NRW Holdings Limited (ASX: NWH) is a company that forms a part of the industrial sector and is a leading provider of diversified services to the sectors such as energy, mining, urban development as well as civil infrastructure.

On 15th May 2019, the shares of NRW Holdings Limited have been on trading halt, pending an announcement regarding the contract award. The company shares will remain in halt until earlier of commencement of trading on Friday 17th May 2019 or when the announcement about the contract award is made.

On 3rd April 2019, the company announced that a Letter of Direction from Coronado Curragh Pty Ltd has been received by the 100% owned subsidiary of NWH, Golding Contractors Pty Ltd. The purpose of the Letter of Direction is to increase the mining plant at the Curragh Main Mine by introducing a fourth fleet to the existing mining operations.

Golding Contractors will provide a major plant and equipment required for the expansion of the mining operations to the company. The additional fleet required for the expansion of the mining operations consists of 4 x hired Komatsu 830E trucks as well as new Caterpillar 6060 excavator along with the ancillary plant.

With this contract, around ~$50 million was added to the companyâs existing contract, with $230 million of indicative value over the remaining period to completion in September 2021.

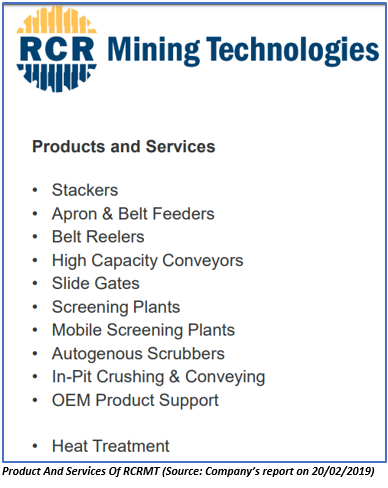

Further, on the same day, RCR Mining Technologies (RCRMT), companyâs subsidiary has been awarded a contract to supply equipment to clients in WA.

NWHâs results in the first half of FY2019 remained strong, with an increase in revenue of 50.9% to $521.1 million as compared to the previous corresponding period (pcp). The EBITDA of $40.3 million in 1H FY2018 reached $74.3 million in H1 FY2019. The net earnings increased from $15.3 million in H1 FY2018 to $28.2 million in H1 FY2019. NRW Holdings Limited declared a fully franked interim dividend of 2 cps. During the six months period, the companyâs order intake was around $1 billion, which has resulted in an increase of $2.4 billion in the total work in hand.

During the period, the company acquired RCR Mining Technologies for $10 million, which was funded through cash. The company also secured new civil contracts for all three major WA iron ore projects.

The balance sheet of the company reported an increase in the net asset base due to an increase in the total asset, followed by a decrease in the total liabilities. The total shareholdersâ equity for the period was $294.24 million.

Companyâs net cash inflow from the operating activities amounted to $58.069 million. The net cash outflow through the investing activities was $29.064 million, and from the financing activities, it was $5.164 million.

At the end of the H1 FY2019, the companyâs net cash and cash equivalents were $82.687 million.

The shares of NWH has generated quite a decent YTD return of 64.37%. The shares of NWH traded last on 14th May 2019 at a price of $2.63. NWH holds a market capitalisation of $988.59 million with approximately 375.89 million outstanding shares and a PE ratio 17.65x and an annual dividend yield of 1.52%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_06_17_2025_03_34_37_469537.jpg)