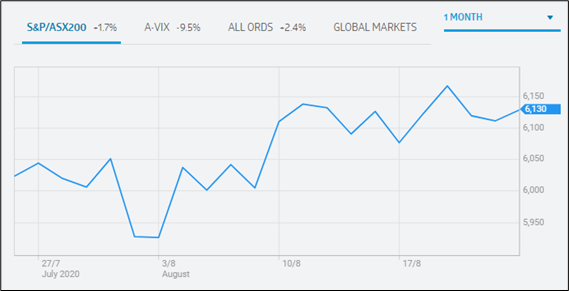

On 24th August 2020, equity market of Australia ended in green, and the benchmark index S&P/ASX200 went up by 18.4 points to 6129.6. In the last one month, the index has gained 1.7%. Most of the sectors on ASX closed in green such as S&P/ASX 200 Consumer Staples (Sector), which moved up by 73.5 points to 13,191.3 and S&P/ASX 200 Health Care (Sector) stood at 43,657.0, reflecting a rise of 48.9 points. At the close of same session, All Ordinaries settled at 6300.3 with an increase of 29.6 points.

S&P/ASX200 Performance (Source: ASX)

On ASX, the share price of Reliance Worldwide Corporation Limited (ASX: RWC) experienced a rise of 17.77% to $3.380 per share. The stock of oOh!media Limited (ASX: OML) inched up by 17.514% to $1.040 per share.

S&P/NZX50 closed the session at 11,921, indicating an increase of 0.71%. The stock of Cannasouth Limited (NZX: CBD) rose by 10.71% to NZ$0.930 per share. On the other hand, the share price of Blackwell Global Holdings Limited (NZX: BGI) tumbled by 15.79% to NZ$0.016 per share.

Recently, we have written an article on oOh!media Limited (ASX:OML), and the readers can view the content by clicking here.

Reliance Worldwide Corporation Limited Reported Growth in Operating Cash Flows

Reliance Worldwide Corporation Limited (ASX:RWC) recently notified the market with FY20 earnings, wherein, it recorded a growth of 5% in net sales to $1,162.4 million. Reported NPAT and EBITDA for the full year amounted to $89.4 million and $217.9 million, reflecting a fall of 33% and 10%, respectively. The company experienced a rise of 56% in cash flow from operating activities to $278.3 million. As on 30th June 2020, the net debt balance of the company stood at $302.2 million, indicating a decline of $124.4 million. RWC declared a partially franked final dividend of 2.5 cents per share, which took the total dividend for FY20 to 7.0 cents per share.

oOh!media Limited Released 1H FY20 Results

oOh!media Limited (ASX:OML) recently released its 1H FY20 results, wherein, it reported a fall of 33% in revenue to $205.0 million. Underlying EBITDA for the period amounted to $10.8 million against $56.0 million in the pcp. OML reported underlying NPATA loss of $16.9 million as compared to the profit of $18.2 million in pcp. The company has cemented its financial position via completion of the equity raising in April 2020. During 1H20, the company has maintained its leading market share in Australia and New Zealand Out of Home markets. The company closed the half-year with a net debt balance of $115.2 million, reflecting a decline of $239.3 million from 31 December 2019.