Paladin Energy Limited (ASX:PDN), formerly known as Paladin Resources Ltd, was established in 1993 and based out of Subiaco, Australia. The company is primarily engaged in the development and operations of uranium mines located in Australia, Africa, and Canada. Its projects include- Langer Heinrich mine in Namibia and Kayelekera mine in Africa; Michelin project in Labrador, Canada; Mount Isa and Manyingee projects in Australia.

The company recently released its Mining Exploration Entity and Oil and Gas Exploration Entity Report for the quarter ended December 31st, 2019. As per the figures posted, the company recorded USD 32.96 million net increase in unrestricted cash and cash equivalents.

Looking at its constituents, the operating activities caused cash inflow valued at around USD 13.37 million mainly arising from receipts from customers offsetting the payments for the purchase of uranium, staff costs, administration and corporate costs, restructuring costs as well maintenance expenditures. Besides, there were cash inflows from investing activities amounting to ~USD 94,000 mainly due to proceeds from the disposal of property, plant and equipment. There were no financing activities throughout the quarter. The company estimates significant cash outflows for the following quarter to be around USD 4.95 million.

The Quarterly Activities Report for the December quarter also set out many important highlights including the sales of 475,000 lb U3O8, recorded at an average selling price of USD 31.41/lb above the TradeTech weekly spot price average of USD 28.57/lb for the December quarter. Besides, the Spot market activity remained spontaneous, on account of regular purchases by Cameco. The gross sales revenue thus generated stood at USD 14.9 million.

The cash and cash equivalents were posted at USD 44.1 million above the guidance of approximately USD 40 million for the quarter, indicating an increase of USD 13.5 million from USD 30.6 million in the previous quarter ended September 30th, 2018.

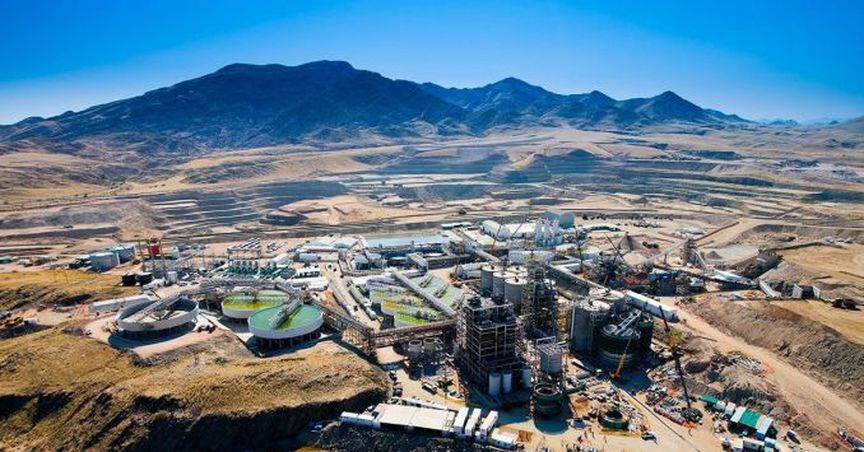

During the three months, the concept study also commenced for the large open pit Langer Heinrich Mine Project situated in the Erongo Region of western Namibia for optimising operations in preparation for a restart decision. Moreover, Paladin will also be implementing a pre-feasibility study for the same, scheduled to be completed within this year, to gauge opportunities for possible improvements in mining and processing at the site to reduce costs, drive productivity and explore the potential for the recovery of vanadium as a by-product.

As for one of the largest Kayelekera Mine Project, located in the west of Karonga in Malawi, Africa, there were no water treatment activities during the period, but the target levels were well achieved for all water storage ponds.

One of the significant acquisitions undertaken in November 2018 by the company was that of the full ownership of all of the outstanding shares in Summit Resources Limited from a previous stake of 82.08%.

The company has a market capitalisation of AUD 324.14 million with approximately 1.75 billion outstanding shares. With the close of the trading session on February 15th, 2019, the stock last traded at a market price of AUD 0.195, up 5.405 %, indicating an intra-day gain of AUD 0.010. PDN has generated a positive YTD return of 12.12%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.