On 14th July 2020, Australian equity market closed in red and the benchmark index S&P/ASX200 went down by 36.4 points to 5941.1. The index has lost 1.19% and 11.28% during the last five days and 52 weeks, respectively. S&P/ASX 200 Industrials (Sector) ended at 5,493.1, reflecting a fall of 47.6 points. S&P/ASX 200 Health Care (Sector) settled the day at 41,109.1 with a fall of 301.8 points.

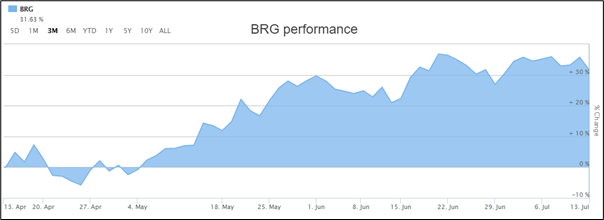

On ASX, the share price of Credit Corp Group Limited (ASX: CCP) moved up by 6.68% to $16.290 per share. The stock of Breville Group Limited (ASX: BRG) stood at $24.240 per share, reflecting an increase of 5.529%.

Stock Performance (Source: ASX)

S&P/NZX50 closed the session at 11,494, reflecting a rise of 0.52%. The stock of Blackwell Global Holdings Limited (NZX: BGI) soared by 23.08% to NZ$0.032 per share. The share price of Geneva Finance Limited (NZX: GFL) rose by 5.41% to NZ$0.390 per share. On the other hand, the stock of TRS Investments Ltd (NZX: TRS) tumbled by 33.33% to NZ$0.002 per share.

Recently, we have written an article on TPG Corporation Limited (ASX:TPM), and the readers can view the content by clicking here.

CCP Ended the Session in Green on July 14, 2020

Credit Corp Group Limited (ASX:CCP) recently stated that net profit after tax for FY20 is likely to be in the range of $10 million to $15 million after accounting for the impairment of purchased debt ledger assets and additional provisioning arising from the impact of the COVID-19 pandemic. However, the company expects NPAT before these adjustments in the range of $75 million-$80 million. The company added that it entered FY21 in a strong position with no net debt and undrawn lines of $375 million. The company continues to produce solid operating outcomes and strong cash flows.

Breville Group Limited Recently Announced Completion of A$10 Mn Underwritten Share Purchase Plan

Breville Group Limited (ASX:BRG) recently notified that Dean Warwick Howell has made a change to holdings in the company on 23rd June 2020 by acquiring 1,764 ordinary shares at the consideration of $29,988. The company also announced successful completion of A$10 Mn underwritten share purchase plan it announced on May 13, 2020. SPP follows the successful completion of the company’s fully underwritten A$94 Mn placement to the eligible institutional investors. As per the release, SPP as well as placement were undertaken at issue price of A$17.00 per share.