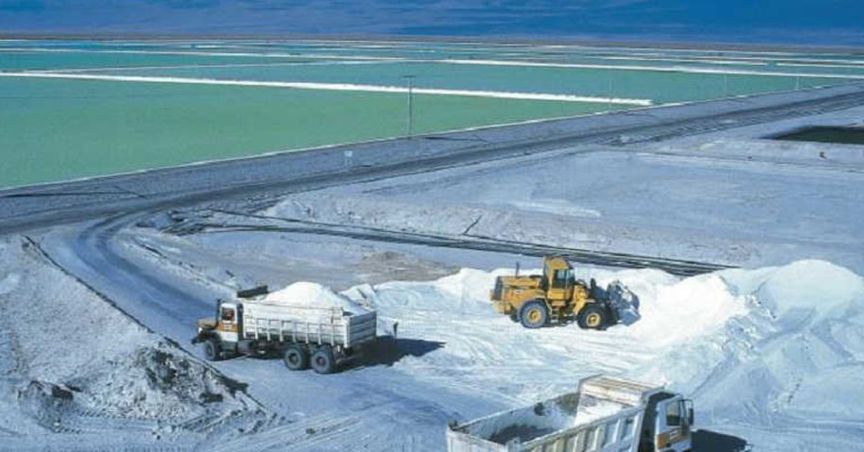

Supports Advantage Lithium private placement: Orocobre Limited (ASX:ORE), a supplier of global lithium carbonate and an established producer of boron, witnessed a stock price fall of 1.61% on July 27, 2018 after the company agreed with Advantage Lithium Corp. to support Advantage’s private placement. ORE is now participating on a pro-rata basis in a C$12 million private placement by Advantage Lithium. The company has signed subscription agreements on July 26, 2018 with Advantage Lithium Corp., according to which ORE will subscribe for 15,064,956 common shares of Advantage Lithium at a price of $0.77 per common shares (for an aggregate subscription amount of $11,600,016.10). ORE has also entered into an agreement on July 26, 2018 with a third party whereby ORE has agreed to sell 8,571,450 common shares of Advantage Lithium to such third party at a price of $0.77 per common shares (for an aggregate sale price of $6,600,016.50). These transactions are subject to satisfaction of certain conditions. ORE is doing these transactions for investment purpose while Advantage will use the fund for general working capital, and to fund continued development and exploration activities on its Lithium properties in Argentina. Further, the shares issued related to Private Placement will be subject to a four month hold period from the date of closing. On the other hand, ORE stock has fallen 5.14% in three months as on July 26, 2018.

[pluginops_form template_id='23834' ]The Income available from dividends remains attractive for many investors.

We take a look at the best yields on the market and assess what they say about a company’s prospect.

One Thing is certain, though, Australia interest rates are still low, making income difficult to come by and keeping the focus for many investors on high yielding stocks. Kalkine’s team of analysts bought you handpicked report for “Top 25 Dividend Stocks For 2018.”

ASX-relevant Special Reports are published year-round to provide a detailed analysis into an investing opportunity or a potential risk to your portfolio.

Click here to get your free report.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkinemedia.com and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.