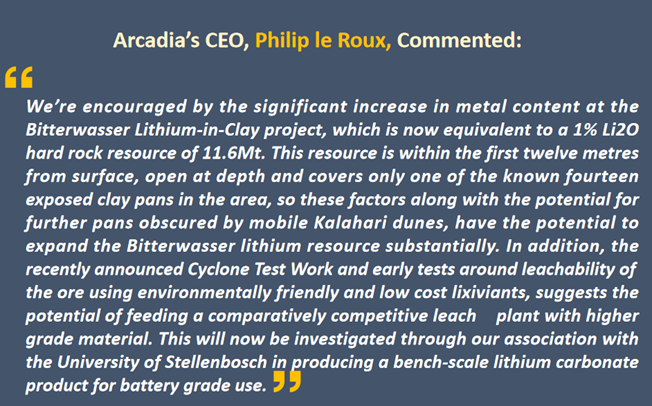

In an important update, ASX-listed diversified exploration company Arcadia Minerals Limited (ASX:AM7) has highlighted remarkable results of the Phase 2 drilling program with an Updated Inferred JORC Mineral Resource Estimate (MRE). The updated MRE is based on data from 77 auger drill holes and 486 core samples. The company currently targets Namibia's Tantalum, Lithium, Nickel, Copper and Gold.

The updated Inferred JORC Mineral Resource Estimate (MRE) is defined over Eden Pan (located in Kalkrand, Namibia) of 85.2 million tonnes@633ppm for 286,909t Li2CO3 (LCE), representing an approximate 560% increase. Moreover, as per the data of Cyclone Test Work, the company is expecting a 430% increase in lithium carbonate equivalent (LCE) content. It is equivalent to a concentrate of 59.6 million tonnes@817ppm for 259,231 tonnes of Li2CO3 (LCE), which could be produced from the MRE.

Source: Company’s website

Must read: Arcadia Minerals (ASX:AM7) delineates potential for district-scale lithium-in-brines system at Bitterwasser

The resource is represented by one of the 14 exposed pans covering just 19% of the total pans' area. Thus, the potential for further pans obscured by cover from mobile Kalahari dunes is also present.

The resource’s ore body is present in depth from 0.2 m to 12 m and open at depth (an indication that mineralisation may be open-ended in depth is based on the Auger drilling data and the 3D modelling undertaken). The possibility of further discovery may expand the Bitterwasser lithium resource substantially.

The company is working at the University of Stellenbosch Chemical Engineering department from July till September 2022 on various lixiviants and processes to investigate the best recovery processes to produce a Battery-Grade Lithium carbonate product possibly. To date, the Leaching test work has been very promising as they've shown a potential for organic acid with a recovery of 82% lithium from clay, thus outperforming sulphuric acid.

Source: Company’s ASX announcement, 24 August 2022

Based on the opinion of the Competent Person (Dr Johan Hattingh), realistic prospects for the economic extraction of lithium exists at the Bitterwasser Eden Pan deposit. He also considers a good potential for delineating further Mineral Resources and Ore Reserves following the ongoing exploration and development.

Future plans: To date, no work has been done on the brine potential at this prospect, and only lithium-bearing clay has been considered a potential resource target; this will receive focused attention shortly. Similarly, the potassium and boron potential at the Eden Pan remains unassessed.

The company’s stock is trading at AU$0.455 on 26 August 2022, higher by 133.333% after the update's release.