The growth in population is driving demand for food, water and natural resources across the world. To satisfy the increased demand for food, intensification of agriculture is required, which in turn requires fertilisers to improve productivity. The transition to precision agriculture is increasing demand for higher quality fertilisers like Sulphate of Potash (SOP).

Amidst the growing demand of fertilisers, Australian-headquartered fertiliser feedstock explorer, Parkway Minerals NL (ASX: PWN) is specifically catering to this bourgeoning demand. It is the only company that has successfully retrieved both potassium and phosphate from greensand deposits.

Parkway wholly owns two projects in Western Australia - Lake Seabrook and Dandaragan Trough Project (DTP). Moreover, it owns 34 million shares of Davenport Resources (ASX: DAV) and 6.5 million shares of Lithium Australia (ASX: LIT).

With an aim to transform global brine processing methods through innovative technology, Parkway has recently purchased brine treatment technology and two brine projects. In September this year, the company has completed the acquisition of Consolidated Potash Corporation (CPC), that has provided it a direct ownership interests in two highly prospective brine projects - New Mexico Lithium Project (NMLP) and Karinga Lakes Potash Project (KLPP) â and the aMES⢠technology platform.

Source: Companyâs Presentation (3rd October 2019)

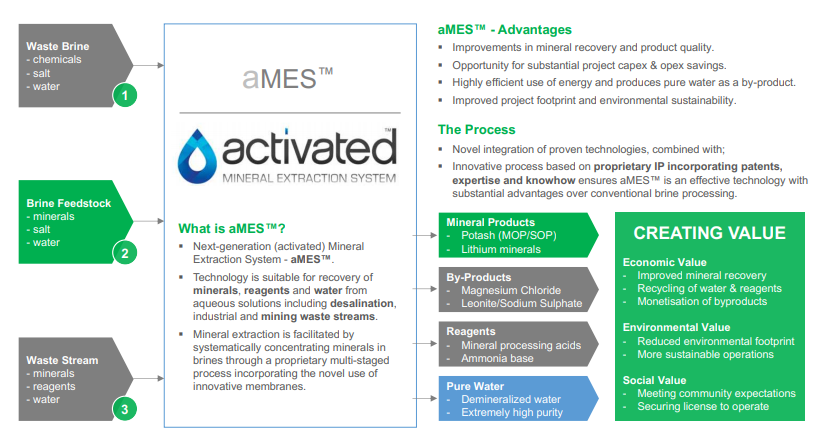

The aMES⢠is the next-generation (activated) Mineral Extraction System, which is suitable for recovery of minerals, reagents and water from aqueous solutions including desalination, industrial and mining waste streams.

The aMES⢠technology is based on innovative system designs, including (patented) designs which provide significant advantages. Below are the key advantages of the the aMES⢠technology platform:

The aMES⢠is an effective technology with substantial advantages over conventional brine processing. The conventional processing plant is highly sensitive to variable feedstock and process conditions, with relatively low potash recoveries. However, the aMES⢠processing plant is an efficient technology that has been specifically optimised for the recovery of intermediate salts and production of high-purity SOP.

Opportunities for aMES⢠technology

The high-quality and low-cost segments of the SOP market are steadily growing, paving the way for for a unique range of brine processing opportunities in the mineral industry. Let us discuss the opportunities available for Parkwayâs aMES⢠technology in the mineral industry below:

Process Water

Desalination plants produce on average 1.5 litres of brine for every litre of freshwater output. Approximately 16,000 desalination plants of the world discharge about 142 million m³/day of brine daily. Amidst this scenario, brine management ranks among the largest restraints to more extensive development and can represent up to 33 per cent of a desalination plantâs cost.

Although a large volume (about 22 million m³/day) of brine is produced at a distance of over 50km from the nearest coastline, very few environmentally sound and economically viable brine management options exist.

Depending on the specific flowsheet, the production of 1 tonne of SOP can require in excess of 10m3 of fresh process water. The aMES⢠technology can recover and recycle high-quality process water from brine, removing/reducing need for fresh water bore field, thereby reducing costs.

Mineral Processing

The primary brine projects comprise playa hosted brines, primarily for the production of potash and lithium. The Solution mining (ISL/ISR) techniques are also utilised to produce potash and other valuable mineral products.

Mineral recoveries associated with flotation and other conventional processes are sensitive to feedstock composition. Parkwayâs aMES⢠technology holds the potential to recover a range of by-product from waste streams.

Waste Brine Disposal

Tailings waste streams usually have a large footprint and represent substantial environmental risks, including community concerns. The construction, operation and maintenance of Tailings storage facility (TSF) represent substantial costs and risks. Amidst this scenario, the treatment of tailings solutions is a high growth sector. In comparison to the conventional means, the aMES⢠technology can effectively process & recover products from the waste streams.

aMES⢠Application Rationale â KLPP and NMLP

Parkway is leveraging its aMES⢠technology to earn into the Karinga Lakes and the New Mexico Lithium Project projects. Let us discuss the application rationale of aMES⢠technology for both of these projects below:

Karinga Lakes Potash Project

CPC holds an initial 15 per cent interest in the KLPP, which is located within the Central Australian Groundwater Discharge Zone and consists of a chain of dry salt lakes. CPC can obtain up to 40 per cent stake in KLPP via staged investment of an additional $2 million. The KLPP has undergone comprehensive appraisal and represents a highly prospective SOP brine project.

In a recently delivered Scoping Study of KLPP based on the aMES⢠technology, it was found that the aMES⢠pathway potentially eradicates the need for gas pipeline, flotation, process steam and a freshwater bore field, which together represent significant costs in the traditional SOP production flowsheet earlier evaluated.

At KLPP, the aMES⢠technology has the potential to swiftly develop a more sustainable and capital efficient potash production operation relative to traditional development pathways. The technology also holds the ability to retrieve magnesium salts as a by-product.

CPCâs JV partners believe that the aMES⢠technology provides the most suitable pathway to potentially developing the KLPP, subject to appropriate feasibility studies. The optimisation opportunities identified at the KLPP have applications for many other potash projects.

New Mexico Lithium Project

CPC holds an initial 70 per cent interest in the NMLP, which is well placed, with major gas, power, road and rail power infrastructure passing via or close to the project area. CPC has the right to obtain up to 100 per cent stake in NMLP via staged investment.

At NMLP, the aMES⢠technology can be applied to:

- Directly process the brine, therefore eliminating or reducing the need for evaporation ponds.

- Rapidly develop a more sustainable and capital efficient lithium production operation relative to conventional development pathways.

- Process and recover a range of additional compounds including potash as a by-product.

In addition to its own projects, Parkway is also exploring a range of third-party brine projects, where there might be an opportunity for the company to provide a brine processing solution, based on its aMES⢠technology.

The aMES⢠technology has attracted the interest of several major OEM and potential EPC partners, as well as prospective end users that recognise the potential of the technology. Parkway plans to create substantial value by developing a portfolio of strategic revenue opportunities.

Stock Performance: As on 8th October 2019, PWN closed the trading session at $0.009, with a rise of a massive 50 per cent relative to last closed price. The stock has delivered a substantial return of 50 per cent in the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.