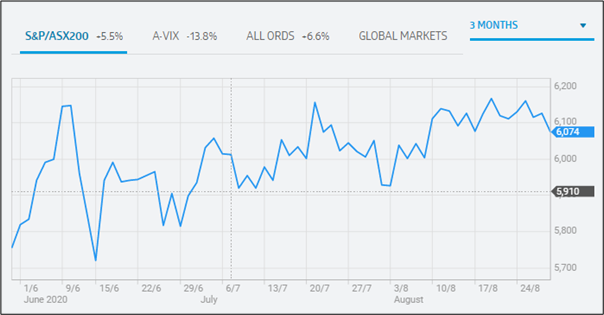

The equity market of Australia ended in red on 28th August 2020, and S&P/ASX200 went down by 52.4 points to 6073.8. During the last three months, the index has gained 5.5%. S&P/ASX 200 Health Care (Sector) witnessed a fall of 458.1 points to 42,678.9. S&P/ASX 200 Materials (Sector) moved down by 256.2 to 14,155.1.

S&P/ASX200 Performance (Source: ASX)

On ASX, the share price of PolyNovo Limited (ASX: PNV) rose by 12.871% to $2.280 per share. The stock of Costa Group Holdings Limited (ASX: CGC) inched up by 11.824% to $3.310 per share.

S&P/NZX50 closed the session in green as there was an increase of 0.33% to 12,093.52 while S&P/NZX20 rose by 0.20% to 8,035.90. Notably, S&P/NZX10 encountered a rise of 0.36% to 2,186.25.

Recently, we have written an article on Greenland Minerals Limited (ASX:GGG), and the readers can click here to view the content.

PolyNovo Limited Ended in Green on Australian Securities Exchange.

PolyNovo Limited (ASX:PNV) recently announced, for FY20, it recorded revenue of $22.229 million, reflecting a rise of 54.6% over FY19. NovoSorb BTM sales revenue for the period amounted to $19.1 million, reflecting a rise of 104% on a YoY basis.

As on 30th June 2020, the company had cash on hand of $11.6 million and possessed unused debt facility of $2 million.

Costa Group Holdings Limited Release 1H CY20 Results

Costa Group Holdings Limited (ASX:CGC) recently notified the market with 1H CY20 results, wherein, it reported revenue amounting to $612.4 million with a rise of 6.8% as compared to 1H CY19. EBITDA – SL for the period amounted to $93.7 million, reflecting an improvement of 13.7%. CGC recorded NPAT –SL of $45.8 million with a rise of 12.0% on 1H CY19. The company has resolved to pay a fully franked interim dividend of 4.0 cents per share on 8th October 2020.

During the half-year, the international segment of the company showcased strong performance with EBITDA-SL growth of 98%.

CGC continues to execute its Australian and international growth plan initiatives. At the end of half-year, the company reported net debt of $181.7 million and leverage of 1.66x.