Kogi Iron Limited (ASX:KFE) is an Australia registered company involved in the business of exploration of iron ore. In an announcement made on Friday 7th June 2019, the company highlighted that it has dispatched the prospectus for its entitlement offer to its eligible shareholders along with an entitlement and acceptance form. In another recent release, KFE updated investors about its continuing Definitive Feasibility Study regarding the building of a steelmaking facility and producing steel billets for sale.

The company shed more light on the market study from Fastmarkets MB further to its 16th January 2019 ASX release. Accordingly, Fastmarkets considered that the Nigerian market has the potential to manage additional new billet production of up to 1.5m tpy on the back of forecasted market demand for steel billets. The Fastmarkets recommended the sales of 100-250,000 tpy in export markets in Cameroon and Ghana. Even though the recommendations which have been stated above from the Fastmarkets report can be considered as reassuring signal of overall potential demand for KFE product, it doesnât represent the initial plant size. Once the Definitive Feasibility Study is completed, KFE will be in a better position to make this decision.

The recommendations provided by Fastmarkets are based on the base case scenario in which Nigerian billet demand will hit 2.3m tpy mark by 2023 and will rise further to 2.9mtpa by 2030. Fastmarkets further added that the average global consumption has been over 200kg per capita, and the consumption was 98kg per capita in 2017 in South Africa. Fastmarkets noted that currently, Nigeria has around 193,000km of road, the majority being in poor condition.

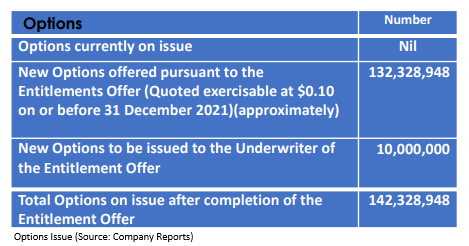

Entitlement Offer

The company published a report stating that on 29th May 2019, it undertook a non-renounceable entitlement issue of 1 new listed option in place of every 5 fully paid ordinary shares in the capital of the company held by eligible shareholders at the record date at an issue price of $0.01 per option. The funds raised under the offer of up to $1,323,289 will provide working capital funding for KFEâs projects. The options issued under the concerned entitlement offer will form a new class of securities of KFE, and it will be quoted and exercisable by paying 10 cents per option at any time on or before 31 December 2021.

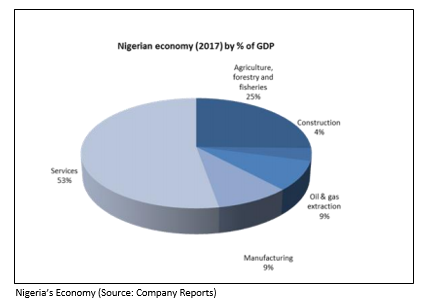

Rapid Growing Economy in Nigeria

In May 2019, the company released its Investor Presentation and highlighted West Africaâs first integrated cast steel project. Nigeria's road system is well maintained and extensive. Furthermore, KFE will rely on the Nigerian infrastructure to deliver products to potential steel rolling mill customers around the country. Nigeria, functioning democracy, is the most popular country with the largest GDP, a growing middle class and educated workforce in Africa. There are 30 steel converters and mills with a combined capacity of 6.5 Mt/annum in Nigeria. The government has recognised its over reliance on oil for ForEx as a weakness and is working hard to encourage Foreign Direct Investment in the mining and steel sectors. The FDI reached US$8.9 billion in 2017 and is still growing. The government continued to fight against Islamic extremism in the North; however, the cast steel project is centrally located in a stable and peaceful region.

The Nigeria steel demand is at 6.8 Mtpa; however, there are no primary billet production facilities in Nigeria. For producing rebar, hot/cold rolled steel and wire coils, most of the steel operations are focused on using the imported and recycled scrap metal. For Nigeria, ECAâs have indicated sector and country appetite in the range of US$500 million and US$750 million and the sourcing strategy has been influenced by the quality of the Export Credit Agency (ECA) support and the associated All in Cost of Funding.

The completion of the Definitive Feasibility Study and the appointment of an EPCM contractor will enable the company to secure firm offers of commitment from the final selected ECA.

Definitive Feasibility Study Overview: Subsequent to the completion of the test work and promotion study of Fastmarkets MB, KFE is well poised to advance the completion of the DFS.

Quarterly Report

In the quarter ending March 2019, the company successfully concluded a capital raising of $575,750 via placement of 6.7 million ordinary shares at 8.5 cents per share to professional and sophisticated investors. KFE had cash at bank of $432,000 at the quarter end. The company had fully paid ordinary shares on issue of 661,644,742 at the end of the quarter. The net cash used in the operating activities for the period stood at $0.423 million, including exploration and evaluation expenses of $0.272 million and administration and corporate costs of $0.153 million. During the quarter, Kogi Iron Limited along with its subsidiary KCM signed a letter of intent to advance the discussions with a Nigeria based steel producer, Inner Galaxy Group.

The current liquidity ratio of the company stood at 0.45x in 1H FY19 when compared to the industry median of 1.87x, which indicates that the company is unable to manage its short-term obligations efficiently. (Source: Thomson Reuters)

For the half year ended 31st December 2018, Kogi Iron Limited paid the unpaid director fees via issuing 3,527,843 shares in consideration of 10.47 cents per share totaling $369,365.

On the stock information front, at the time of writing (on 7th June 2019, AEST 01:00 PM), the stock of Kogi Iron Limited was trading at $0.070, down 6.667% during the dayâs trade, with a market capitalisation of ~$49.62 million. Today, it reached dayâs high at $0.070, which is also dayâs low, with a daily volume of 86,293. Its 52-weeks high price stands at $0.200 and 52-weeks low price at $0.065, with an average volume of 348,633. Its absolute returns for the past six months, three months and one month are -24.24%, -6.25% and -9.64%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.