Ovato Limited (ASX: OVT) is engaged in the business of print media production. Further to the print and production capabilities, the company has evolved to provide a full breadth of marketing services to customers.

In a release dated 20th May 2019, the company updated the investors about its Entitlement Offer. By undertaking a 1 for 2.3 accelerated pro-rata non-renounceable entitlement offer, OVT will raise ~$15.5 million.

With respect to utilisation of proceeds from the entitlement offer, OVT will use the funds to strengthen the companyâs balance sheet by reducing leverage and providing additional financial flexibility and to accelerate the completion of NSW site consolidation project.

The new site consolidation (NSW) to become a âSuper Siteâ is on track to be finished on budget and earlier than expected. With respect to the cash expenses, OVT reported an estimated site consolidation total cash spend of ~$50 million between FY19 to FY21. The cash spend includes the purchase and installation of the new 80pp cost-effective press at Warwick Farm, redundancies and site work.

The companyâs total annualised savings for the period stood at ~$24 million from FY21, including $4 million, $14 million, $6 million in FY19, FY20 and FY21, respectively.

The print Australia revenue picture was softer than expected in 2H FY19. The company is expecting FY19 revenue to decline 12% in comparison to FY18, because of fall in newspaper volumes at a faster rate than expected and moving towards cold-set printing by publishers. The increased competition in the publishing and retail customers is another case of a decline in the revenue, along with the softer retail conditions and temporary reduction in activity associated with the recent NSW state and federal elections.

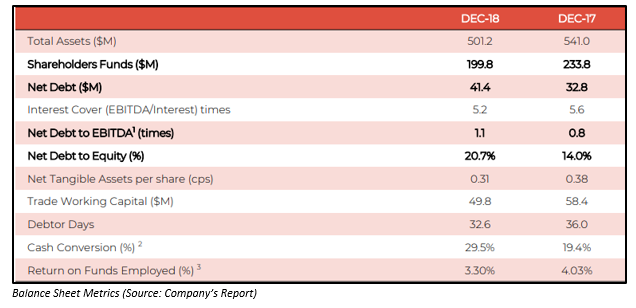

Because of the industry overcapacity and continued price led pursuit of market share, the OVT New Zealand revenues were lower than expected. The net debt of the company stood at $41.4 million in December 2018 as compared to $32.8 million in December 2017. The company reported a cash conversion of 29.8% in December 2018.

Looking forward, the company is expecting FY19 revised EBITDA guidance in the range of $30 million to $33 million, which was previously $37 million to $40 million. Post receipt of the entitlement offer proceeds, the company anticipates pro forma FY19 net debt to reduce in the range of circa $42 million to $46 million and expect a reduction in pro forma net debt/EBITDA of circa 1.4x. With respect to leverage, OVT is forecasting a rise of 2.1x in H1 FY20, as a result of financing of a new press.

The company believes the implementation of its various strategies in developing an integrated print media and marketing service business with a diverse stream of revenue sources will drive an efficient and profitable company beyond FY20.

In another update, Ovato requested ASX to place its securities on a âTrading Haltâ, pending an announcement with respect to the outcome of the institutional component of the accelerated entitlement offer. The securities would remain in a trading halt until the normal trading day on 22nd May 2019.

The stock of OVT last traded at a price of $0.068, with a market capitalisation of $34.69 million as on 16th May 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.