On 29th July 2020, the equity market of Australia ended in red, and S&P/ASX200 went down by 14.1 points to 6006.4. During the last five days, the index has lost 1.13%. S&P/ASX 200 Materials (Sector) settled at 14,270.0, reflecting a fall of 250.7 points. S&P/ASX 200 Information Technology (Sector) moved down by 1.56% to 1,629.2.

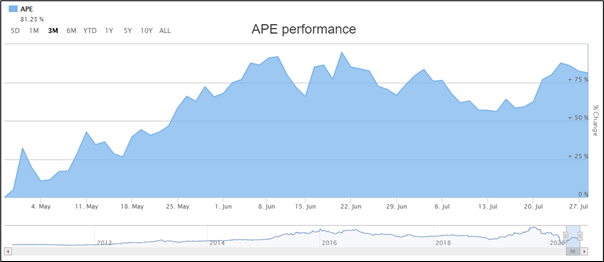

On ASX, the share price of AP Eagers Limited (ASX: APE) settled at $7.990 per share. The stock of PolyNovo Limited (ASX: PNV) stood at $2.270 per share with a rise of 3.182%.

Stock Performance (Source: ASX)

S&P/NZX50 settled the session at 11,599, reflecting a rise of 0.18%. The share price of New Talisman Gold Mines Limited (NZX: NTL) rose by 14.29% to NZ$$0.008 per share. The stock of Plexure Group Limited (NZX: PLX) inched up by 9.09% to NZ$1.320. However, the share price of Blackwell Global Holdings Limited (NZX: BGI) moved down by 15.00% to NZ$0.017 per share.

On the same day, the share price of Wellington Drive Technologies Limited (NZX: WDT) witnessed a fall of 5.71% on an intraday basis to NZ$0.066 per share. Also, the stock of T&G Global Limited (NZX: TGG) encountered a decline of 5.20% to NZ$2.550 per share.

Recently, we have written an article on Mount Burgess Mining NL (ASX:MTB), and the readers can view the content by clicking here.

AP Eagers Limited Finished 2019 Annual General Meeting on 29th July 2020.

AP Eagers Limited (ASX:APE) recently completed its 2019 Annual General Meeting, wherein all resolutions were passed on a poll. The Chairman of the company stated that the group recorded a statutory loss after tax amounting to $80.5 million for the year to December 31, 2019. The group managed to deliver underlying operating profit before tax of $100.4 million despite challenging market conditions.

PolyNovo Limited Ended in Green on Australian Securities Exchange.

PolyNovo Limited (ASX:PNV) recently advised the market that it has received funding of US$15 million from BARDA to support the Pivotal trial program of NovoSorb BTM. The company would make a modest co-funding and “in kind” contribution to the trial with the final budget to be announced after the US FDA approval.

With respect to the US, the company stated that June 2020 was the new record sales month.

The company has opened 7 new hospital accounts since the record sales month announced on 7th April.