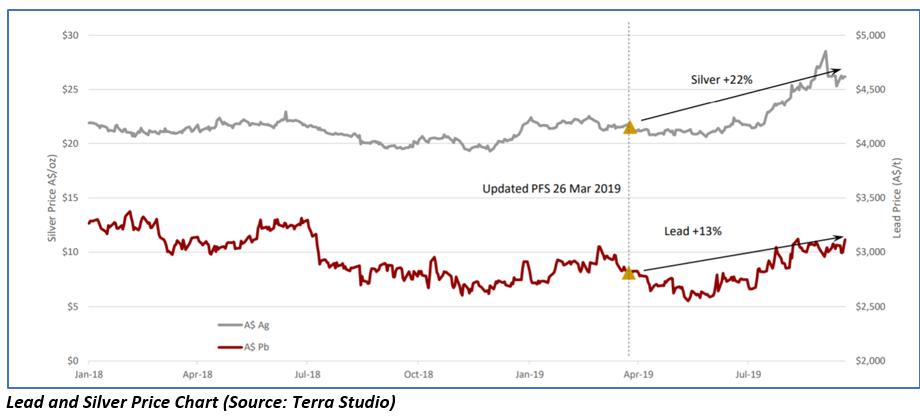

In the past few months, the prices of silver and lead have moved in a positive direction. This has boosted the confidence of many exploration companies which are exploring these commodities. One exploration company which is currently unravelling lead and silver opportunities in Australia is Pacifico Minerals.

Australian exploration company, Pacifico Minerals Limited (ASX: PMY) has released an investor presentation today, in which it has noted the rise in the prices of lead and silver.

Pacifico Minerals has also released its 2019 Annual report; wherein, it has highlighted the progress it has made with its Sorby Hills Project.

During the most part of the year, the company was focused on the development of its 75% Sorby Hills Lead-Silver-Zinc Project, which it acquired in October 2018 to significantly change the track amidst the challenging conditions faced by junior resource players owing to uncertain global political and economic environment.

The remaining 25% of the project is held by extremely supportive Joint Venture partner â Henan Yuguang Gold and Lead Co. Ltd.â that controls Chinaâs largest lead smelting capacity and is the countryâs largest silver producer.

Merits of Sorby Hills Project

- Large global resource - Global Resource to 29.98Mt of 4.7%Pb equivalent including 10.85Mt of 5.0%Pb equivalent in Indicated Resources;

- Outstanding existing infrastructure - Existing sealed road to transport concentrate from site to the facilities at Wyndham Port, 150km away;

- Granted Mining Leases and Western Australian Environmental Protection Authority approval in place;

- Great metallurgy- Recent metallurgical testwork confirmed rougher flotation testing with sulphidisation up to 96% Pb (lead) and 95% Ag (Silver) recovery on Fresh composites.

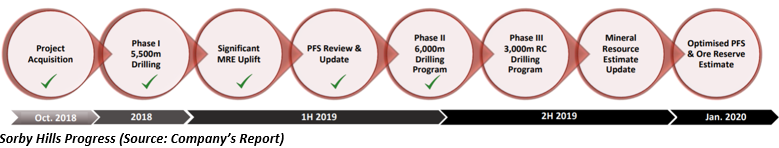

Till now, the company has made significant progress in the development of the project.

Phase I drilling campaign

In 2018, the company completed the Phase I drilling campaign which was focussed on providing angled and oriented diamond drill core into the B, C, CD link, D, F and I deposits. The Phase I drilling campaign included a combination of reverse circulation (âRCâ) to end of hole and RC precollar with diamond drilled tails to end of hole.

Notable drill intercepts from Phase I drilling include:

- 0m at 8.3% Pb equivalent (7.6%Pb, 32 g/t Ag) and 1.1%Zn from 37m â B Deposit hole AB033;

- 7m at 9.1% Pb equivalent (7.5%Pb, 68 g/t Ag) and 1.1%Zn from 76m â CDEF Deposit hole ACD019;

- 7m at 13.2% Pb equivalent (10.8%Pb, 105 g/t Ag) and 0.4%Zn from 75.7m â CDEF Deposit hole AF005;

- 0m at 8.6% Pb equivalent (7.3%Pb, 56 g/t Ag) and 0.4%Zn from 11m â CDEF Deposit hole ACD046;

- 3m at 6.5% Pb equivalent (5.5%Pb, 42g/t Ag) and 0.23%Zn from 90m â I Deposit hole AI011;

- 0m at 7.8% Pb equivalent (6.6%Pb, 53 g/t Ag) and 0.9%Zn from 82m â I Deposit hole AI010;

Final assay results for Phase I, obtained during June quarter, confirmed that C, DE, and F deposits are linked and can be referred to as a single deposit (CDEF) with a strike length of 1.7km and which may be minable with a single open cut.

Updated PFS

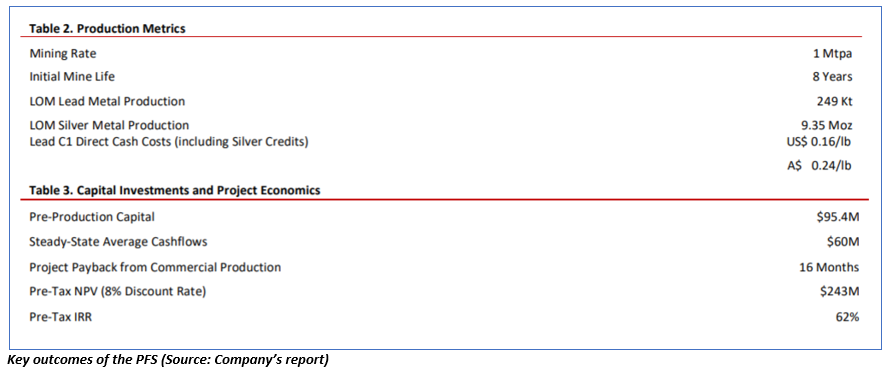

This year in March, the company updated a pre-existing Pre-Feasibility study. The PFS indicated steady state annual production of concentrate containing approximately 31.125ktpa of lead and 1.17Mozpa of silver. As per the study, the Pre-production capital expenditure is estimated to be around $95.4 million. Working with an update of the most recent MRE, the PFS envisaged a 1Mtpa throughput rate over an initial 8-year mine life.

Phase II Drilling Campaign

In May 2019, the company commenced Phase II infill and extension drilling campaign (30 RC holes and 45 HQ3 diamond holes for a total of 5,959 m) which was focused on shallow mineralisation at the B and CDEF deposits above 100m depth, that may be mineable by open pit.

The company engaged Entech Mining, mining and geotechnical consultants, with an aim to provide geotechnical information for pit designs (pit wall stability), convert Inferred Resources to Indicated Resources, and deliver representative samples for further metallurgical work.

Notable results from Phase II drilling Program include

- 0m at 15.3% Pb equivalent (13.0%Pb, 89g/t Ag) and 1.0%Zn from 24m â CDEF Deposit drill hole ACD080;

- 0m at 11.3% Pb equivalent (9.0%Pb, 88g/t Ag) and 1.2%Zn from 59m â CDEF Deposit drill hole ACD071;

- 0m at 5.6% Pb equivalent (5.0%Pb, 21g/t Ag) and 0.5%Zn from 23m â CDEF Deposit drill hole ACD056;

- 0m at 7.6% Pb equivalent (6.9%Pb, 26g/t Ag) and 0.1%Zn from 29m â B Deposit drill hole AB050;

- 0m at 10.2% Pb equivalent (8.8% Pb, 52g/t Ag) and 0.3% Zn from 68m (including 16m at 13.5%Pb equivalent (11.7% Pb, 68g/t Ag) and 0.37% Zn from 63m) â CDEF Deposit in drill hole ACD082;

- 0m at 13.7% Pb equivalent (12.4% Pb, 51g/t Ag) and 0.3% Zn from 80m â CDEF Deposit in drill hole ACD058.

What Now?

- Phase III drilling program to commence in October 2019.

- Offtake and strategic investment discussions progressing.

- Plans to complete an Optimised PFS Study and Ore Reserve Estimate by January 2020.

Pacificoâs Other Projects:

- Borroloola West Project, Northern Territory â Copper, Zinc, Lead, Silver (51% stake)

- Mount Jukes Project, Tasmania â Gold, Base Metals (15% stake)

- South Australian Project â Cobalt, Copper, Manganese (100% stake)

- Violin Project, Guerrero, Mexico â Gold, Copper (Option Agreement to Acquire 100% stake)

- Colombian Projects â Gold, Copper, Silver (100% stake)

FY19 Financial Performance

For the year ending 30 June 2019 (FY19), the company reported revenue of $0.104 million with an increase of 21.85% on the last year. For FY19, the company incurred an operating loss after income tax of $3,344,077.

During the year, the company spent $1.96 million on mining interest and paid ~$0.9 million to Suppliers and Employees. The net cash outflow from operating activities was $2.83 million in FY19.

During the year, Pacifico completed capital raisings for $7.91 million before costs. At 30 June 2019, available cash funds totalled $1.98 million. At the end of FY19, the company had current assets of $2.37 million and current liabilities of $1.05 million.

Stock Performance

At market close on 25 September 2019, PMYâs stock was trading at a price of $0.010 with a market capitalisation of circa $28.88 million.

The Group will continue exploration and development activities and to assess commercial opportunities for corporate growth, including the acquisition of interests in projects, as they arise.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.