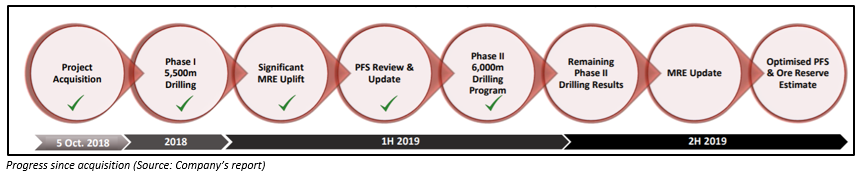

Exploration company, Pacifico Minerals Limited (ASX: PMY) is rapidly advancing the development of its 75% owned Sorby Hills Lead-Silver-Zinc Project. The recent testwork results at the project have confirmed that the project area has significant potential to produce high-quality lead (Pb) concentrate containing appreciable silver (Ag) credits. Since the acquisition of the Sorby Hills Project in October 2018, the company has made substantial progress in its development.

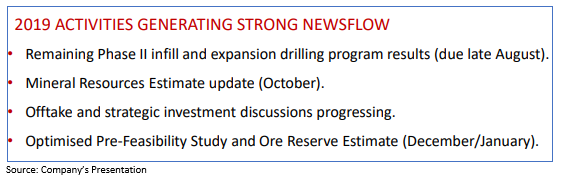

On 19 August 2019, the company released an Investor Presentation in which it highlighted the recent results and developments in relation to the Sorby Hills project.

Sorby Hills Project Overview

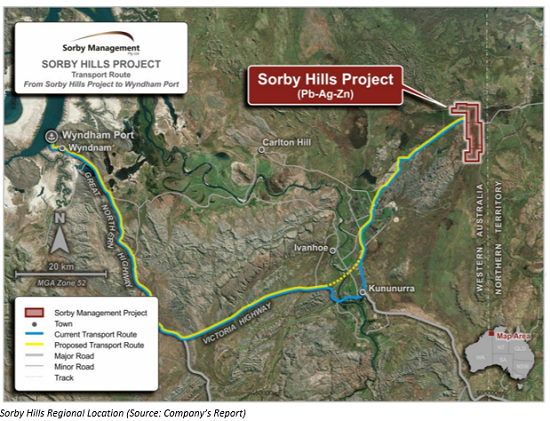

Located around 50-kilometer north-east from the regional centre of Kununurra, the Sorby Hills Lead-Silver- Zinc Project has an outstanding infrastructure (refer below figure) which allows for fast-tracked production.

At present, there are several sealed roads that are used to transport concentrate from the Sorby Hills site to the facilities at Wyndham Port, facilitating the operations of the project. Pacifico Minerals has already secured key government approvals for the development of this project.

Sorby Hills Project Development

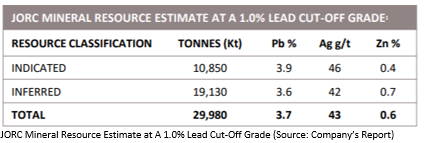

In late 2018, the company conducted a Phase I drill program at the project, which increased the Global Resource to 29.98 Million tonnes (Mt) of 4.7% Pb (lead) equivalent.

It has been confirmed by the final results of the Phase 1 drilling campaign that C, DE, and F deposits are linked and can be referred to as a single deposit (CDEF) at a strike length of 1.7km and may be minable with a single open cut.

Notable drill intercepts from Phase I drilling include:

- 9.0m at 8.3% Pb equivalent (7.6%Pb, 32 g/t Ag) and 1.1%Zn from 37m â B Deposit hole AB033;

- 9.7m at 9.1% Pb equivalent (7.5%Pb, 68 g/t Ag) and 1.1%Zn from 76m â CDEF Deposit hole ACD019;

- 20.0m at 8.6% Pb equivalent (7.3%Pb, 56 g/t Ag) and 0.4%Zn from 11m â CDEF Deposit hole ACD046;

- 2.6m at 19.5% Pb equivalent (15.3%Pb, 175g/t Ag) and 0.65%Zn from 108.5m â CDEF Deposit hole AF047;

- 7.3m at 5.8% Pb equivalent (4.1%Pb, 70g/t Ag) and 0.02%Zn from 110.7m â CDEF Deposit hole AF048;

- 11.7m at 13.2% Pb equivalent (10.8%Pb, 105 g/t Ag) and 0.4%Zn from 75.7m â CDEF Deposit hole AF005;

- 12.3m at 6.5% Pb equivalent (5.5%Pb, 42g/t Ag) and 0.23%Zn from 90m â I Deposit hole AI011;

- 10.0m at 7.8% Pb equivalent (6.6%Pb, 53 g/t Ag) and 0.9%Zn from 82m â I Deposit hole AI010;

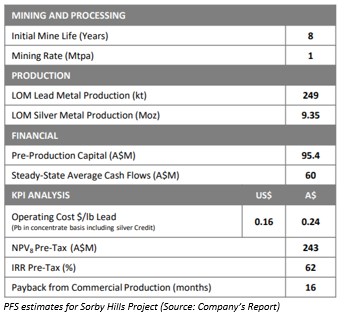

In the first half of 2019, the company completed a Prefeasibility Study (PFS) at the project which significantly de-risked the project and confirmed highly robust associated financials. The PFS suggested 8-year initial Mine life with estimated CAPEX of A$95.4 million and pre-tax NPV8 of A$243 million.

The recent metallurgical testwork at the project has confirmed rougher flotation testing with sulphidisation up to 96% Pb and 95% Ag recovery on fresh composites. Besides, the cleaner flotation testwork has confirmed that the final concentrate grade of 65% lead (Pb) can be produced from the project. The heavy liquid separation testwork has also returned impressive results with lead losses lower than the 10 per cent assumed in the recent Prefeasibility Study, increasing the value of the project from an exploration perspective.

The recently obtained results from the Phase II drilling campaign have confirmed the geological continuity of the mineralisation of CDEF Deposit. The company has also observed zinc mineralisation, confirming the significant potential for future zinc production.

Notable drill intercepts from Phase II drilling include:

- 21.0m at 5.6% Pb (lead) equivalent (5.0% Pb, 21g/t Ag) and 0.5%Zn from 23m â CDEF Deposit drill hole ACD056;

- 14.0m at 15.3% Pb equivalent (13.0% Pb, 89g/t Ag) and 1.0%Zn from 24m â CDEF Deposit drill hole ACD080;

- 23.0m at 11.3% Pb equivalent (9.0% Pb, 88g/t Ag) and 1.2%Zn from 59m â CDEF Deposit drill hole ACD071;

- 11.0m at 7.6% Pb equivalent (6.9% Pb, 26g/t Ag) and 0.1%Zn from 29m â B Deposit drill hole AB050;

With the compilation and further assessment of historical drill hole information, the company has gained more confidence in the geological and mineralisation model. Pacifico Minerals believes that the Mineral Resource Estimates of the project has excellent potential to grow with the drilling of extensions and targets outside of the main defined deposits. The company further believes that it is on track to complete the DFS (Definitive Feasibility Study) of the project in 2020.

Lead market Opportunity

Lead is majorly used in automotive (AV) batteries, and its demand is increasing in countries like India, Japan, and the Republic of Korea. International Lead and Zinc Study Group has forecasted that the Global lead demand will increase by 1.2% to 11.87 million tonnes in 2019 while many analysts at Business wire have predicted that global lead market demand will grow at a CAGR of 6.74% between 2018 and 2022.

Board and Management Team

The company currently has a well experienced Board and Management Team, which includes:

- Richard Monti (Chairman) - Geologist with over 30 yearsâ experience in technical, commercial, marketing and finance within the exploration and mining industry;

- Simon Noon (Managing Director)- A Mining Executive with substantial experience in management, marketing and finance within the exploration and mining industry;

- Peter Harold (Non-Executive Director)- Process Engineer with over 30 yearsâ experience in the minerals industry;

- Andrew Parker (Non-Executive Director)- Lawyer with extensive experience in the exploration and mining industry;

- Aaron King (Project Manager)- Metallurgist with more than 25 yearsâ experience in the mining and resources sector.

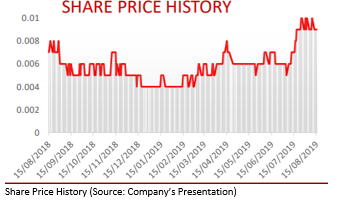

Stock Performance: In the last three and six months, PMYâs stock has provided a return of 50% and 80%, respectively. PMYâs stock has gained 125% on YTD basis.

At the time of writing i.e., 20 August 2019 (AEST 3:30 PM), PMYâs stock is trading at a price of $0.009 with a market capitalisation of 20.82 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.