Saracen Mineral Holdings Limited (ASX: SAR)- another ASX-listed gold miner recognised higher profits and revenue amidst the gold rush, which propelled many gold miners in the Australian market.

Gold prices in the Australia markets are at a record high, while it remains at multi-year highs in the international market. The higher prices coupled with ramped up production, have boosted the income stream, which in turn, is now allowing the gold mining companies to distribute benefits to the shareholders in terms of higher stock returns and dividends.

Newcrest Mining Limited (ASX: NCM) recently posted decent profits and surpassed market expectations. The company declared high dividends as well for the shareholders in FY2019.

Read Here: Newcrest Beats Industry Expectation; While GORâs Gruyere Leaps For 100,000 Shiny Ounces

Post the bumper financial year 2019; it is time for Saracen to demonstrate an unprecedented move. The company announced an inaugural âDividend Policyâ to break the chain of no dividend.

SAR FY2019 Highlights:

Operational Metrics:

SAR achieved a record production of 355,077 ounces for FY2019 and witnessed a reduction in cost, the all-in sustaining cost (or AISC) of the production stood at A$1,030 per ounces in FY2019.

The production in FY2019 underpinned a yearly growth of over 12 per cent, while the cost decreased by over 9.5 per cent in FY2019.

SAR witnessed a production growth at both of its wholly-owned gold prospects, namely the Carosue Dam Operations (or CDO) and the Thunderbox Operations.

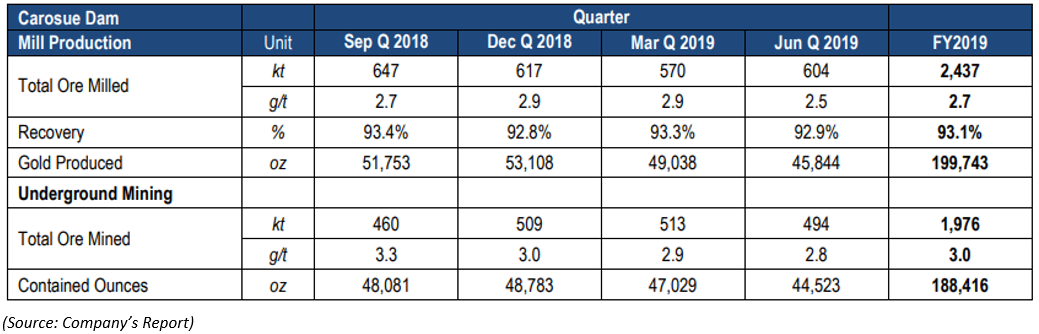

CDO Growth:

SARâs CDO milled lower ore grades (2.5g/t) during the June 2019 quarter as compared to the ore grades (2.9g/t) processed by the operations in March 2019 quarter. The lower grade quality led to a fall in recovery rate during the June 2019 quarter, which stood at 92.9 per cent, against the recovery rate of 93.3 per cent in March 2019 quarter.

The lower grade coupled with a fall in the recovery rate increased the volumes of milled ore, which stood at 604k tonnes during the June 2019 quarter, up by almost 6 per cent against the previous quarter volume of 570k tonnes.

Despite that, the company managed to surpass the previous year production level of 171,301 ounces, and the overall production from the CDO in FY2019 stood at 199,743 ounces. SAR also witnessed a fall in AISC of the gold operation at CDO, and the AISC for FY2019 stood at A$1,056 per ounce, as compared to the previous corresponding period (or pcp) AISC of A$1,199 per ounce.

The quarter wise production metric for CDO is as:

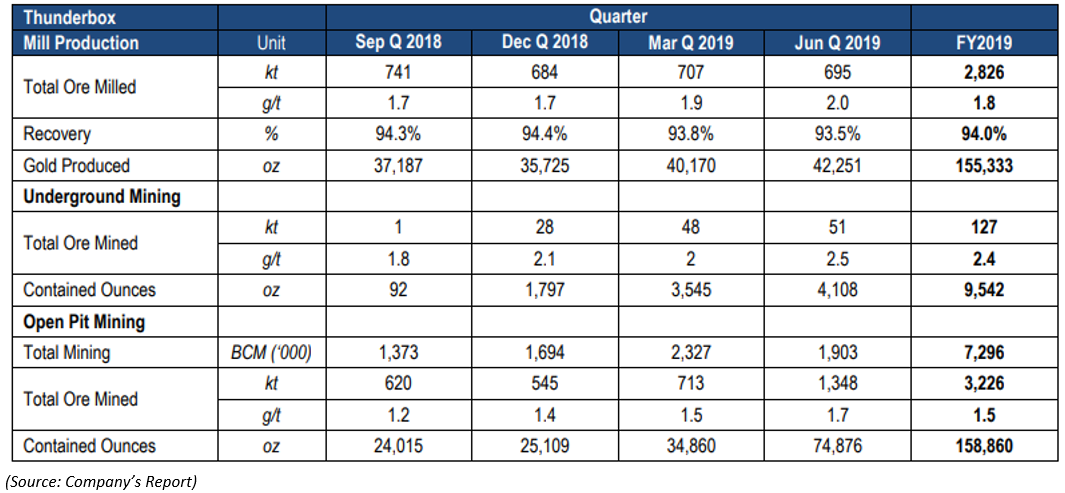

Production at the Thunderbox:

The output from the operations surpassed the FY2018 level of 145,152 ounces, and the overall production from the operations in FY2019 stood at 155,333 ounces.

During the June 2019 quarter, the company milled 695k tonnes of ore, which was lower than the pcp milled volume of 707k tonnes of ore. The increased ore grades coupled with steady recovery rate in the June 2019 quarter, supported the production to surpass the pcp production level.

The gold production in June 2019 quarter stood at 42,251 ounces, up by 5 per cent against the March 2019 quarter gold production of 40,170 ounces.

The quarter wise production metric for the Thunderbox operations is as:

Financial Metrics:

The revenue of the company underpinned the growth of 9 per cent in FY2019 and stood at A$555.6 million against the previous financial year revenue of A$511.0 million. The net profit after tax (or NPAT) of the company for FY2019 stood at A$92.5 million, up by 22 per cent as compared to the previous financial year NPAT of A$75.6 million.

The underlying NPAT witnessed a growth of 40 per cent in FY2019 and stood at A$94.2 million against the pcp underlying NPAT of A$67.3 million. While the NPAT grew by 22 per cent, the EBITDA of the company recorded an increase of 11 per cent in FY2019 to stand at A$219.5 million.

Liquidity and Cash Flows:

SARâs cash flow from the operating activities in FY2019 stood at A$228.059 million, up by over 19 per cent as compared to the previous financial year cash flow from the operations of A$191.425 million.

Post adjusting with other cash inflows and outflows, the closing cash left with the company at the end of FY2019 (ended 30 June 2019) stood at A$118.715 million, up by almost 19 per cent, as compared to the closing net cash of A$99.774 million at the end of FY2018.

The total cash and liquid position of the company at the end of FY2019 stood at A$154.4 million, out of which approx. A$10.3 million was represented by 5,882 ounces of gold in transit.

The available liquidity, including an undrawn debt facility of A$150 million at the end of FY2019 stood over A$300 million.

Exploration and SARâs Policy:

During FY2019, the company allocated A$60 million for exploration with an aim to unlock values from the brownfields and greenfields opportunities. The company intends to build an early-stage project pipeline along with the growth of the existing prospects.

The current managing director of the company- Raleigh Finlayson explained the companyâs policy and mentioned that the priority target of the company remains exploration and growth.

SARâs policy is focused on growing the earnings, production and mine lives of the prospect, and the company allocated A$50 million for exploration in FY2020.

However, a higher free cash flow allowed the company to consider a dividend payout.

Dividend Policy:

While the company did not pay any dividend in the past and in FY2019, SARsâ inaugural dividend policy decided to target a dividend distribution for FY2020, which would represent 20 to 40 per cent of NPAT.

However, the policy remains subjective to the maintenance of a minimum cash balance of A$150 million.

Shareholdersâ Joy:

The long-term investors have enjoyed the appreciation in the share prices of the company, further the short-term investors have also enjoyed the recent gain in the share prices of the company over the bull run in gold.

Return Profile:

The share prices of the company have delivered massive returns over the long-term and decent returns over the short-term.

As per yesterdayâs closing price of the shares (AS$3.910), the company delivered a return of 1768.06 per cent in 10 years, and 798.85 per cent over the last five years.

The yearly returns from the company stand at 104.18 per cent, while short-term yields such as the YTD and past six months return of the company stands at 34.36 per cent and 21.43 per cent respectively.

The shares of the company closed the session today on ASX at A$3.720.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.