Highlights

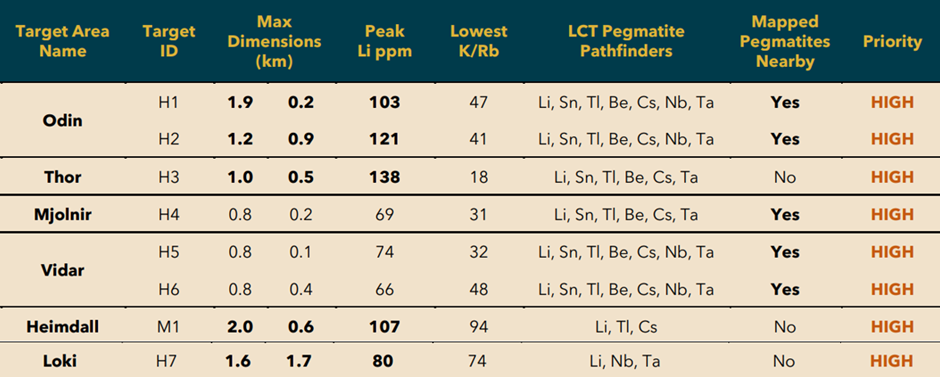

- Results from 1,220-hole auger programme at First Hit have defined 19 lithium anomalies with eight immediate priority targets.

- Peak lithium assay values of 138ppm have been reported, and 95 samples returned values of >50ppm.

- The largest anomaly measures 2.0km x 0.6km.

- The company intends to further refine and analyse the target anomalies.

Viking Mines Limited (ASX: VKA) has reported encouraging assay results from the latest drilling at its First Hit Lithium and Gold project, WA Goldfields. During the December 2023 quarter, the company completed the 1,220-hole auger programme at the project, over the Ida Fault, which is known to host significant lithium deposits.

The auger programme has defined 19 lithium anomalies across the project, out of which eight immediate priority targets have been identified. These high-priority targets require immediate follow-up field work and exploration. The identified priority targets have associated caesium, tantalum and thallium anomalies, which are indicative of lithium-caesium-tantalum ("LCT") pegmatites, known for hosting spodumene mineralisation.

The peak values of up to 138ppm Li have been received and 95 samples have returned values >50ppm.

Size of the anomalies is significant. The largest anomalies include, Heimdall (2km x 0.6km), Odin (1.2km x 0.9km) and Thor (1km x 0.5km).

The goal of the auger drilling was to define geochemical anomalies for further investigation.

An external consultant, Dr Nigel Brand of Portable Spectral Services conducted an initial data review, which lead to the identification of 19 anomalies.

High priority targets

Image source: Company update

Focus is on growing land position

The company informed that it is actively pursuing tenure near the already established land holding on the Mt Ida Fault. Moreover, the company is consolidating and growing the land position in the well-known lithium district.

Data source: Company update

The auger drill programme results support VKA’s strategy of exploring lithium in the prospective district and securing a significant land position. As much of the company’s tenure was not previously explored for lithium, VKA has an opportunity to identify lithium mineralisation with its dominant landholding position.

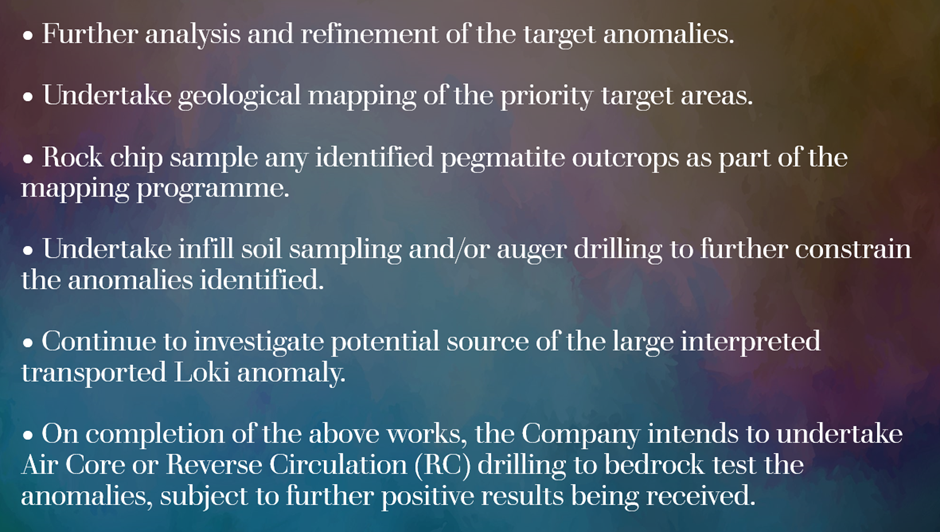

What’s ahead?

VKA is well funded for ongoing exploration activity with cash balance of more than AU$5 million at the end of the December 2023 quarter.

Following the significant results, VKA intends to undertake following activities-

Data source: company update

VKA shares traded at AU$0.012 apiece at the time of writing on 19 February 2024.