Highlights

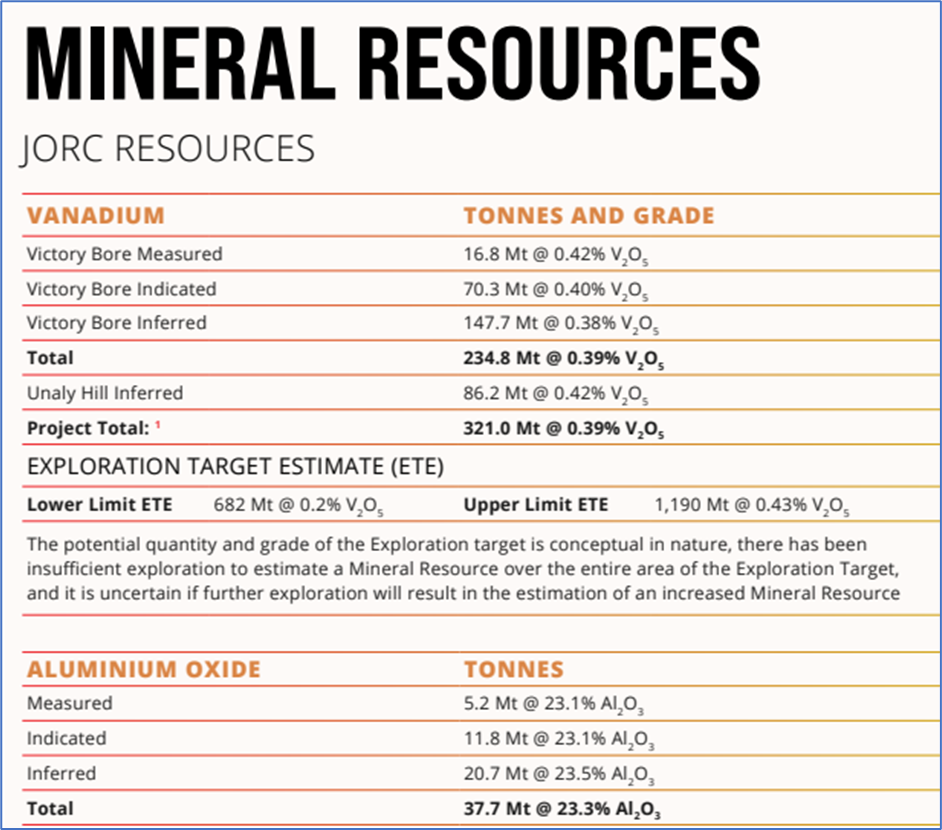

- Surefire Resources is developing one of Australia’s largest vanadium deposits.

- Inferred Mineral Resource of Victory Bore stands at 147.7 Mt at 0.38% V2O5.

- The company is focused on completed a pre-feasibility study at Victory Bore.

Mineral explorer Surefire Resources NL (ASX: SRN) is going full steam at its 100% owned Victory Bore Vanadium project, which is considered as one of Australia’s largest critical mineral deposits. Across Victory Bore, the mineral deposits contain more than 3 billion pounds of contained vanadium and 2 million tonnes of high purity alumina (HPA) aluminium oxide.

Image source: company update

Surefire sharpens focus on Victory Bore amid strong tailwinds

The main resource comprises two thick lodes of Vanadiferous Magnetite (50m wide, open at depth), and the secondary resource is one thick lode of aluminium oxide (50m wide, open at depth). The company informed that the testwork has indicated that aluminium oxide products can be a high-grade feedstock for HPA.

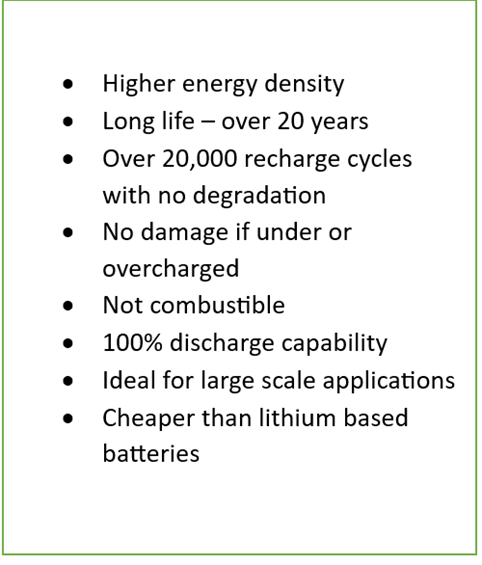

Surefire has its focus on the VRB (vanadium redox battery) storage battery market, which is expected to grow at a strong pace over the coming years. The company referring to studies suggests that the market for VRB batteries is forecast to reach AUD50-100 billion by 2025.

These batteries offer a number of benefits such as:

Data source: SRN PPT

SRN also highlights the growing demand for HPA across new applications, which comprise LED replacement lighting, CO2 emission separators, semi-conductors, and lithium-ion battery cells.

In 2022, the global demand for HPA was in the range of 60,000 tpa to 80,000 tpa, and the anticipated annual demand growth is between 13.5% and >20%, highlights the company update.

The development plan for Victory Bore

As part of the development plan, the company has inked an MoU with the Kingdom of Saudi Arabia (KSA) for concentrate processing and vanadium production. HPA feedstock from the project can also be processed in KSA as its demand is appreciating or for export to Europe.

The KSA is a major market for vanadium products, especially in the steel sector, where demand is growing at 4-5% YoY.

To know more about the MoU with KSA, click here.

Plans ahead

For the Victory Bore project, the company aims to conclude a pre-feasibility study, advance Saudi processing option, and progress with VRB strategy. Also, with testwork confirming production of HPA 4N 99.99% from the project, the company aims to undertake a scoping study.

SRN shares were trading at AU$0.014 at the time of writing on 29 September 2023.