Highlights:

- King River (ASX:KRR) has sharpened its focus on the Speewah vanadium project amid growing opportunities in the vanadium market

- Vanadium has emerged at the forefront of an emerging new energy market, owing to global focus on a sustainable and green future

- Vanadium-based batteries have major advantages over their counterparts

As per the United Nations, decarbonisation is one of the most important and hardest goals of the current generation and a matter of concern for all economies globally.

To execute this paramount goal, organisations around the globe are striving hard to reduce carbon emissions and achieve net-zero carbon status.

They are targeting carbon-intensive sectors like energy, contributing a major chunk of carbon emissions. And to execute this mammoth task, technologies like renewable energy act as the major weapon in their arsenal.

Companies are storing renewable energy (solar, wind, hydro, etc.) in high-capacity grid batteries, thus enhancing the use of renewable energy.

What makes vanadium-based batteries to stand out

Among all these developments lies battery metals which act as the building blocks for these greener technologies.

One such battery metal is vanadium, which has significant merits over its counterparts, especially due to its storage and grid-relief capacities. Along with being a favoured technology, it also has further developmental upsides.

Vanadium-based batteries can be considered above par based on the following technological advantages:

Safe and sustainable: Vanadium-based batteries are non-flammable, non-toxic, and can be considered way safer than the other alternatives.

Additionally, the vanadium metal used in these batteries can be fully reused or recycled at the end of the battery’s lifespan.

Efficient and reliable: These batteries have lower emissions and lower associated energy costs giving them an intrinsic edge. Their life span is twice as much as lithium-based batteries and can go up to 20-plus years.

They don’t pose a performance loss when used in harsh conditions, and the users can expect a 100% depth of discharge from these batteries.

Ease of scalability: One major quality required in grid batteries is their ease of scalability, as they tend to serve a larger population in later stages. With vanadium-based batteries, companies can easily build the required capacity by adding more storage tanks.

One example where vanadium batteries can be seen in full action is the Dalian Flow Battery Energy Storage Peak-shaving Power Station in China. It is a leading Vanadium Redox Flow Battery facility with an initial capacity of 400 MWh and an output of 100 MW.

King River Resources’ world-class vanadium asset

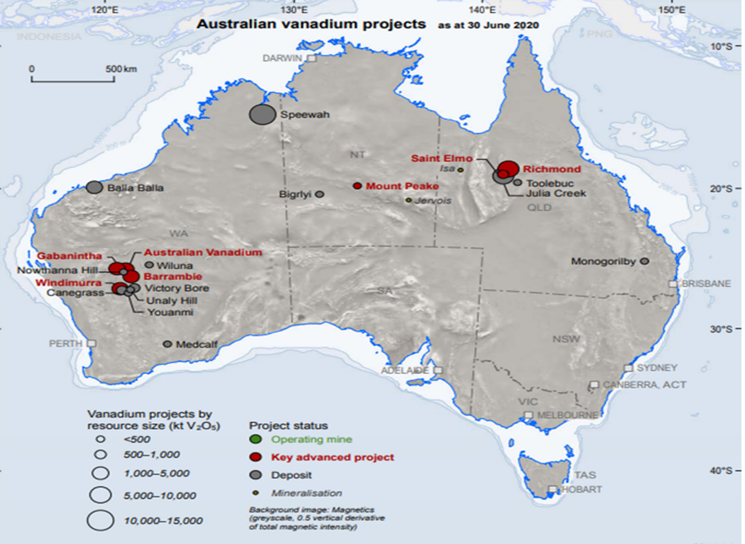

King River Resources Limited (ASX:KRR) is making rapid strides to develop its fully-owned Speewah Vanadium Project in Kimberley, Western Australia.

The ASX-listed exploration mining firm highlights Speewah as Australia’s largest vanadium-in-magnetite deposit based on tonnes and the vanadium pentoxide (V₂O₅) content.

(Image source: KRR update, 23 September 2022)

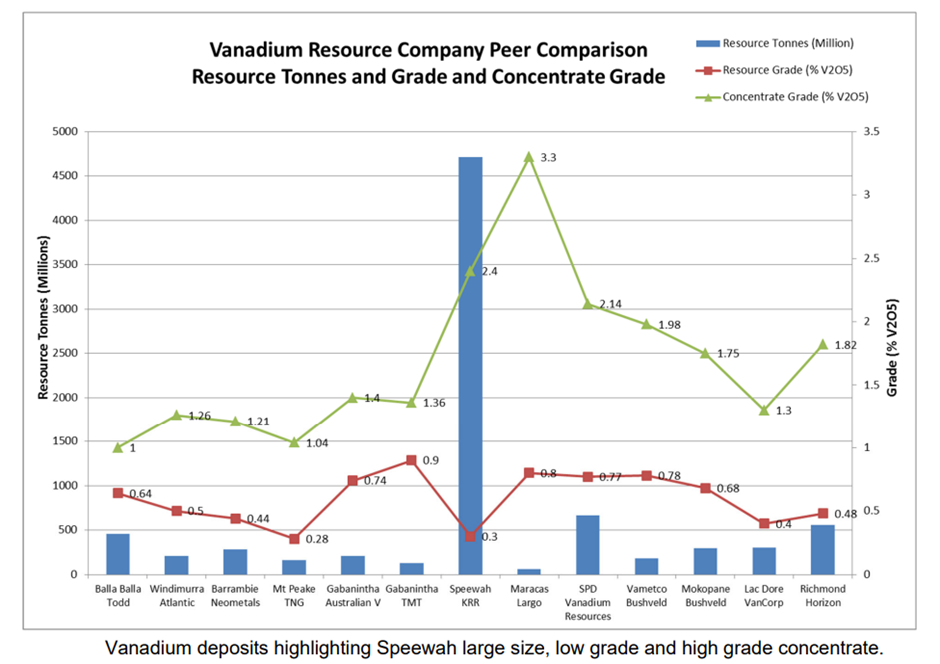

The company recently conceptualised a development plan for the project, which holds a measured, indicated, and inferred mineral resource of 4,712 million tonnes at 0.3% vanadium pentoxide, 3.3% titanium dioxide, and 14.7% iron.

As per King River, the project’s large deposit size supports a conceptual development plan for a potentially long mine life.

Open-cut mining for rock with low strip ratio

King River plans to execute open-cut mining on the Central Vanadium deposit, outcropping fresh rock from the shallow subsurface with shallow dipping geometry and a low strip ratio of 0.4.

Competency in producing high-grade concentrate

As per the company, it can produce a high-grade vanadium-bearing magnetite concentrate from both low- and high-grade zones.

Its approach for high-grade concentrate production from the deposit is by crushing, grinding, and magnetically separating the Central Vanadium’s high-grade (HG) zone deposit.

However, a greater mass of disseminated magnetite gabbro feed is required from the deposit of a low in-situ grade of 0.3-0.4% V₂O₅ with the disseminated nature of the mineralisation.

(Image source: KRR update, 23 September 2022)

In addition, the company is working with Murdoch University's Hydrometallurgy Research Group on an optimised process flow sheet for producing high-purity products. It includes producing vanadium pentoxide, titanium dioxide, and iron metal.

Given the global push towards low-carbon energy production, demand has been rising for vanadium in the production of vanadium redox flow batteries, master alloys, and titanium oxide pigments. As there is considerable demand for vanadium, King River focuses on accelerating the development program for its Speewah vanadium project.

Stock price information - KRR shares were trading at AU$0.012 in the early hours of trading on 13 December 2022, up more than 4% from the last close.