Highlights

- Vanadium Resources (ASX: VR8/DAX: TR3) is an emerging vanadium producer focused on advancing development of its flagship Steelpoortdrift project.

- In 2023, VR8 increased its interest in the Steelpoortdrift Vanadium Project to 86.49%.

- The company aims to generate a vanadium-rich concentrate and process it at the Salt Roast Leach Plant at Tweefontein, so as to produce up to 18,000t of vanadium pentoxide per annum.

- A definitive feasibility study (DFS) confirmed Steelpoortdrift as a world-class deposit with robust economics over an initial 25-year mine life.

- Substantial vanadium deposit +180 years.

The recent years have seen a significant rise in the demand for vanadium. Over the next few years, the demand is only expected to soar higher, owing to energy storage capabilities of the critical mineral.

Thanks to its growing application, vanadium has garnered attention of many mineral exploration and development companies.

Emerging vanadium producers, such as Vanadium Resources Limited (ASX: VR8/DAX: TR3) are advancing the development of their vanadium-focused projects. VR8, an Australian company with its flagship project located in South Africa, intends to tap into the vanadium mineral resource to establish a secure supply of vanadium catering to the demand of the global market.

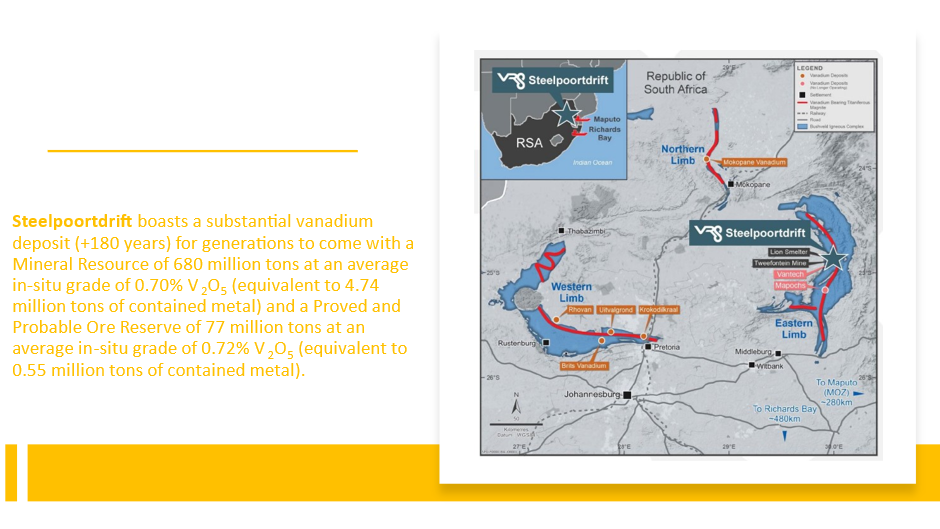

VR8’s flagship Steelpoortdrift Vanadium Project sits within the heart of the Steelpoort Valley, where numerous world-class mining and processing operations are based. It is situated within the popular Bushveld Geological Complex in South Africa.

In November 2023, VR8 increased its interest in Steelpoortdrift to 86.49%. To know more, read here.

One of the world’s largest and highest-grade V2O5 deposits

Image Source: Company PPT

The company aims to generate a V2O5 rich concentrate from Steelpoortdrift and process it at the Salt Roast Leach Plant at Tweefontein, so as to produce up to 18,000t of vanadium pentoxide per annum.

The project holds the potential for producing the required concentrate for a substantial lifespan of over 180 years at the proposed throughput rates of concentrate for its Tweefontein operations.

➢ Global Mineral Resource of 680Mt at 0.70% V2O5

➢ Total Ore Reserve of 77Mt at 0.72% V2O5

➢ Mineralisation outcrops at surface and dips shallowly (~10º) – less waste to mine, low strip ratios

➢ Orebody able to achieve a high-grade concentrate of greater than 2% V2O5

The crucial DFS results

VR8 has completed a DFS confirming Steelpoortdrift as a world-class deposit with robust economics over an initial 25-year mine life, 100% ownership post-tax NPV7.5% of US$1.2 billion, IRR of 42% and a 27-month payback on pre-production capex of US$211 million. The increased ownership to 86.49% has raised the Company’s attributable NPV7.5% to US$1.05 billion.

Image Source: Company PPT

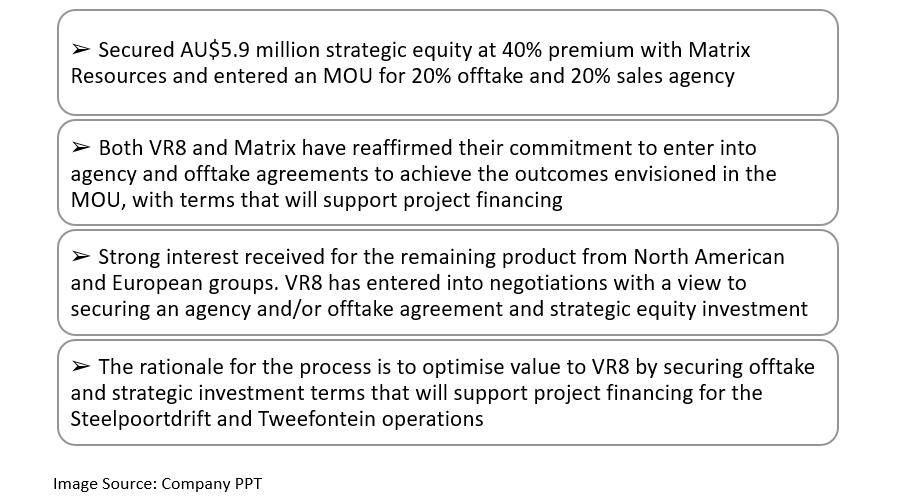

Offtake agreement advances

At present, the company has focused its attention on completing FEED activities, growing the project development and execution team, obtaining debt financing, and building partnership with strategic groups to unlock the maximum project value and prepare for final investment decision.

Vanadium Resources is targeting first concentrate and flake production in the second half of 2026.

VR8 shares traded at AU$0.051 on 9 January 2024.