Mayne Pharma Group Limited (ASX:MYX) is a specialty pharmaceutical company which manufactures and sells branded as well as generic pharmaceutical products worldwide. The Group operates two product development and manufacturing facilities: located in Greenville, USA and Salisbury, Australia. It has a proven expertise in formulation of complex oral and topical dose forms like modified-release products, potent compounds, and predominantly unstable compounds.

On 14th May 2019, the company released its Market Update for the 10 months ended 30th April 2019.

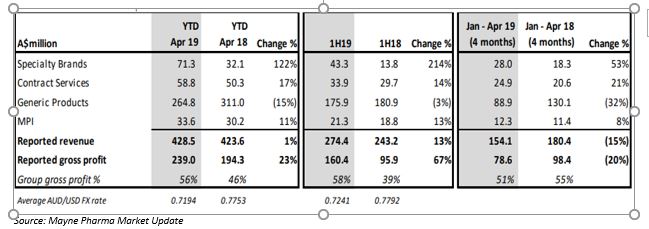

The Group sales were impacted in the second half of FY19 (2H19) by increased competition in key generic products as well as generic market trading pressures. The total Group revenue amounted to $ 154 million for the first four months of CY19, which is 15% lower as compared to the prior corresponding period (pcp). Besides, the gross profit was approximately $ 79 million, also down 20% on pcp.

The Generic Products Division sales were around $ 89 million in the first four months of CY19, 32% lower on pcp. The Dofetilide sales were down 84% on pcp to USD 3.7 million and liothyronine sales were down 23% on pcp to USD 9.8 million. As a result, the gross profit margin reduced to 45% in the concerned period from 57% recorded in the first half of the financial year FY19.

Meanwhile, the Specialty Brands Division delivered a strong performance in the first four months of CY19 with sales up 53% on pcp to $ 28 million. There was growth across all key products including FABIOR® (up 45%), SORILUX® (up 4%) and the DORYX® family (up 39%) in USD terms. Besides, the recent launch of LEXETTE in February 2019 also boosted the growth as its total prescriptions exceeded 700 as reported in the latest data disclosed.

The Metrics Contract Services (MCS) also reported a 21% improvement in the revenue to $ 25 million, primarily due to rising commercial manufacturing revenues along with later stage formulation development work. Looking ahead for the MCS business, the pipeline of commercial manufacturing opportunities remains abundant with more than 20 commercial manufacturing quotes already issued.

Lastly, the Mayne Pharma International division also recorded an 8% increase in the revenue to ~$ 12 million as it continued to leverage from sales of itraconazole growing worldwide.

A snapshot of the companyâs 2019 year-to-date performance is as follows:

The cash at hand at the end of the period stood at ~$ 111 million, $ 15 million higher than the position at 31st December 2018.

The Group expects better results for FY20 on the back of recent specialty brand launches of LEXETTE⢠and TOLSURA®, expansion of the generic and proprietary dermatology and womenâs health portfolios, possible market supply disruptions as well as the prospective pipeline of Metrics Contract Services business.

Recently, Investors Mutual Limited increased its shareholding in the company from 6.05% to 7.08%. With a market capitalisation of ~ AUD 894.36 million, the MYX stock is trading at AUD 0.557, down 01.42 % on 15th May 2019 (as at 3:05 PM AEST).

The cash at hand at the end of the period stood at ~$ 111 million, $ 15 million higher than the position at 31st December 2018.

The Group expects better results for FY20 on the back of recent specialty brand launches of LEXETTE⢠and TOLSURA®, expansion of the generic and proprietary dermatology and womenâs health portfolios, possible market supply disruptions as well as the prospective pipeline of Metrics Contract Services business.

Recently, Investors Mutual Limited increased its shareholding in the company from 6.05% to 7.08%. With a market capitalisation of ~ AUD 894.36 million, the MYX stock is trading at AUD 0.557, down 01.42 % on 15th May 2019 (as at 3:05 PM AEST).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.