Highlights

- VRX’s five advanced silica sand projects contain 1.4 billion tonnes of high-purity sand.

- Arrowsmith North has a total mineral resource of 513Mt and an ore reserve of 221Mt.

- Approvals for Arrowsmith North are nearing completion, with first production expected in 2025.

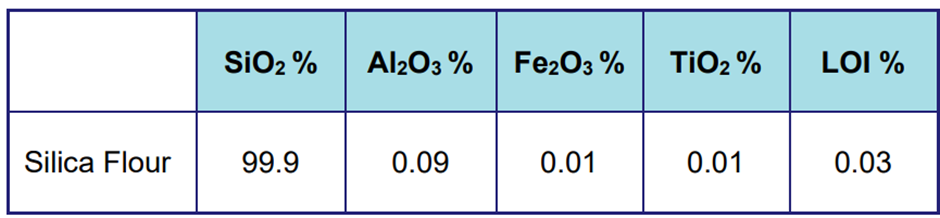

- The assay results for high-grade silica flour from the Muchea Silica Sand Project confirmed that the product meets the specifications requested by end users.

VRX Silica Limited (ASX:VRX) is an Australian exploration company focused on silica sand, with five advanced projects situated in Western Australia's premier Tier 1 mining region. VRX holds multi-decade deposits of high-purity silica sand (96% to 99.6% SiO2) on granted mining leases, totalling 1.4 billion tonnes.

The company aims to capitalise on opportunities for silica sand exports, while also targeting potential growth in Western Australia’s glass manufacturing and downstream industries. It eyes to target the float, container, solar panel markets. VRX highlights that, according to Freedonia estimates, the float (plate) glass and container glass market in Asia is growing at 5-6% annually, while the cover glass (solar panels) market in Asia is expanding at 30% annually.

Currently, VRX focuses on advancing environmental approvals for its Arrowsmith North project and testing high-grade silica flour from its Muchea Silica Sand Project.

Environmental approvals progress at Arrowsmith North

Arrowsmith North, the company’s most advanced development, benefits from its proximity to the Brand Highway and the Geraldton-Eneabba railway, providing direct access to the Geraldton Port for bulk exports.

The project boasts a total mineral resource of 513 million tonnes (MT) at 98.0% SiO2, with an ore reserve of 221 MT at 99.5% SiO2. The updated bankable feasibility study has outlined a 25-year mine life with an ungeared NPV10 of AU$167 million.

Following environmental approvals, production is expected to begin within 8-12 months, utilising a 2Mtpa processing plant with a patented process circuit. The environmental approval process is nearing completion, with VDT trials set to commence soon.

In March 2024, VRX Silica received feedback on its Response to Submissions (RtS) from the Environmental Protection Authority (EPA), with revised RtS expected to be lodged in September 2024. The company has also submitted its Mining Proposal and Works Approval for assessment, alongside the Environmental Review Document (ERD).

First production from Arrowmsmith North is expected in 2025.

Muchea high-grade silica flour testwork

The Muchea silica sand project is strategically located near rail infrastructure and a key port, facilitating bulk shipping.

The total mineral resource of the project is 208Mt at 99.6% SiO2, with an ore reserve of 18.7Mt at over 99.9% SiO2. With a low CapEx of AU$40 million, the planned 2Mtpa operation is projected to generate AU$3.3 billion in revenue over its initial 25-year mine life, highlights the company.

A one-tonne sample from the project has already been tested at a specialised lab in Germany to ascertain the quality and yield of silica flour that can be processed from the selected raw material. This testing follows the AU$2 million grant in matched funding awarded to VRX through the Investment Attraction Fund (IAF). Under the terms of grant, VRX received additional AU$150,000.

The R&D activities, beginning with the silica flour production, are set to open doors to high-value downstream processing opportunities.

In April 2024, the company released promising assays for the high-grade silica flour derived from the project. The assays aligned with the product specifications provided by the company and requested by end users.

Assay Results. Image source: Company update

The company has sent samples to a targeted group of potential customers in Asia.

VRX shares traded at AU$0.030 apiece on 10 September 2024.