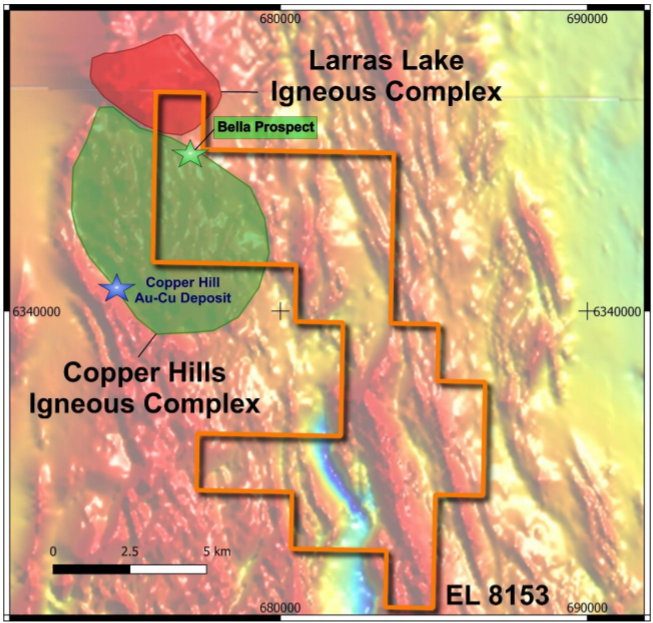

The aggressive exploration work which is currently underway at Belgravia has identified a second major porphyry intrusive complex, the Larras Lake Igneous Complex (LLIC) at the project, as announced on 3 December 2019.

This Complex lies immediately north of the Copper Hill Igneous Complex (CHIC) and is also known to be gold mineralised. It is also adjacent to the Companyâs Bella Prospect (figure 1).

Figure 1: Location of the Larras Lake Igneous Complex in relation to the Belgravia Project (Source: Company reports)

Fortunately, both the previously announced Bella prospect and the LLIC porphyry targets are included within the drone magnetics survey, which is currently underway.

In the past couple of months, the Australian exploration company, Krakatoa Resources Limited (ASX: KTA) has been steaming ahead with the exploration of its recently acquired Belgravia Project. Surrounded by majors, the company had acquired this project with great confidence in its geological setting.

The field due diligence conducted at the project has already confirmed the prospective nature of the Belgravia Project and the 6 initial targets, as announced on 9 October 2019.

The Belgravia Project is located within the Molong Volcanic Belt, home to significant metal endowments, such as Cadia Valley (43.4Moz Au, 7.97Mt Cu), and the adjacent Copper Hill (890Koz Au, 310Kt Cu).

Historic Work at Larras Lake 2nd Porphyry Target

- In 1995 Mount Isa Mines (MIM) identified weak potassic and propylitic alteration associated with a monzodiorite intrusion at Larras Lake through a Rotary Air Blast (RAB) program comprised mostly shallow.

- Later in 1997 Newcrest Mining Limited drilled four Reverse Circulation (RC) holes to test earlier MIM RAB anomalies (defined as 200ppb Au and >300ppm Cu).

- The limited historical drilling program by Newcrest supports the LLIC as being gold mineralised, with better results including:

- 30m @ 0.20 g/t Au from 163m (Hole: LLR004) including 1m @ 1.15 g/t Au and 0.28% Cu from 185m

- 3m @ 1.02 g/t Au and 0.10% Cu from 56m (Hole: LLR004) including 1m @ 2.28 g/t Au and 0.21% Cu from 56m

- 6m @ 0.26 g/t Au from 105m (Hole: LLR004)

- 6m @ 0.18g/t Au from 84m (Hole: LLR003)

- 1m @ 0.88g/t from 109m (Hole: LLR003)

Newcrest drill logs note increasing alteration at depth and in the direction of the Belgravia Project, including âhematite dustingâ and âpervasive sericiteâ, which are strongly associated with mineralisation at Cadia.

Alteration-styles and returned gold grades are interpreted as characteristic of drilling on the periphery of a more extensive mineralised system. The LLIC and The CHIC provide the company with a highly prospective area of over 15km2 for the discovery of porphyry clusters

Krakatoa is of the view that the metal tenor and distribution, and that of the alteration minerals, support the theory that Newcrest drilled the periphery of a larger mineralised system that potentially lies at depth and direction consistent with the Companyâs Belgravia Project.

Considering the prospectivity of Belgravia, and KTAâs recent move to acquire the Turon Project which is prospective for High-grade âSlate Beltâ orogenic gold and Shear-hosted gold mineralization in the same Lachlan Fold region, it can be said that KTA are working hard to create value for investors. The increasing market confidence in KTA is evident in its share price performance. In the last three months, KTA has doubled its shareholdersâ wealth, with the share price rising by 100% over the period.

KTA believes that it is loaded with leverage, as their market cap at sub $7m remains substantially lower than the majority of peers in the Lachlan Fold.

On 4 December 2019, KTAâs stock was trading at a price of $0.039 with a market cap of around $6.93 m.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.