Highlights

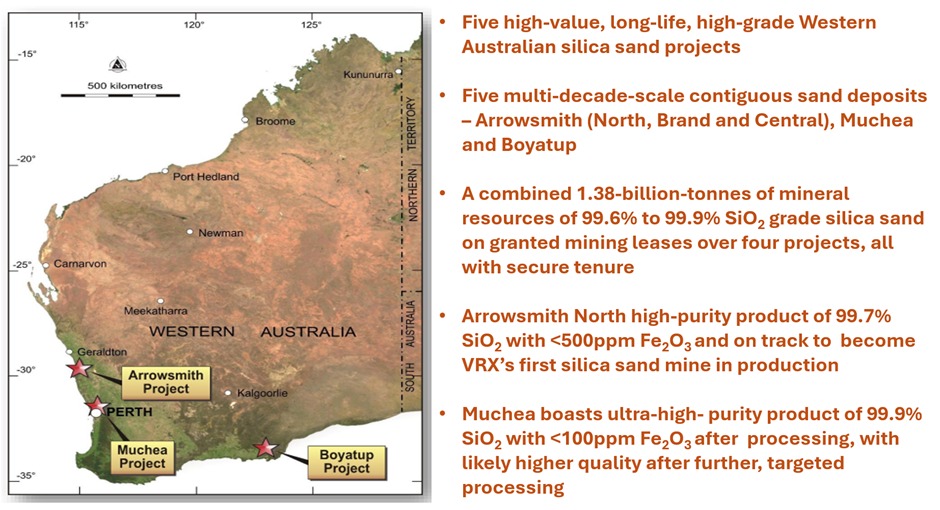

- VRX Silica holds five advanced projects in Western Australia, with a total mineral resource of 1,381 million tonnes.

- Arrowsmith North and Muchea have been featured in Austrade's 2024 Critical Minerals prospectus.

- Arrowsmith North, poised to become VRX’s first silica sand mine in production, is undergoing environmental approvals process.

- Muchea project has secured a AU$ 2 million grant to support its high purity quartz (HPQ) initiative.

VRX Silica Limited (ASX:VRX), a pure play silica sand company listed on the ASX, has been advancing its projects in Western Australia. With a pipeline of five projects: Muchea, Arrowsmith North, Arrowsmith Brand, Arrowsmith Central, and Boyatup, the total mineral resource of VRX’s silica sand projects was re-estimated at 1,381 million tonnes in June 2023.

Data and image source: Company update

Both the Arrowsmith North and Muchea projects have been highlighted in Austrade’s 2024 Australian Critical Minerals prospectus, underscoring the Australian Government’s recognition of silicon and silica sand as critical minerals. In its annual report for the year ended 30 June 2024, the company detailed ongoing activities in these two projects.

Arrowsmith North: Pioneering Silica Sand Production

Arrowsmith North is poised to become VRX’s first silica sand mine in production, although progress on the environmental approvals process has been slow. In FY24, the company saw the completion of multiple important technical stages, including approval from the Environmental Protection Authority of Western Australia to publish the Arrowsmith North Environmental Review Document for a Public Environmental Review (PER), which commenced on 19 June 2023.

During the four-week PER period, public and governmental submissions were collected and provided to VRX for review in early September 2023. The company submitted its responses to the EPA by late September 2023, and the EPA issued formal comments in April 2024, leading to an updated response lodged in May 2024.

VRX has maintained regular consultations with the EPA to finalise the response, which incorporates a detailed Rehabilitation Management Plan aimed at minimising the project's environmental impact. This plan was peer reviewed before being re-submitted to the EPA in late September 2024.

Muchea Secures AU$ 2mn Grant for HPQ Initiative

At the Muchea silica sand project, the company is advancing metallurgical test-work and process circuit design to explore downstream manufacturing opportunities for high purity quartz (HPQ) flour. This initiative is bolstered by a AU$ 2 million grant from the WA State Government Investment Attraction Fund.

The primary market for HPQ flour is the rapidly growing LCD production sector, which demands high-quality silica flour with specific size requirements. Preliminary samples sent to potential buyers have shown promising results, confirming that the project meets the necessary specifications and generating strong interest in long-term supply agreements.

As VRX investigates alternative markets for its high-grade raw sand at the Muchea silica sand project, it aims to capitalise on the growing demand amid worsening global supply constraints, tapping the promising opportunity for growth in this sector.

The share price of VRX was AUD 0.035 per share on 04 October 2024.