Galan Lithium (ASX: GLN) is a mineral exploration company, incorporated in 2011 and formerly known as Dempsey Minerals until August 2018. Led by a highly experienced Board, the company is focussed on exploration of lithium brines within South Americaâs world-renowned Lithium Triangle (Figure 1) on the Salar de Hombre Muerto in Argentina.

Figure 1, Source: Presentation - Lithium Supply & Markets Conference (Chile)

As per its capital structure, Galan has a market capitalisation of around AU$ 27.16 million with ~ 129.33 million outstanding shares. While the companyâs Directors and Management hold 30% of the stake, around 55% is held by its top 20 Shareholders. The cash in hand stood at AU$ 4.65 million as of 31st March 2019.

Today, on 11 June 2019, GLN zoomed up 4.76% mid-day, settling the dayâs trade at AU$ 0.205. In addition, the company has also released its Lithium Supply & Markets Conference (Chile) Presentation, throwing light on its ongoing activities and outlook ahead.

Hombre Muerto Basin: A Significant Investment Opportunity

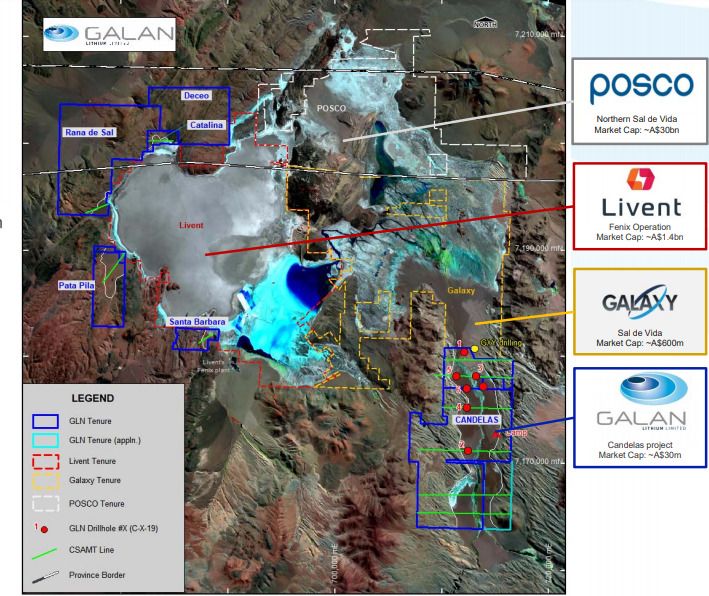

The brines within Hombre Muerto are rich reserves of highest-grade lithium with proven low impurity levels, making it a Tier 1 location. According to Galan, 60 percent of the worldâs annual production of lithium comes from brines from the Atacama and Salar de Hombre Muerto. Besides, the basin has a good neighbourhood with Livent Corporationâs El Fenix operation and Galaxy Resourcesâ (ASX: GXY) Sal de Vida project, where POSCO recently bought a part for USD 280 million.

Figure 2, Source: Presentation - Lithium Supply & Markets Conference (Chile)

Figure 2, Source: Presentation - Lithium Supply & Markets Conference (Chile)

Galan holds six projects totalling around 25000Ha with potential brine coverage conservatively comprising ~ 7,800Ha in Hombre Muerto, where the topography is quite favourable for mining lithium brines, such as the presence of ground water sourcing, volcanic rocks, arid climate, hypothermal activity, closed basin and faulted environment. Besides, the requisite infrastructure including power, sealed roads and processing water are also in place.

Candelas Lithium Brine Project

Within the Hombre Muerto basin, Galanâs primary target is the Candelas Lithium Brine Project located in Catamarca province, including a ~ 15 km long by 3-5 km wide Las Patos channel, which accounts for ~ 79% of incoming waters and lithium into the Salar.

The project area indicates the potential to host heavy brines as confirmed by the preliminary field measurements and laboratory analyses following the recent geophysics and drilling activities.

Drilling Campaign Stage 1

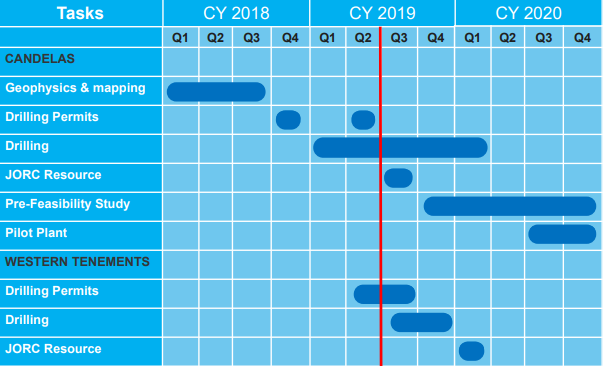

In December 2018, the Secretaria de Estado de Mineria â Gobierno de Catamarca granted the permits for Stage 1 and the drilling commenced at Candelas Project in January 2019, when Galan Lithium embarked on a journey to unlock the potential at its new target.

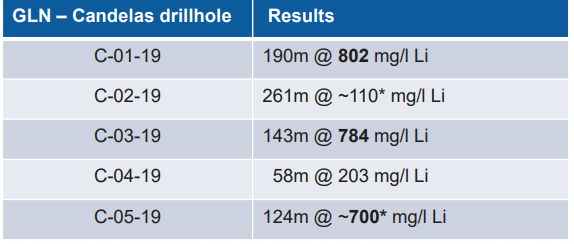

Drillhole highlights

Estimate from field data, awaiting assay confirmation.

Source: Presentation - Lithium Supply & Markets Conference (Chile)

Exceeding the companyâs expectations, an intercept of ~190m @ 802 mg/l was received from the maiden drill hole (C-01-19) in March 2019 with very low impurities (Mg/Li ratio ~ 2.70).

This paved the way for the continuation of campaign, whereby the drilling commenced for the second drill hole (C-02-19), located on geophysical CSAMT line 4, ~9.5 km south of C-01-19. The geology of C-02-19, completed to a total depth of 662 m, was mostly similar to that of C-01-19. However, the preliminary field data (from a 202 m section of C-02-19) returned conductivity levels of ~90,000 mS/cm and specific gravity (SG) of ~1.045, lower than the figures for C-01-19.

Immediately afterwards, the third drillhole C-03-19 was completed to a depth of 430 m with assays disclosed in April 2019. The results included an intercept of 143m @ 784 mg/l Li with low impurities and high conductivity levels of 183 to >200 mS/cm.

After further sampling of the brine, the rig was moved to the fourth drillhole C-04-19, where the field test returned a moderately conductive (100 mS/cm - 143 mS/cm) brine horizon, intercepted over 117 m from ~ 371 m to 488 m to the end of the hole, as announced on April end 2019.

On 29 May 2019, Galan reported the receipt of initial assays from the fifth drillhole (C-05-19), demonstrating good lithium grades from brine horizon (220 to 380 m), ranging between 491 -856 mg/l Li with consistently low impurity levels.

Drilling Campaign Stage 2

On 16 May 2019, Galan Lithium announced to have received permits from the Secretaria de Estado de MinerÃa ? Gobierno de Catamarca for its Stage 2 drill programme at the Candelas Project, whereby the drilling for the sixth hole, C-06-19, has been completed in the northern channel section, giving encouraging results. The activities are currently on standby and are expected to resume as the weather settles.

Western Basin Projects

Galan Lithium has completed resistivity surveys at four new targets in Salar De Hombre Muerto. The initial near surface water sampling has given encouraging results with several samples greater than 1000 mg/I Li. Besides, the resistivity values from the targets, which lie adjacent to Liventâs operations, are similar to Candelas, depicting positive implications for lithium grade potential.

The company anticipates receiving drilling permits shortly, with drilling at Pata Pila (see Figure 2) scheduled for Q3 2019.

Achievements and Indicative Next Steps

With consistent headways achieved, Galan is aiming to define a JORC compliant Maiden Resource estimate by Q3 CY2019. SRK (Australia) is overseeing the resource definition. Going forth, Galan intends to undertake a Pre-Feasibility Study (PFS) on Candelas to evaluate the production of lithium carbonate. Furthermore, a pilot plant is planned to be operating during Q3 2020, targeting the production of battery grade lithium carbonate.

Achievements and Indicative Next Steps; Source: Presentation - Lithium Supply & Markets Conference (Chile)

The Right Commodity, The Right Time

Galan Lithium is operating at a time when the province of Catamarca has been very supporting of lithium exploration to foreign emerging explorers, making Argentina a pro-mining and investment destination. The fixed exchange rate between US$ and Argentina Peso has been removed and capital controls are no longer in place. Besides, major export duties and trade controls have been waved off. There is a consistent royalty regime, introduced in 2017, for all minerals across most of the country.

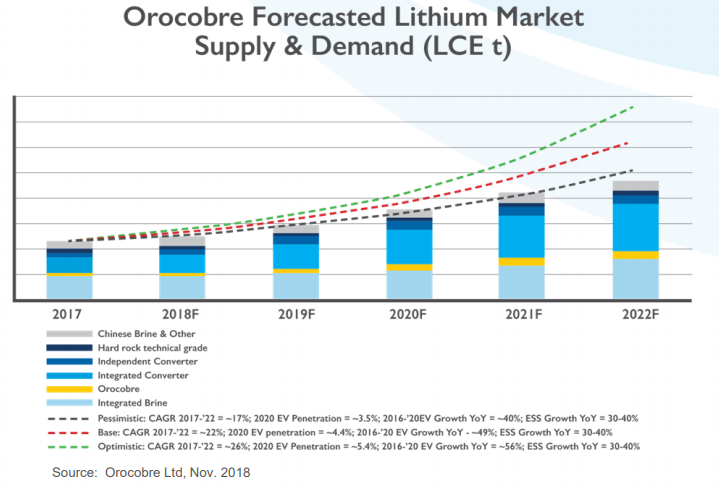

With the electric vehicle (EV) revolution kicking in, there has been an uptick in Li demand for EV batteries. In the past two years, the lithium price has significantly risen with the current prices at US$ 10,900/t Lithium carbonate equivalent (LCE).

Source: Presentation - Lithium Supply & Markets Conference (Chile)

The demand for lithium is expected to expand further, which is expected to exert an upward pressure on the prices, thereby presenting a compelling economic case for the lithium industry players.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.