The resources sector of Australia envisages the performance of companies considered to generate strong economic stimuli. This sector generally provides opportunities, which primarily include wealth of the economy, jobs and wages, and innovative technologies etc. On Australian Stock Exchange, the resource sector is identified as S&P/ASX 200 Resource, which is trading at 4,716.4 with a fall of 0.02% on 12th September 2019 (AEST 3: 17 PM).

Letâs get to know about whatâs trending within the resources sector with help of four companies:

Kidman Resources Limited

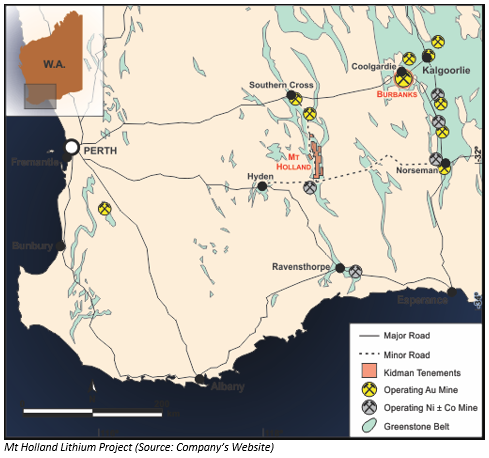

Kidman Resources Limited (ASX: KDR) is engaged into exploration and development of Mt Holland Lithium Project.

Approval of Scheme of Arrangement

The company through a release dated 12th September 2019 announced that its scheme of arrangement has been approved by Federal Court of Australia.

- Under the terms of scheme of arrangement, Wesfarmers Lithium Pty Ltd would purchase all the issued ordinary shares in KDR.

- The company anticipates lodging a copy of the Court's orders with the Australian Securities and Investments Commission (ASIC) on 13th September 2019, at which time the Scheme would become legally effective.

Change in Substantial Holding

The company recently announced that UBS Group AG and its related bodies corporate has made a change to their substantial holdings with current voting power of 7.67% as compared to the previous voting power of 6.35% on 16th August 2019.

A Look at Quarterly Performance

As per the release dated 11th July 2019, the company published a performance for the quarter ended 30th June 2019 wherein its stated that:

- During the quarter period from 1st April 2019 to 30th June 2019, the company and Wesfarmers Limited had entered into a Scheme Implementation Deed, wherein it was proposed that Wesfarmers would acquire 100% of the shares in Kidman at the consideration of $1.90 per share by way of a Scheme of Arrangement.

- At the end of quarter, the company reported cash outflow of around $1.4 million because of change in the estimate and timing of tax payable and the cash position of the company stood at around $25.6 million.

When it comes to the price performance of stock, Kidman Resources Limited was last trading at a price of A$1.895 per share on 12th September 2019. It witnessed a surge of 53.44% in the time span of six months. On Year-To-Date basis, the stock posted a rise of 74.65%.

Carnarvon Petroleum Limited

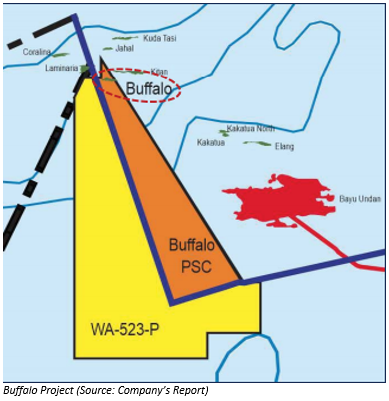

Carnarvon Petroleum Limited (ASX: CVN) is involved into exploration, development and production of oil and gas, and was officially listed on Australian Stock Exchange in 1984.

The company has recently published a Good Oil Conference presentation dated 12th September 2019, wherein it communicated that it has achieved numerous major milestones in the recent weeks.

- The company stated that the wireline logging of the Dorado-3 well has been completed. It has provided evidence of hydrocarbon deposits within the Baxter, Crespin and Caley intervals.

- It further added that the flow testing of Dorado-3 well has been scheduled to begin shortly after the positive results from wireline logging.

- When it comes to Dorado-2 appraisal well, it successfully provided confirmation of a large deposit of liquids and gas.

- The Buffalo project of the company is progressing well with the recent signing of Production Sharing Contract and 3 well EP being granted

Addition to S&P/ASX All Australian 200

The S&P Dow Jones Indices has recently made an announcement dated 6th September 2019, wherein Quarterly Rebalance of the S&P/ASX Indices was mentioned. The S&P Dow Jones Indices announced that Carnarvon Petroleum Limited will be added to S&P/ASX All Australian 200, which will be effective at the market open on 23rd September 2019.

Key Takeaways from Annual Report 2019

The company stated that it has entered into an agreement with CWX Global Limited in order to settle the outstanding deferred amount, which is payable to Carnarvon for a sum of US$4.0 million with $0.05m paid on the agreement date and the balance paid on 30 June 2017 in cash or shares in CWX. The cash and cash equivalent of the company stood at $73.90 million in FY19 as compared to $63.606 million in FY18

When it comes to the price performance of stock, Carnarvon Petroleum Limited was last traded at a price of A$0.395 per share on 12th September 2019. It witnessed fall of 16.30% in the time span of six months. On Year-To-Date basis, the stock posted a rise of 16.67%.

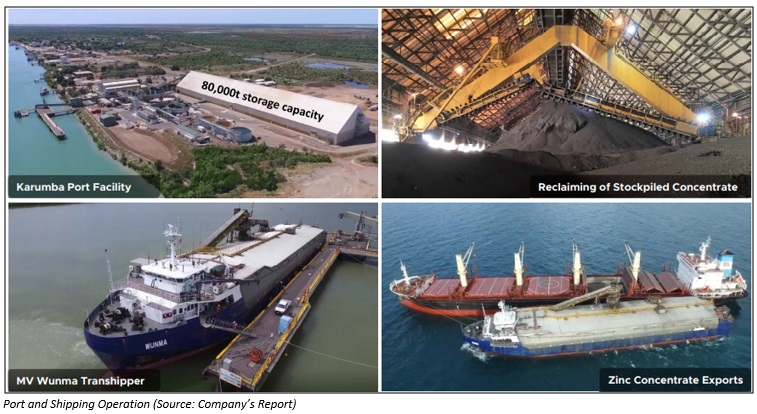

New Century Resources Limited

New Century Resources Limited (ASX: NCZ) is engaged in development of exploration projects in minerals.

Recently, the company through a release updated the with results of General Meeting, which was held on 12th September 2019. The following resolutions were passed the meeting:

- Resolution 1- Ratification of prior issue of Tranche 1 Placement Shares

- Resolution 2- Approval to issue Tranche 2 Placement Shares

- Resolution 3- Approval to issue Shares to Directors and Management

- Resolution 4- Ratification of prior issue of Options to Director

- Resolution 5- Approval to issue Options to Director

Key Points from Investor Presentation:

As per the presentation, the company is focused on improved operational performance. The company is bringing entire plant capacity online over FY20 and full cleaner circuit removes recovery bottleneck for 8-9Mtpa operations & 12Mtpa expansion. The company is aiming continued recovery trend growth at 8-9Mtpa for 2019 & 12Mtpa ramp up in early 2020.

Milestone Achieved

- As per the release dated 22nd August 2019, NCZ has achieved a milestone of becoming a first company in order to obtain a royalty deferral agreement with the Queensland (QLD) Government under the Resources Regional Development Framework.

- It was mentioned in the release that the agreement follows a substantial period of engagement as well as due diligence by the Government of Queensland (QLD), and identifies the significant benefits of the companyâs model to mine rehabilitation and local stakeholder value creation.

In another update, the company announced that Macquarie Group Limited and its controlled bodies corporate has made a change to their substantial holdings in the company with the voting power of 7.44% against previous voting power of 12.03%. The company further stated that the change was made on 15th August 2019.

When it comes to the price performance of stock, New Century Resources Limited was last traded at a price of A$0.327 per share on 12th September 2019. It witnessed fall of 61.73% in the time span of six months. On Year-To-Date basis, the stock posted a fall of 60.00%.

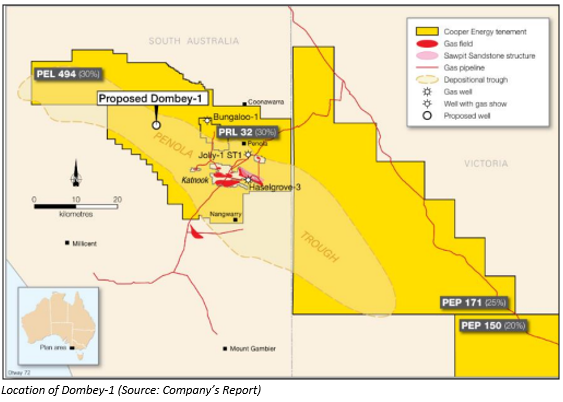

Cooper Energy Limited

Cooper Energy Limited (ASX: COE) is into securing, finding, developing, producing and selling of hydrocarbons. As per the release dated 11th September 2019, the company which is having an interest of 30% in PEL 494, announced that the spudding of Dombey-1, which is an onshore gas exploration well. The company further stated that Dombey-1 is in PEL 494, in the adjoining PPL-62 licence area containing gas discoveries in the Pretty Hill Formation and Sawpit Sandstone. It added that these reservoirs are the primary targets of Dombey-1. If the company receives successful results in the primary target reservoirs, it has planned to drill deeper in order to test the potential of a secondary target, which is the Lower Sawpit Sandstone.

Financial Performance:

- In FY19, the company reported statutory net loss after tax amounting to $12.1 million, reflecting a fall from net profit after tax of $27.0 million.

- The significant items stood at ($25.4) million.

- The underlying profit after tax of the company stood at $13.3 million, reflecting a rise of 36% from $9.8 million.

- It posted underlying EBITDA amounting to $32.9 million with a rise of 1% from $32.6 million.

When it comes to the price performance of stock, Cooper Energy Limited was last traded at a price of A$0.620 per share on 12th September 2019. It witnessed a rise of 25.77% in the time span of six months. On Year-To-Date basis, the stock posted a rise of 41.86%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.