An Australian, publicly-listed mineral resource company, Dark Horse Resources Ltd (ASX: DHR) particularly focusses on Argentina. The company has invested in four gold and lithium projects with an aim to become a producer of high-grade Lithium and to discover a multimillion-ounce gold deposit. The key projects of the company include San Jorge Lithium Brine Project, Cachi Gold Project, Central Argentina Lithium Spodumene Project and Las Opeñas Gold Project.

The company has released an update on its Las Opeñas Gold Project through an ASX announcement on 26 July 2019. Dark Horse Resources informed about the completion of a diamond?sawn rock channel sampling program and detailed mapping at the Las Opeñas Gold Project. The exploration results confirmed widespread high-quality zones of gold and silver at the project.

Exploration Results

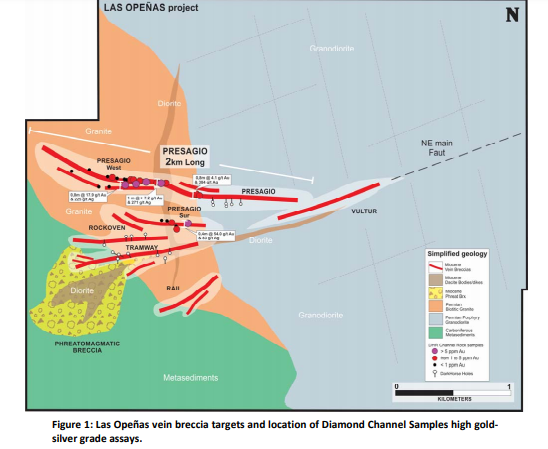

In all, forty-three channel samples were cut over the Presagio (34 samples) and Vultur (9 samples) mineralised zones. Out of which, seventeen samples were found to have gold assays over 1 g/t and five had gold assays over 5 g/t. The company mentioned that the highest silver grade was 739 g/t, and the highest gold grade was 54 g/t. Presagio and Vultur are among the five mineralised vein systems identified by the company under its drilling program.

The exploration results demonstrated significant gold and silver mineralisation at the intersection of northeast and northwest faults. The mineralisation was found to be parallelly distributed across the Presagio vein?breccia system on?echelon structures. The geoscientist team of the company has interpreted a hypothetical geological model of Presagio that indicated the targeted mineralization at depth.

Source: Companyâs Report (26th July 2019)

The company will use the positive results of this discovery to target further drilling that is expected to begin in the last quarter of 2019 post the Argentinean winter.

Recent Activities at Las Opeñas Gold Project

On 27th May 2019, the company released an update on the Argentine Gold Project that highlighted the completion of a first phase Reverse Circulation drilling program (17 drill holes for 1,535m) at Las Opeñas, confirming some high-grade mineralised zones in San Juan province. Post the completion of the program, five mineralised vein systems were detected at the project that included Rock Oven, Viscacha, Tramway, Vultur and Presagio.

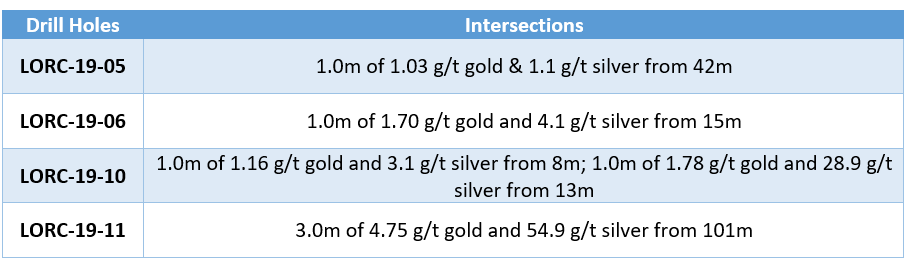

Two prospects were tested at the Tramway and Rock Oven vein targets by the first 11 drill holes for 1,017m that delivered significant assay results, including the following intersections:

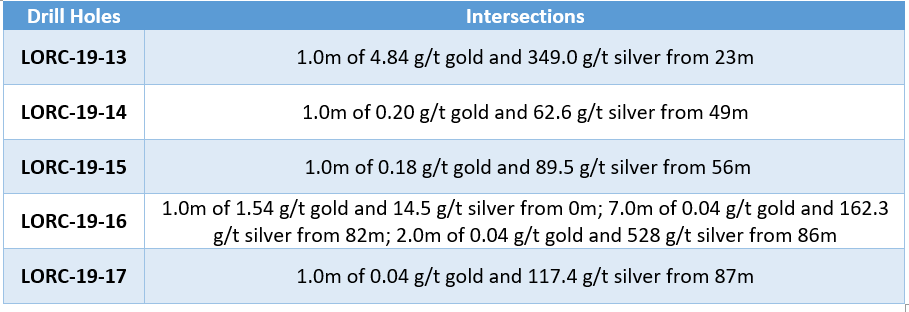

Subsequent to the testing at Tramway and Rock Oven, Presagio was tested with six holes for 518m, delivering the following intersections:

The initial 17-hole program is a known program that was previously tested but not drilled by the companiesâ Teck and Genesis. They focused their drilling on an adjacent low-quality phreatomagmatic breccia target and did not test the high-quality gold, base metal rich quartz veins identified by the Dark Horse Resources during sampling and surface mapping at the Las Opeñas Gold Project. The project was later taken over by the Dark Horse Resources to focus on the epithermal gold system, where the mineralisation of gold and silver takes place in stock work zones, vein breccias and high-grade veins.

Overview of Las Opeñas Gold Project

Situated on the border of the Indio Belt of Argentina, the Las Opeñas Gold Project contains multi-million-ounce gold deposits that incorporate Pascua Lama (18Moz) and Veladero (12Moz). The mining lease lies at a relatively low altitude, between 2,800m and 3,500m, covering an area of 1,462ha. Free of the glacier and periglacial geoforms, the project has an excellent access from San Juan city and Rodeo township. The project is connected to the nearest village of Angualasto through a well-maintained public gravel road.

Las Opeñas Gold Project Location, Source: Companyâs Report

A Look at Companyâs Financial Performance

In March this year, the company released its half-year financial report for the six months ending 31st December 2018. The company reported a total comprehensive loss for the period amounting to ~AUD 2.23 million against the loss of ~AUD 1.79 million reported in the prior corresponding period. The cash and cash equivalents at the end of the half-year stood at AUD 2.16 million.

The company incurred operating cash outflows of ~AUD 847k in the half-year which was more than the expenses of ~AUD 492k in pcp. The net assets of the company at the end of the reported half-year were valued at AUD 12.3 million.

Stock Performance

The stock of the company rose 33.33 per cent on ASX today, closing the trading session at AUD 0.004. With ~14.3 million of shares in rotation, the market capitalisation of DHR was at AUD 6.07 million. During the intraday trade, the stock touched a high value of AUD 0.006 at around 10:30 AM AEST. The stock has generated a negative return of 40 per cent on YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.