Pioneer Resources Limited (ASX:PIO) is an exploration company with exposure to gold, nickel, lithium and base metal projects in Western Australia. The company today confirmed 1 Km priority nickel sulphide target at Leoâs Dam on the completion of 60 aircore holes for 4,142m.

On 25 March 2019, PIO notified about the commencement of aircore drilling at the Leoâs Dam Nickel Prospect, located approximately 2KM NE of the Blair Nickel Mine within Golden Ridge Project. Leoâs Dam is one of the five priority targets for nickel sulphide in Golden Ridge Project.

Leoâs Dam Nickel Sulphide Target Advances -

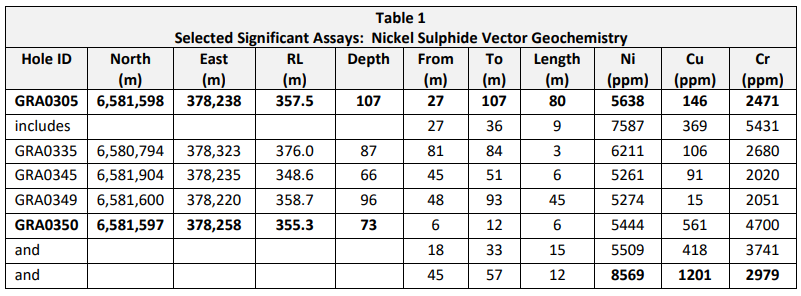

The drilling programme which commenced last month was reportedly designed to test the ultramafic rocks showing evidence of fertility for nickel sulphide mineralisation, following the discovery of nickel sulphides in the year 2018. Litho- geochemical data is used to understand the availability, fertility of ultramafic rocks as a potential host for nickel sulphide mineralisation. The company believes that the presence of nickel, chromium, magnesium and copper in an unweathered rock along with correct geological environment may assess the host of nickel sulphide. When the holes that return a positive nickel sulphide vector were collated with earlier drilling, an anomaly of nickel sulphide exceeded one kilometre in length, prioritising multi-element geochemical area for further drilling.

Image: Nickel Sulphide Vector Geochemistry (Source: Companyâs Report)

Image: Nickel Sulphide Vector Geochemistry (Source: Companyâs Report)

David Crook, Managing Director of PIO, stated that the intersection of nickel sulphides at the Leo Dam Target in 2018has increased the prospectivity of Golden Ridge Project as well as the validity to the Blair Dome geological model has been added. He further mentioned results from the drilling are consistent with geochemical anomalies which makes Leoâs Dam ultramafic unit as a target for future work.

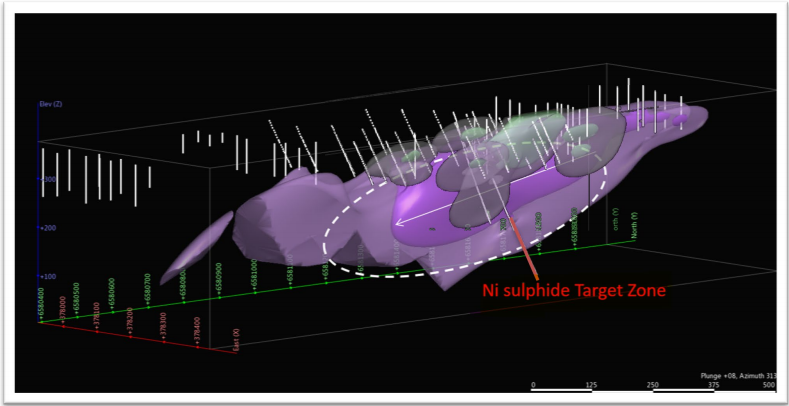

Composite Nickel (purple), Copper (grey, green) Regolith geochemistry showing nickel sulphide target (Source: Company Report)

Composite Nickel (purple), Copper (grey, green) Regolith geochemistry showing nickel sulphide target (Source: Company Report)

Cobalt intersections â

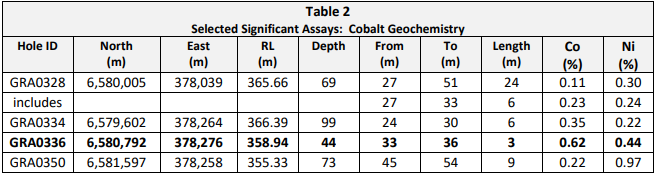

The current drilling programme did not target cobalt specifically. However, east-west drilling traverses has returned significant high-grade cobalt intersections. PIO reckons that Leoâs Dam cobalt mineralisation has similarities to that Mt Thirsty Deposit. Mt Thirsty Deposit is a cobalt-nickel deposit which is operated by Barra Resources Limited (ASX:BAR). BAR recently notified about the advances in extractive metallurgy for its cobalt-nickel deposit.

Cobalt Geochemistry (Source: Company Report)

Cobalt Geochemistry (Source: Company Report)

Outlook â

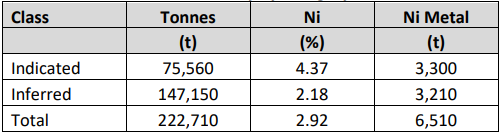

The company stated that the target is defined for the nickel sulphide extraction, and the next phase will include RC drilling to form platform holes required for down-hole electromagnetic surveys to detect rocks that may host enormous nickel sulphide mineralisation. Golden Ridge Project includes priority nickel sulphide targets which are Anomalies 13 and 14, Blair South, Rocket along with Leoâs Dam. As per previous developments to the Golden Ridge Project, PIO led the project with innovative changes to the geological model which proposed the existence of Blair Dome. Ultramafic domes which host major nickel sulphide mines at Kambalda, Tramways and Widgiemooltha. These domes are similar to Blair Dome geologically and in size. Blair Nickel Mine Deposit may reportedly host prospective, basal ultramafic contact target zone. The table below is showing mineral resources estimate for the Blair Nickel Mine, which is 222,710t of nickel sulphide ore with a grade of 2.92% Ni.

Mineral Resource Summary: Blair Nickel Mine (Source: Company Report)

On 14 May 2019, the stock of the company closed at a price of $0.014, with a market capitalisation of circa A$ 21.1 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.