iCar Asia Limited (ASX: ICQ) has been operating Internet-based automotive portals in Malaysia, Thailand and Indonesia. In South East Asia, when it comes to buying or selling new or old vehicles, iCarAsia is a popular name that comes to everybodyâs mind.

Recently, the companyâs Malaysian brand, Carlist.my announced that it is planning to launch a WeChat mini program. WeChat is the worldâs largest mobile chat application, with over 20 million Malaysian users.

With WeChat mini program, Carlist.my will be able to run special promotions to WeChat users within the mobile social communication app, and Wechat users will be able to search for cars, make direct enquiries to car dealers about models for sale from Carlist.my, all without leaving the WeChat app. This mini program is anticipated to help car buyers to connect with car sellers.

It is expected that by the end of May 2019, users will be able to use the WeChat mini program. The launch of this program is a testament that the company is one step ahead in a highly competitive automotive market.

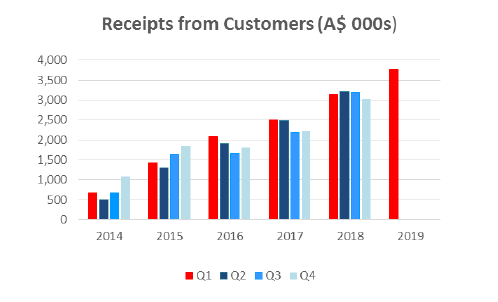

As far as the companyâs financial performance is concerned, the company has reported strong financial results with outstanding operational metrics in FY 2018. For the year ended 31st December 2018, the company reported a revenue of around $11.56 million, ~27% higher than the previous corresponding period. During the year, the receipts from customers increased by 46% to $13.69 million.

Highlights for the 2018 year

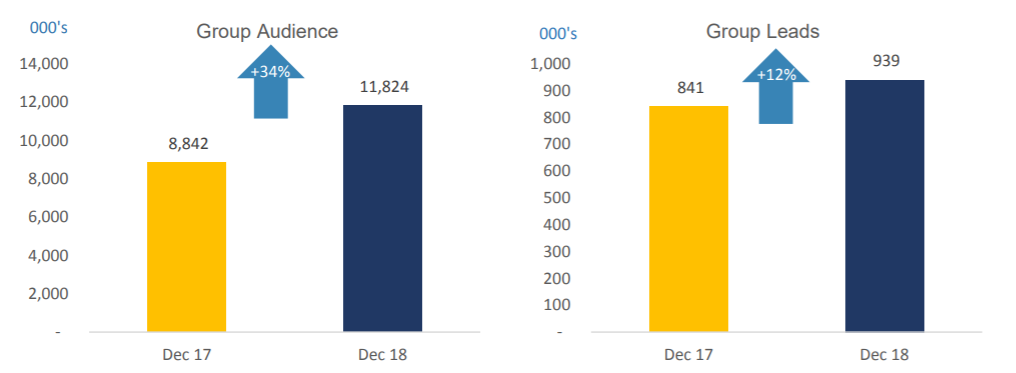

- 34% year-on-year growth in total audience numbers across the group to approximately 12 million unique visitors per month;

- 12% year-on-year growth in average monthly leads across the group.

Group operational metrics (Source: Companyâs Report)

Group operational metrics (Source: Companyâs Report)

In FY 2018, the company delivered growth in all of its key operating metrics across all countries.

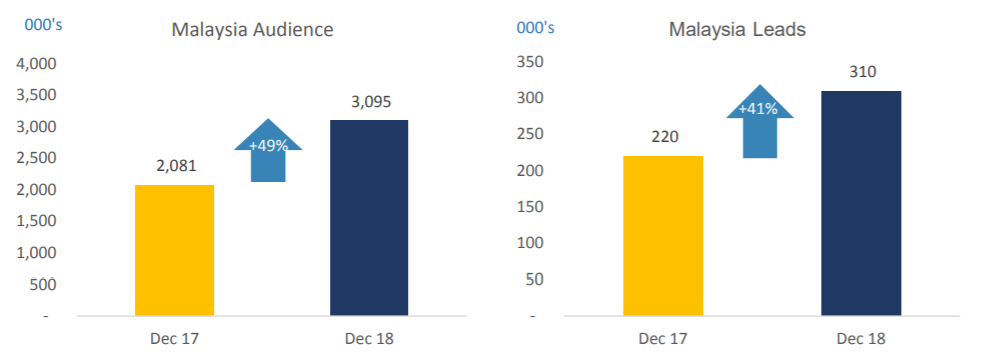

The Malaysian and Thailand business achieved an important financial milestone by becoming EBITDA and cash flow positive in FY 2018. The companyâs average monthly audience in Malaysia and Thailand increased by 49% and 27%, respectively, on a year-on-year basis. The Indonesian business had a transformative year with Average monthly audience and lead volumes growing strongly by 32% and 16% in 2018, respectively on Y-o-Y basis. As a result, the Group remains on track to reach EBITDA breakeven by the end of 2019

These strong operational metrics are expected to underpin future growth across all businesses in 2019.

Malaysiaâs operational metrics (Source: Companyâs Report)

Malaysiaâs operational metrics (Source: Companyâs Report)

In the first quarter of 2019, the company reported $3.8 million of cash receipts from customers, up 25% as compared to Q4 2018. In parallel, the companyâs unaudited revenues in Q1 2019 grew 30% on a year-on-year basis to $2.6 million.

Receipts from Customers (Source: Companyâs Report)

In the last six months, the companyâs stock has provided a return of 76.922%, with a YTD return of 70.37%. On 30th May 2019, ICQâs stock traded at $0.230 with a market capitalisation of $88.42 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.