Highlights

- Tempest Minerals (ASX:TEM) has announced to demerge its 100% owned lithium projects into new IPO.

- TEM subsidiary West Resource Ventures will acquire rights to the Smith Creek lithium brine project in Nevada, USA.

- The company aims pre-IPO capital raising by WRV issuing up to 10% pre-IPO capital to potential investors.

Australia-based mineral exploration company Tempest Minerals Limited (ASX:TEM) company announced that its wholly owned subsidiary, West Resource Ventures Pty Ltd (WRV) is gearing up for a new initial public offering (IPO).

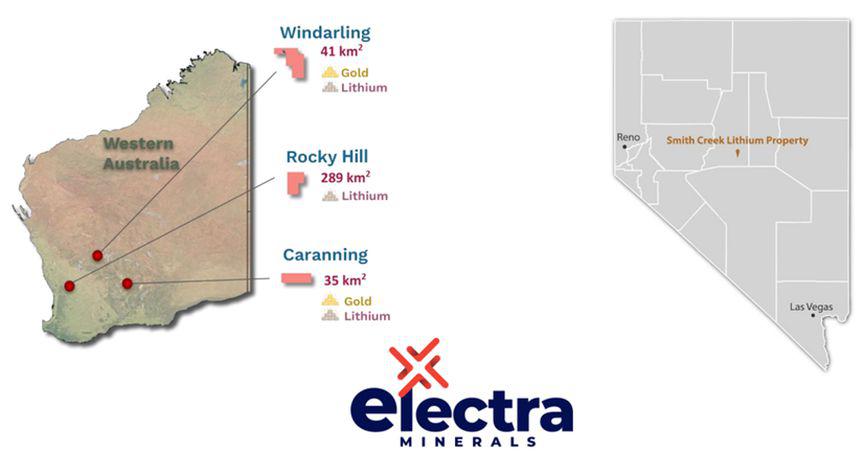

West Resource Ventures, the holder of several lithium tenements in Western Australia, will now be renamed as Electra Minerals Ltd.

WRV to acquire LON and LON Tenements

As per the latest announcement, WRV has executed a binding term sheet to acquire Lithium of Nevada Pty Ltd (LON), which has a binding agreement with TSX-V listed Iconic Minerals Ltd for the rights to acquire up to 50% of the Smith Creek Project.

WRV has also agreed to acquire the LON Tenements in consideration for the issue of WRV shares to the shareholders of LON (Vendors), subject to fulfillment of numerous conditions. Of the total consideration shares, 50% will include ordinary shares in WRV and 50% will include performance shares which will convert to ordinary shares in WRV upon LON earning the 50% interest in the Smith Creek Project.

IPO and pre-IPO capital raising details

Under the IPO, the Western Australian underexplored hard rock lithium exploration projects of WRV will combine with the Smith Creek lithium brine property in Nevada, the United States of America.

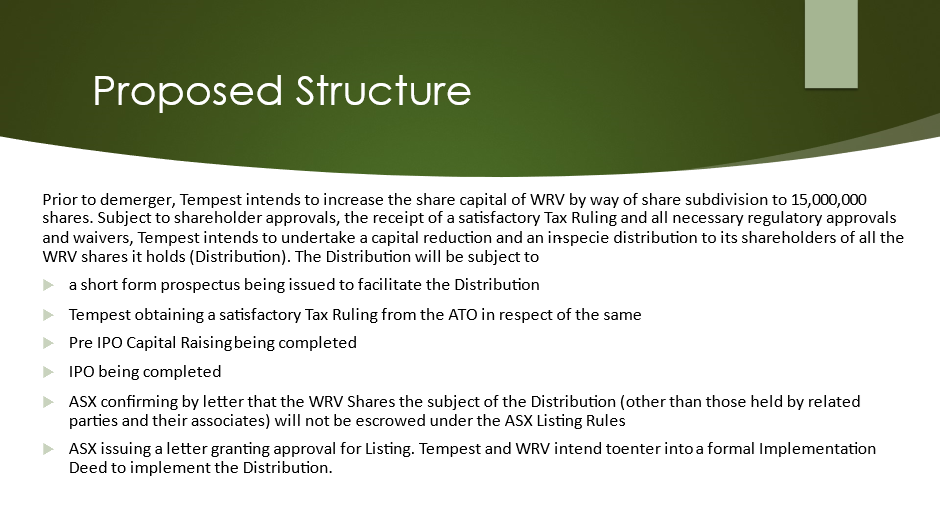

WRV eyes investor support for a pre-IPO capital raising by issuing a maximum of 10% of the pre-IPO capital value to potential cornerstone investors, including Tempest shareholders. Not more than 3,500,000 convertible notes that convert to WRV shares at AU$0.10 each to raise AU$3.5 million (pre-IPO capital raising) are planned to be issued. The note holders will have the option of converting the WRV shares on WRV being admitted to the official list of ASX or repaid from proceeds of the IPO.

Tempest will use all reasonable endeavours to support the pre-IPO capital raising.

Then under a prospectus, WRV plans to raise nearly AU$10 million through the issue of WRV shares.

Image source: ©2022 Kalkine Media®, Data Source: TEM Announcement

Proposed Board

The company has proposed that initially the WRV Board will have up of two representatives appointed by LON. There will be maximum two representatives appointed by Tempest and maximum two independent directors. Both the parties are looking forward to bringing onboard an experienced CEO.

Image source: ©2022 Kalkine Media®, Data Source: TEM Announcement

Smith Creek Project in opportune lithium location

According to the company, Nevada (USA) is a preferred lithium investment destination and is regarded highly prospective for large lithium brine deposits. The region boasts an ongoing track record of multiple producing lithium operations. With extensive infrastructure, Nevada is located close to many ports and possible downstream processing sites, including a Tesla Giga-factory.

Situated within Smiths Creek Valley in Nevada, the Smith Creek Project includes the current LON claim blocks spread across an area of 65.4 km2 over a major gravity low. The enclosed Smith Creek Valley Basin spans over 1,507 km2, a bit bigger than the Clayton Valley Basin where lithium brines are produced.

The project is based within a volcanic ash unit considered to be a potentially good source of lithium. Previous drilling at the project did not test for lithium. However, previous drillholes did encounter brines at depth. Surface sampling around hot springs and brine evaporites nearby assayed a maximum of 470 ppm Lithium.

The Smith Creek Project is near the Silver Peak lithium mine, which produces more than 5,000t of lithium carbonate equivalent (LCE) per annum and Clayton Valley Lithium Project, which is anticipated to produce around 10,000t of LCE a year and resources in excess of 1.5Mt of LCE, according to the company update.

WA hard rock lithium projects

A hotbed for hard rock lithium in the global market, Western Australia hosts major operations such as Mt Marion (450kpta-900ktpa) and Wodgina (750ktpa). Also, several new exploration provinces are developing within the region.

With recent recognition of the South Western quadrant of Western Australia as a new domain for exploration of lithium resources, key projects have gained the required focus.

The company’s WA projects have a significant holding in Western Australia of ~365 km2 (29 km2 granted - 336 km2 pending) across three areas.

After exploration by TEM at the Rocky Hill project, extremely anomalous soil results were reported recently. This included lithium up to 60ppm in soils along with strong LCT pegmatite indicator signatures.

Image source: ©2022 Kalkine Media®, Data Source: TEM Announcement

Image source: ©2022 Kalkine Media®, Data Source: TEM Announcement