On 22nd July 2020, the equity market of Australia ended in red, and S&P/ASX200 settled at 6075.1 with a fall of 81.2 points. Most of the sectors on ASX ended in red such as S&P/ASX 200 Consumer Staples (Sector), which moved down by 146.8 points to 13,004.9. S&P/ASX 200 Health Care (Sector) experienced a fall of 1389.4 points and closed at 41991.4. All Ordinaires stood at 6192.6, indicating a decline of 76.2 points at the end of the same session.

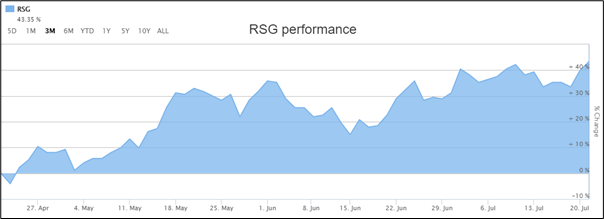

On ASX, the share price of Resolute Mining Limited (ASX: RSG) went up by 12.903% to $1.400 per share. The stock of Challenger Limited (ASX: CGF) stood at $4.680 per share with a rise of 7.094%.

Stock Performance (Source: ASX)

S&P/NZX50 closed at 11,723, indicating a fall of 0.12%. The share price of Blackwell Global Holdings Limited (NZX: BGI) soared by 28.57% to NZ$0.090 per share. The stock of Allied Farmers Limited (NZX: ALF) inched up by 6.25% to NZ$0.680 per share. On the other hand, the stock of Steel & Tube Holdings Limited (NZX: STU) moved down by 5.17% and settled at NZ$0.550 per share.

Recently, we have written some crucial information on Platina Resources Limited (ASX:PGM), and the readers can click here to view the content.

Resolute Mining Limited Reported Decent Production Growth in June 2020 Quarter

Resolute Mining Limited (ASX:RSG) recently released its results for the quarter ended June 2020, wherein, it reported total gold production of 107,183 ounces at an AISC of US$1,033/oz. The company experienced zero recordable injuries in the quarter, which reduced the Total Recordable Injury Frequency Rate (TRIFR) to 1.07.

As of 30th June 2020, total borrowings of the company stood at US$307 million. The company ended the quarter with a net debt balance of US$220 million. The company had an estimated recoverable gold in circuit inventory of 82,506oz with a market value of around US$146 million as of 30th June 2020.

Challenger Limited Ended in Green on 22nd July 2020

Challenger Limited (ASX:CGF) recently notified the market that it has made a change to its substantial holdings in IRESS Limited on 13th July 2020 with a current voting power of 8.04% as compared to the previous voting power of 6.98%. On June 22, 2020, the company stated that it would be undertaking SPP as part of an equity raising to further strengthen the capital position as well as provide flexibility to enhance earnings. In the release dated July 1, 2020, the company stated that SPP is not underwritten and it is aiming to garner up to $30 Mn.