FTSE 100 fell over 1 per cent on Monday (before the market close on 15th June 2020) as a resurgence in the number of COVID-19 cases in some parts in Asia, and the US fizzled out the euphoria of economic reopening.

The market sentiments are expected to be affected by the following triggers:

- As social distancing measures are in place, the UK opened the doors for non-essential shops.

- Investor keeping an eye over a new round of Brexit negotiations.

- House sales rebounded in Britain with the lifting of lockdown restrictions.

Given the current market conditions, we are going to review two support services stocks to see how they have been navigating through the economic turbulence. The two support services stocks are Bunzl PLC (LON:BNZL) and DCC PLC (LON:DCC). As on 15th June 2020 (before the market close at 12.06 PM GMT+1), BNZL stock surged by around 7.59 per cent, whereas, DCC stock dipped by over 1.67 per cent. The gains of BNZL was seen after its trading update today. Hence, we will scan through the financial and operational position of both the Companies to understand the stock price movement in a better way.

Bunzl PLC (LON:BNZL) – Delivering consecutive dividend growth from the last 26 years.

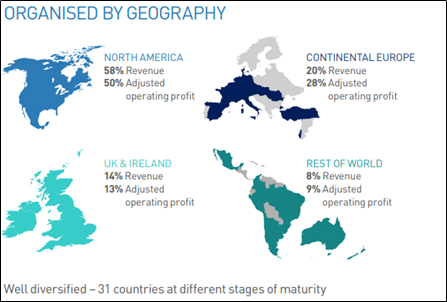

Bunzl PLC is a FTSE 100 listed Distribution Company with international operations. It provides one-stop-shop distribution and outsourcing to B2B customers. The Company caters to various market sectors, such as food service, safety, retail, healthcare, grocery, and cleaning & hygiene. It operates with a network of 3,000 sales specialist and 2,600 customer service specialists. The Group has expanded its business through acquisitions over the years which induced them to develop operations from merely 12 countries in 2004 to around 31 countries presently. The Company was incorporated in 1940, while origins go back to 1954.

The Company is expected to announce its half yearly results for FY20 on 24th August 2020.

(Source: Company Website)

Synopsis of Recent Regulatory Updates

22nd April 2020: Vin Murria was appointed as a non-executive director to join the Board from 1st June 2020.

6th April 2020: Due to the emerging situation of COVID-19, the Group rationally decided to withdraw the proposed dividend of FY19.

Pre-Closing Trading Statement (for the six months ending 30 June 2020)

As on 15th June 2020, the Company affirmed the business resilience during the economic turbulence has been underpinned by its ability to swiftly respond to demand by maintaining the supply chain. The major highlights of the statement are given below:

- The Company is expected to deliver a decent performance in half-year results despite the market backdrop.

- Revenue is projected to surge by around 6 per cent at both constant and actual exchange rates.

- The overall operating margin is anticipated to be marginally higher than the same period of the last year due to the change in the mix of products sold.

- Despite the anticipation of healthy trading performance in the first half, the Company could not quantify the full-year guidance, given the evolving uncertainties presented by the COVID-19

Share Price Performance Analysis

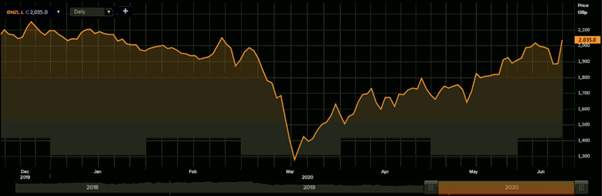

(Source: Refinitiv, Thomson Reuters) -1-Year Chart as of June 15th, 2020, before the market close

On 15th June 2020, BNZL’s shares were trading at GBX 2,035.00 (before the market close as at 11.04 AM GMT+1). Stock's 52 weeks High is GBX 2,216.38 and Low is GBX 1,242.00. Total outstanding M-Cap. (market capitalization) stood at approximately GBP 6.38 billion, and the dividend yield was 0.82 per cent.

Business Outlook – Resilient business model

Bunzl is a well-established and diversified business with operations in the Asia Pacific, the Americas and Europe. It has delivered consistent dividend growth for the past 26 years. Even in the first half of 2020, the Company is expecting a decent growth in business despite the challenging market conditions. It depicts the resilience in the business model to combat the uncertainties. It has a substantial amount of funding headroom available and healthy cash flow & balance sheet position, and there was no material impact on the business during the first half of business. However, the Company remain cautious due to the impact of prolonged lockdown and uncertain timing of recovery in global economies.

DCC PLC (LON:DCC) – Moving ahead of market expectations

DCC PLC is a FTSE 100 listed Company which is engaged in the procurement, sales, marketing, distribution, and business. The Company operates across four separate divisions: DCC Energy, which is involved in the sales, marketing and distribution of oil and liquefied petroleum gas; DCC Healthcare, which provides products and services to healthcare providers and health & beauty brand owners; DCC Technology, which is involved in the sales, marketing and distribution of technology products; and DCC Environmental, which provides a range of waste management and recycling services.

The Company will release its next interim results for H1 FY21 on 10th November 2020.

(Source: Presentation, Company Website)

Recent Significant Developments of 2020

19th May 2020: As Mr. Leslie Van de Walle decided to retire. Mr. Mark Breuer succeeded the Mr. Van de Walle, as Senior Independent Director, while Mr. David Jukes was appointed as Chairman of the Remuneration Committee.

25th March 2020: The Company decided to take over Amerilab Technologies. It will bolster the capability of DCC Health & Beauty Solutions. The total consideration of the transaction is based on the enterprise value of nearly USD 85 million.

Financial Highlights (for the year ended 31 March 2020)

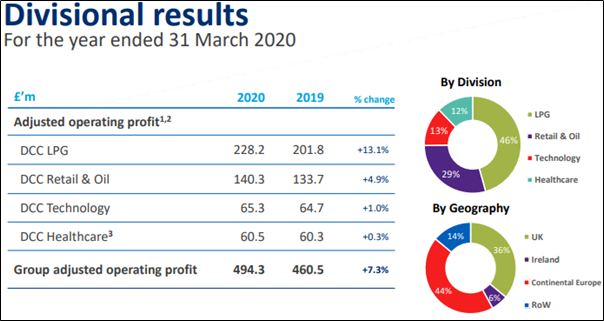

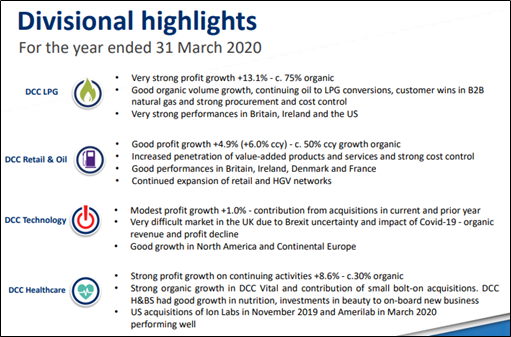

As on 19th May 2020, the Company reported its annual results and reported an excellent performance across all its divisions. The key highlights of the results are given below:

- Group’s adjusted operating profit increased to GBP 494.3 million (by 7.3 per cent against FY18), which was ahead of market expectations.

- Nearly GBP 170 million of capital commitment have been made for new acquisitions.

- Experienced exceptionally good demand for all its divisions due to the lockdown scenario.

- Delivered a decent return on capital employed, while balance sheet appeared liquid and flexible.

(Source: Presentation, Company Website)

Liquidity and Balance Sheet Position

As at 31st March 2020, DCC reported net debt of GBP 60.2 million ((excluding lease creditors), representing Net Debt to EBITDA of 1.0 times. The cash balance stood at GBP 1.7 billion and there was GBP 350 million of undrawn committed facilities.

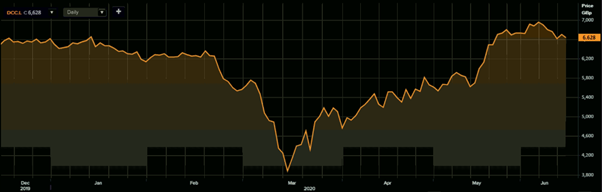

Share Price Performance Analysis

(Source: Refinitiv, Thomson Reuters) -1-Year Chart as of June 15th, 2020, before the market close

On 15th June 2020, DCC’s shares were trading at GBX 6,628.00 (before the market close as at 11.11 AM GMT+1). Stock's 52 weeks High is GBX 7,548.00 and Low is GBX 3,463.00. Total outstanding M-Cap. (market capitalization) stood at approximately GBP 6.60 billion, and the dividend yield was 2.17 per cent.

Business Outlook – Market Leading Position to Withstand Short-term uncertainty

DCC PLC has a resilient and diverse business model, and it is well-positioned in the market to support its development into the future. Invariably, the Company can be impacted by the social distancing restrictions to curtain the infection. However, the Company is in a sturdy position to navigate through this period of uncertainty. It continues to have opportunities, capabilities, and platforms to ensure the development of all four division.

_06_10_2025_01_00_15_274451.jpg)