Aiabba Minerals Limited, headquartered at Level 12, 10 Eagle street, Brisbane, QLD 4000 in Australia , is a mineral resources company engaged in exploration and development of resources in Papua New Guinea with a bent towards establishing partnerships with the local communities for creating a favourable landscape for investment.

The company has a high commitment to ensuring the wellbeing and innovating of the surrounding local community as well as the nation through the fulfilment of its social responsibilities and obligations.

Project Portfolio

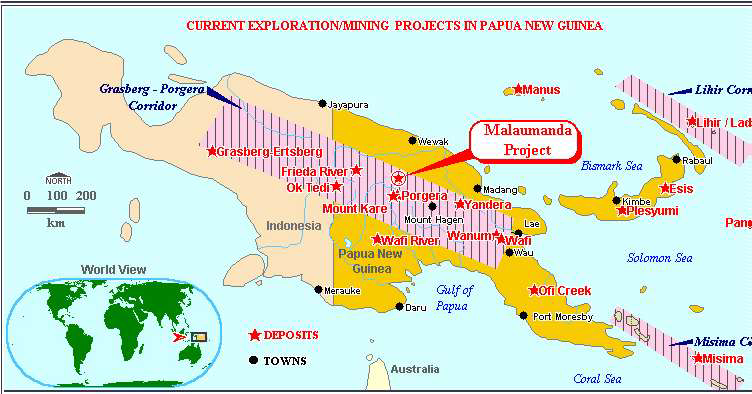

The companyâs core portfolio comprises Papua New Guinean exploration properties that are pre-dominantly gold and gold copper targets located within a major structural zone, the New Guinea Thrust Belt, which marks the convergent boundary between the Australian Plate, to the south, and the Pacific Plate, to the north hosting major world class mines and deposits in the region. Malaumanda/EL2421 and EL2586-EL2587 are located 40km north of the Porgera (32Moz) mine, 100km east of Frieda River (20Moz Au & 13Mt Cu) deposit, 470km west of Wafi Golpu (46Moz Au & 10Mt Cu) deposit and the Lihir (64Moz Au) mine all in PNG and the Grasberg (180M0z Au & 70Mt Cu) mine in the Papua province of Indonesia side of the international border. Grasberg, Lihir are 1st and 5th largest gold producers respectively in the world, 2019

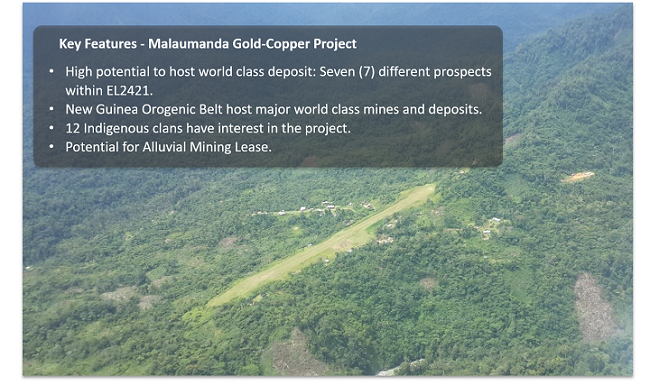

Currently, the company is focussed on advancement of its flagship asset Malaumanda Gold and gold Copper Project with intensive exploration underway, making way for eventual development and moving into production within a short time frame. The exploration license EL2421, with high potential, was acquired In May 2017 from the Malaumanda Development Corporation Ltd and granted in May 2016 and renewal granted by the Mineral Resources Authority (MRA-former mining department) of Papua New Guinea. Malaumanda is situated in the southern parts of East Sepik region, Central Range of Papua New Guineaâs Highlands region.

Source (Company Website)

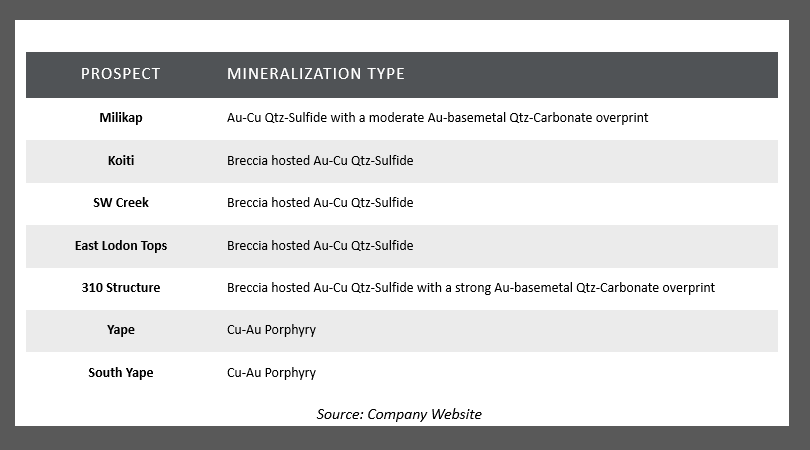

The key prospects located within the project area include â

Work programs such as reconnaissance geological mapping, stream sediment and soil sampling & trenching are under planning for specialist geological studies and excavations. In addition, a geological team and field crews are planned to be deployed for commencing field activities and designing of drill targets for the second term of the license.

Aiabba Minerals has further packed two more applications for EL2586 & EL2587 surrounding the currently owned license area, which would take the total ground package to 3085 km2. The applications have already gone through the MRA board. According to the company, it is a high potential region prospective for intrusive-related gold+/-copper deposits, porphyry copper-gold deposits and structurally-controlled gold lode deposits.

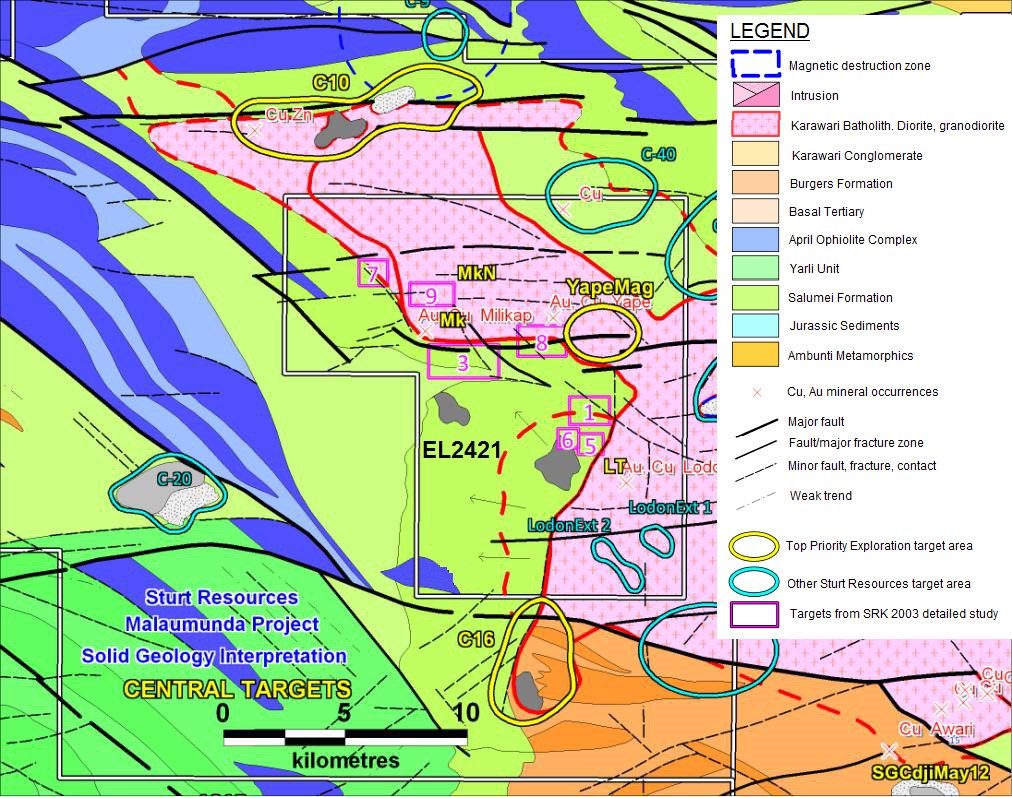

The company has interpreted airborne survey through Southern Geoscience for Geophysics Interpretation on the main Malaumanda/EL2421 and adjacent properties as below.

Malaumanda regional geology and exploration targets generated from geophysics. Source: Southern Geosciences Geophysics Interpretation Report for Sturt Resources in 2012.

Capital Raising

Aiabba Minerals is now working on getting listed on the Australian Securities Exchange (ASX) with its shareholders being a key focus of the strategic plan and raising finance at both the local and international level, as feasible, through individual and corporate investors.

The company plan is to raise A$3 million through seed capital firstly to develop the placer deposit resources value US$22million represents only 15% of the total 20,000 m2 area focus for mining along the Korosameri river section. Production from the alluvial that would provide for the company to complete its financial obligations for the advancement of work at its tenements and with an aim to acquire a new drilling rig and move forward with the Initial Public Offering (IPO) for resources calculation on EL2421.

Leadership

The company has also restructured its board and management team which comprises some of the brilliant minds and highly experienced members, to achieve its current goals. All key board members combined have an extensive ASX, senior board and management experiences for as long as 20-50 years. Mr Anthony Gates (Advisor) has been engaged with the Malaumanda Project and the local community since 1996. As a result, he built a strong network within the country. The board is headed by Moses Mondowa (Executive Chairman & Managing Director) who has over 20 yearsâ of experience. The other board members are Dr. Brett Scarlett, Max Kairu and Helen Mark.

Papua New Guinea- A Favourable Mining Jurisdiction

According to MRA, Papua New Guinea has a dynamic and flourishing mineral sector which immensely contributes to the GDP, providing royalties to landowners, for more than a third of government tax revenue, dividends to equity holders and several other tangible benefits to host communities that would not otherwise be provided through any other source.

The mineral wealth of Papua New Guinea is expansive with gold, rare earth elements, nickel, copper, cobalt, chromium, molybdenum, iron and platinum deposits embedded within its borders.

Gold â Outlook

The last one year has been a treat for investors chasing gold with the gold spot trending at near record highs of +AUD 2,000 per oz in the international market.

The key factors that have been driving Gold to perform so well include increased uncertainty and volatility in the global market influencing business and investment decisions and central Banks slashing bond yields. Gold shines best in times of uncertainty and maintains its purchasing power unlike normal currencies, thus known as a popular hedge in times of downturns.

Both gold-backed exchange traded funds (ETFs) and key central banks are hoarding gold, while individual investors are actively seeking direct/indirect exposure to business models of gold miners.

Concludingly, gold, with a bright outlook, is a great choice of mineral for aspiring miners like Aiabba Minerals Limited.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.