Highlights

- Reward pre-feasibility study (PFS) represented a highly attractive mine development opportunity in the NSW region.

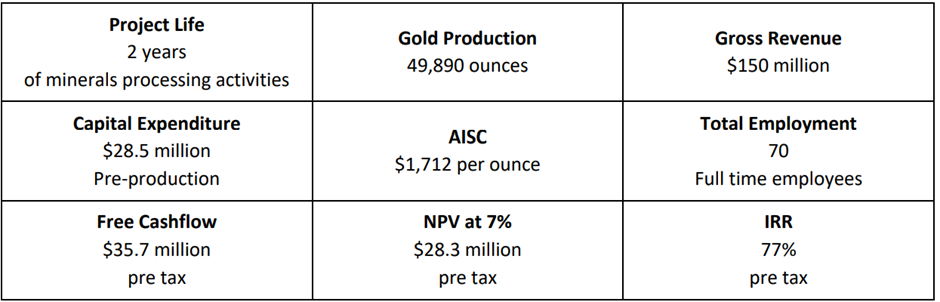

- The study outlined a pre-tax free cashflow of AU$35.7 million at AU$3,000/oz gold price.

- Total mineral resource estimate for the deposit is 419,000 tonnes at 16.72g/t Au for 225,200oz Au.

- Average monthly gold production of 2,169oz is expected over 23 months with 92% gold recovery.

Vertex Minerals Limited (ASX: VTX) has released PFS results for its Reward Gold Mine, Hill End NSW. The study demonstrated strong economics and robust base for further growth. The study outlined a pre-tax free cashflow of AU$35.7 million at AU$3,000/oz gold price.

Pre-tax net present value at 7% is AU$28.3 million and internal rate of return is 77%.

Average monthly gold production expected from the project is 2,169 oz with 92% gold production over 23 months. The expected gross revenue is AU$150 million with capital expenditure of AU$28.5 million pre-production.

The Mineral Resource Estimate (MRE) for the Reward gold deposit stands at 419,000 tonnes at 16.72g/t Au for 225,200oz Au. The indicated mineral resource includes 70,500 ounces of gold while inferred mineral resource contains 154,700 ounces.

The company believes that the key financial metrics of the project would improve with the conversion of the inferred to indicated resources via additional drilling.

Probable ore reserve of the project is 130kt at 9.7 g/t Au, including 40,900 ounces of gold.

Key PFS Highlights

The financial estimates and production schedules of the project are based on the indicated (~75% of AU) and inferred (~25% of AU) mineral resources.

Image source: Company update

Mine development can add to the resource base and extend mine life, while offering the best opportunity efficiently diamond drilling.

As per the PFS, the best platforms for additional exploration drilling are from the underground mine because of the rugged terrain of the area. The proposed development offers access to explore along strike and down dip.

The PFS indicates that gold recovery of 92% is achieved by employing gravity separation techniques.

The company conducted PFS on the existing resource base, and the decision reflects substantially enhanced exploration drilling outcomes that are expected to be achieved via drilling from new development within the underground mine.

The encouraging PFS’ financial outcomes provide a justification to draft a mine plan that would enable the upgrade of inferred mineral resource by way of improved access. Moreover, this facilitates more effective exploration of the mineralised corridor on strike and below the current mineral resource.

The pathway sketched in the PFS delivers a significantly strong financial outcome and maximised the extraction of the indicated mineral resource, says the company.

VTX shares jump

Shares of VTX jumped 11.11% to AU$ 0.150 apiece during early morning trading hours on 3 January 2024.