Highlights

- Placement completed at a significant premium of $0.11 (~40% premium) with a strong strategic partner invested in working with VR8 to develop the Steelpoortdrift Vanadium Project

- Matrix is part of Lygend Investment, which company operates across the nickel (Ni) industry value chain

- Under the agreement, VR8 has granted Matrix the exclusive right (for four months) to negotiate 10-year offtake rights for 40% of VR8’s Vanadium products from Phase 1

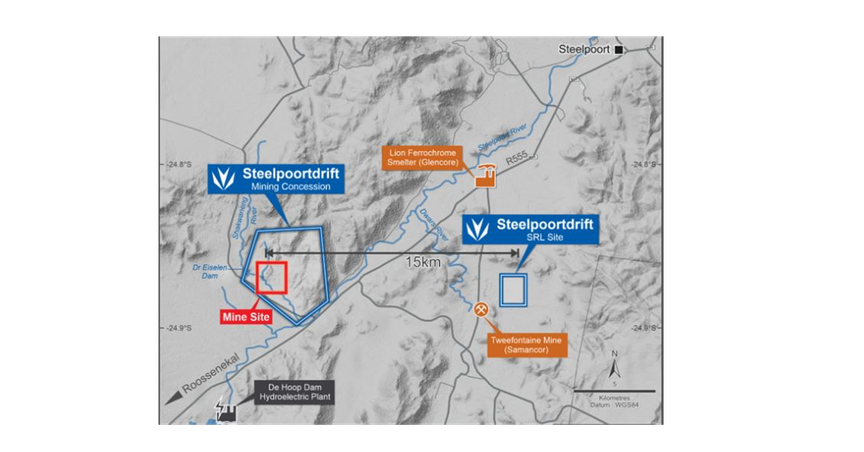

- VR8’s Steelpoortdrift Vanadium Project is in South Africa, and a DFS conducted by VR8 has confirmed robust economics

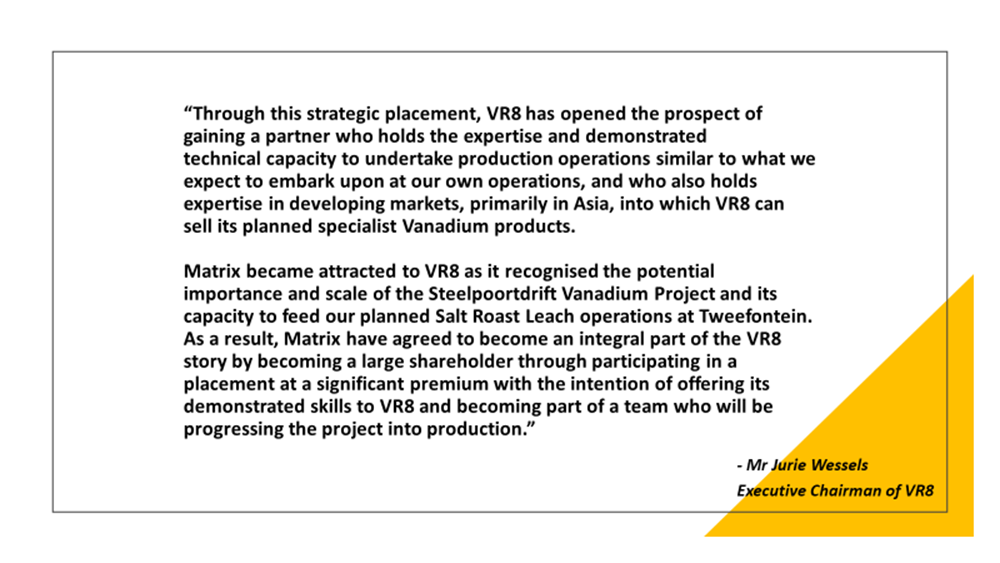

ASX-listed exploration company Vanadium Resources (ASX:VR8/FRA:TR3) -- which is progressing fast with the development of its Steelpoortdrift Vanadium Project (South Africa) -- has announced the signing of a Subscription Agreement between VR8 and Matrix Resources (Zhejiang) Co., Ltd (a subsidiary of Lygend Investment and part of the larger Lygend Group). The Agreement is for a strategic investment of AU$5.91 million (via share subscription) by Matrix in VR8 and is conditional on approval from the Chinese Government by the way of Overseas Direct Investment approval.

The Placement price of over 53.7 million new shares (fully paid) is AU$0.11, which is a premium as compared to VR8's 15-day and 30-day volume-weighted average price. ASX-listed VR8 shares surged 16% on 3 May 2023 and traded at AU$0.087 at the time of writing.

Source: Company update

More Details

The Subscription Agreement between the two companies would involve Matrix subscribing to 53,763,800 shares of VR8 for a 9.99% interest in Vanadium Resources. VR8 has also given Matrix Resources exclusivity to negotiate and finalise an offtake arrangement for Vanadium Resources' output from Steelpoortdrift Vanadium Mine and Concentrator and the Tweefontein. This exclusivity is for a four month period, and any offtake would likely be limited to a 10-year Phase 1 production duration and for up to 40% of the output.

It is further informed that Matrix may be allocated half of the offtake as agent, while for the other half Matrix may enter into the arrangement as principal. The offtake is targeted at Asian markets. Notably, Matrix is a part of the larger Lygend Resources & Technology Co., Ltd. (a listed entity in Hong Kong). Lygend's expertise would support VR8 in funding, development, construction, commissioning, and operations of the Steelpoortdrift Vanadium Project.

Placement

Over 53.7 million new fully paid VR8 shares would be issued as part of the Agreement. The price is AU$0.11 per share, and this represents approximately 40% premium to VR8's 30-day VWAP (premium of ~30% over 15-day VWAP). Post this placement, Matrix would hold 9.99% interest in Vanadium Resources. The issue of subscription shares would likely take place on 2 June 2023.

Under the terms of the Agreement, VR8 would enable Matrix to partake in future equity fund raising exercises at the price and conditions on par with other participating parties. This obligation, however, would expire when Matrix's voting power falls under 5%, or if Matrix does not participate in equity capital raisings despite being eligible.

Offtake

The offtake rights for supply of up to 40% of Vanadium products (related to Phase 1 production over 10 years) can be negotiated by Matrix within four months of signing of the Subscription Agreement. The offtake is intended for the Asian market, with Matrix taking half as agent and the remaining as principal. The MOU for this is in place to agree the floor-price-mechanism that can satisfy prospective debt funding partners.

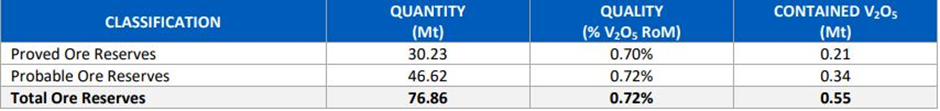

Notably, Steelpoortdrift is among the world’s largest undeveloped vanadium deposits. VR8’s Project updated Ore Reserve Statement (as at 30 September 2022) is in the below picture. After completion of DFS, VR8 is progressing with respect to FEED studies, debt financing arrangements, and other activities to unlock the maximum value.

Source: Company update