Highlights:

- 2022 has been a very busy period for Saunders, with a number of significant multi-million-dollar contracts wins during the year

- These contracts hold strategic importance, fuelling Australian industries’ development and boosting the company’s order book for 2023 and beyond

- Some key Saunders’ achievements during 2022 in review.

The calendar year 2022 has been a busy ride for the multi-disciplined engineering and construction firm, Saunders International Limited (ASX:SND), which secured major contracts during the year.

These project wins boosted the company’s order book and portfolio, and are strategically important to boosting Australia’s growth and development, as per Saunders.

With more than seven decades of experience in providing solution-focused services, Saunders has won key projects involved with building Australia’s infrastructure facilities and improving the nation’s security and defence capabilities.

The year posed some economic uncertainties due to the global commodity crunch and the pandemic. However, Saunders has successfully managed the impacts of these uncertainties while leveraging market opportunities.

These strategic project wins and effective economic management have cumulatively led to a strong order book comprising large multi-million-dollar complex projects.

NSW Local Government Authorities recognise Saunders’ expertise

During the first quarter of 2022, the company was awarded AU$17 million worth of infrastructure projects focused on New South Wales.

The projects covered construction works for NSW Local Government Authorities including:

- Design and build of a 52m-long bridge in the Narrabri region.

- Construction of a four-span, 45m-long bridge, which includes approach road works in the Port Macquarie region.

- Super T bridge girders for four bridges as part of the Sydney Gateway project.

Saunders in project win spree in H2

For Saunders, the second half of 2022 emerged as one of its successful tender win periods. Demonstrating project and technical competencies and persistence to deliver the best value option, the company won several multi-million-dollar projects under two major government programs, nationally the “Boosting Australia’s Diesel Storage” and in NSW “Replacing Country Bridges” program.

In August, the company’s order book saw a substantial boost with AU$24 million worth of new projects, that will engage the range of diversified services offered by Saunders.

2022 in review

(Source: © 2022 Kalkine Media®, data source: Company update, 4 August 2022)

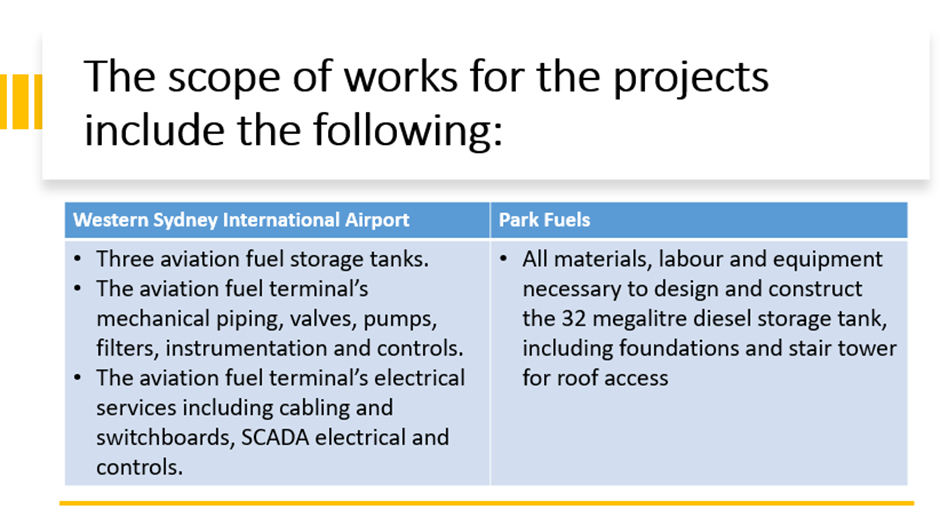

October boosted Saunders' confidence as the company won two more strategically important projects holding a cumulative project value of AU$53 million.

These project wins include the contract for building the aviation fuel terminal for the new Western Sydney International Airport and designing and constructing a 32-megalitre diesel storage tank for Park Fuels, Kooragang Island, Newcastle.

This diesel storage tank project is part of the Australian Government's “Boosting Australia’s Diesel Storage Program” (BADSP).

(Source: © 2022 Kalkine Media®, data source: Company updates, 17 and 27 October 2022)

More recently, Saunders secured a design and construction contract for two 4-megalitre aviation fuel tanks in Katherine, Northern Territory.

Saunders believes that the AU$8.5 million contract is a significant win for its defence sector strategy, which is anticipated to attract increased momentum as new defence projects reach the market.

The calendar year 2022 has been a year of positives for Saunders, which has boosted its performance by leveraging its core competencies. Apart from being a quantitatively advantageous year, Saunders has added federal and local government authorities and defence organisations to its strategic clientele list.

SND shares traded at AU$1.140 apiece on 23 December 2022.