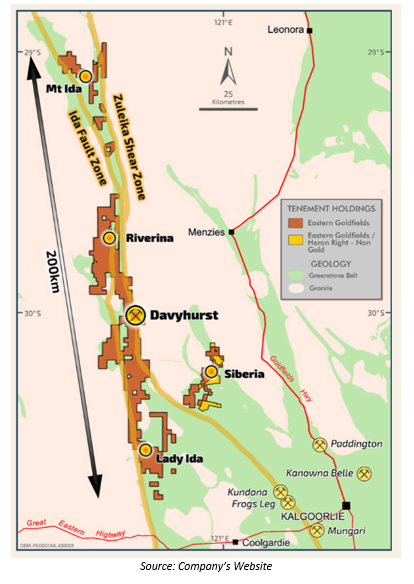

Perth, Australia-based Ora Banda Mining Limited (ASX:OBM) is exploring for and developing its gold land package in the Eastern Goldfields region of Western Australia, also renowned as one of the Tier 1 gold mining jurisdictions worldwide. The companyâs strategic and prospective ground tenure spans 200 km strike across the highly bountiful greenstone belt, which hosts high-grade resources of gold, nickel, sulphide and base metal mineralisation.

The companyâs total ground package comprises six projects spanning across an area of 1,336 km2 (referring to the figure above) including- Davyhurst Project, Siberia Project, Riverina Project, Mulline Project, Mt Ida Project and Lady Ida Project, where more than 112 prospective areas are defined alongside an existing Davyhurst Processing Hub (@ 1.2Mtpa). Of these areas, Ora Banda is initially targeting resource development activities at five key well-analysed and advanced deposits (Riverina, Waihi, Callion, Siberia and Golden Eagle) located within different projects, and together hosting 9.2 Mt @ 2.8 g/t for 840 koz of JORC Reserve.

| Key Deposits | Target | Distance to Plant | Current JORC Resource |

| Riverina | OP | 48 km | 2.6Mt @ 2.5g/t for 205koz |

| Waihi | OP & UG | 3 km | 914Kt @ 2.4g/t for 71koz |

| Callion | OP & UG | 14 km | 169Kt @ 2.6g/t for 14koz |

| Siberia | OP | 37 km | 4.8Mt @ 3.2g/t for 498koz |

| Golden Eagle | UG | 2 km | 656Kt @ 2.5g/t for 54koz |

| TOTAL | 9.2Mt @ 2.8g/t for 840koz | ||

Key Deposit Summary; OP- open pit; UG- underground; Source: Corporate Presentation

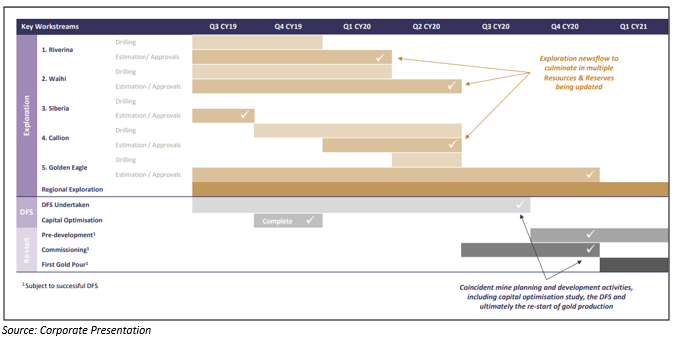

The companyâs main objective is to upgrade the current resource based on extensional drilling, followed by resource and reserve definition, that would be incorporated into the Definitive Feasibility Study (DFS) which would involve definition of key parameters for an initial 5-year mining investment case.

Waihi Prospect in Focus

As Ora Banda embarked on a new journey with its $30 million recapitalisation process closed on 28 June 2019, after which it got relisted on the ASX, different exploration programs were kickstarted by the company with around 2,568 diamond core samples from 8 previously drilled holes across the high-grade Waihi deposit and further 2,684 diamond core, RC and auger samples from other programs, were forwarded to laboratories for expedited analysis as they were left un-assayed on account of financial constraints.

On 29 July 2019, Ora Banda published the assays (23m @ 9.1g/t Au from 128m, including 13m @ 7.1g/t Au and 7m @ 16.6g/t Au) from the previously undertaken drilling programs at its project tenure within the Eastern Goldfields, indicating high-grade gold mineralisation, especially at Waihi and also demonstrating further exploration potential of the overall land tenure. This provided an encouraging push to Ora Banda to pursue further resource drilling and exploration activities, that are currently underway and being ramped up with the initial focus at 2 prospects- Waihi and Riverina.

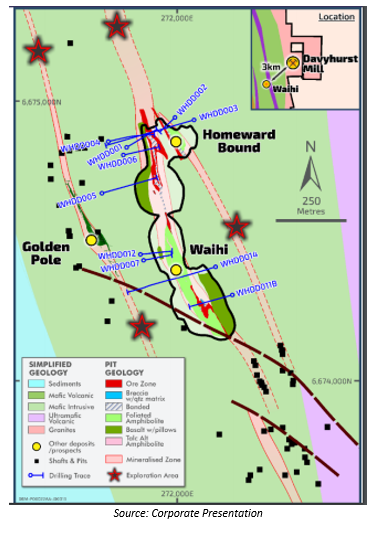

Waihi prospect, which is located very close, ~ 3 km, from the Davyhurst Processing Hub, is a priority exploration target (along with Riverina) comprising 3 major lodes including Homeward Bound, Waihi Main and Golden Pole with a published mineral resource of 914 Kt @ 2.4 g/t for 71 koz, presenting a strong near-term production case.

Besides, there is also an immense scope of expanding the current resource base at Waihi with new diamond drilling already underway, commencing at the Golden Pole mine with drilling planned for Homeward Bound. The overall exploration program will first aim at upgrading the resource to JORC 2012 followed by Reserve definition and expansion of high-grade underground targets.

Latest Shallow High-Grade Results- On 14 October 2019, Ora Banda announced the first assay results received from its initial resource definition drilling program at Waihi. The outstanding result returned include-

- 0m @ 19.2 g/t from 38 metres.

- 0m @ 4.2g/t from 36 metres and 6.0m @ 4.7g/t from 57 metres.

The main focus of initial diamond and RC drilling programs at Waihi was on upgrading and extending the existing Waihi Main Shoot mineral resource within a preliminary 2019 optimised pit shell. The extensional drilling program intersected 23m @ 9.1g/t from 128 metres at WHDD003 hole at Homeward Bound ore lode at depth and down plunge of the exiting open pit.

The detailed review of the Waihi deposit by a consultant structural geologist of all newly collected core samples, has greatly assisted with the development and advancement of a structurally dominated mineralisation model for Waihi and this work remains ongoing.

Stock Performance

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.