Highlights

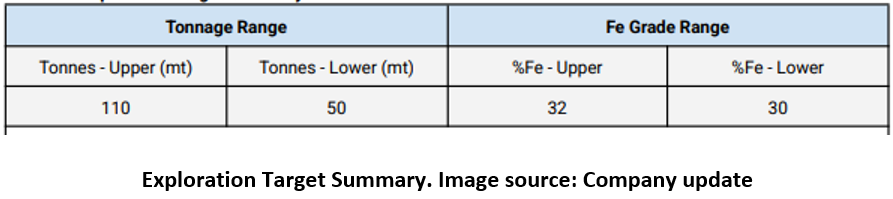

- At the Remorse Deposit, the company established an initial exploration target of up to 50-110 Mt at 30-32% Fe.

- Initial metallurgical studies have been initiated at the Remorse Deposit with over 5 tonnes of mineralised samples submitted for testing.

- TEM inked a MOU signed with Green Steel and Iron Pty Ltd (GISA) to support sustainable development plans.

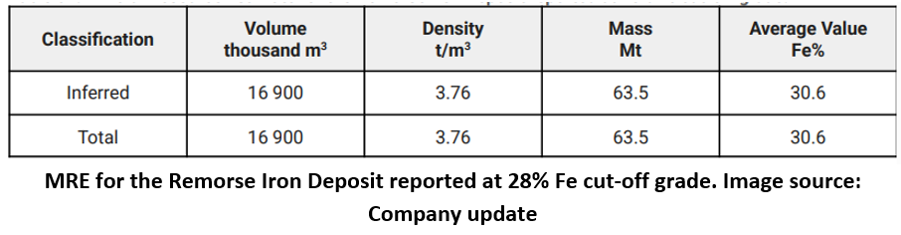

- Maiden inferred resource estimate for the Remorse Deposit outlined 63.5 million tonnes at 30.6% Fe, a key transition from an exploration target to a resource definition.

- The company has raised AUD 400,000 via a placement, and a proposed entitlement offer aims to raise an additional AUD 1.469 million.

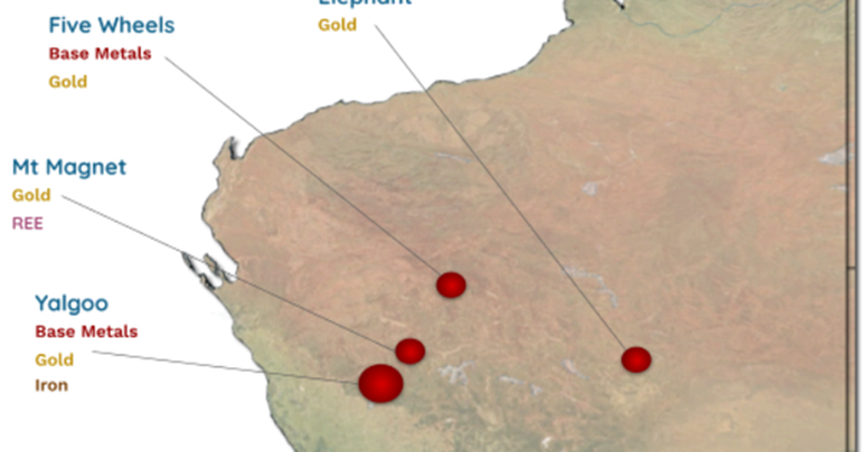

Tempest Minerals Limited (ASX:TEM) focused on advancing its Remorse Deposit at the Yalgoo Project during the three-month period ended 31 March 2025.

Over the quarter, the company entered into a strategic partnership with a key player in green steel production and strengthened its capital position through a successful placement and a proposed entitlement offer.

Iron Discovery at Remorse Deposit

Drilling conducted at the Remorse Deposit in 2023 and 2024 delivered encouraging results, revealing a ‘very strong base metals signature’. This led to further drilling in September 2024, which resulted in the discovery of a large-scale magnetite iron deposit.

During the March 2025 quarter, TEM released an updated exploration target for Remorse, confirming its potential to become a high-quality, rapidly developable asset.

As part of ongoing studies, TEM collected nine representative samples from the 2024 drilling campaign, spanning several kilometres of the mineralised zone. Over 5 tonnes of composite samples were submitted to IMO Laboratory in Perth for metallurgical analysis, including grindability and Davis Tube Recovery (DTR) testing.

Inaugural Resource Estimate for Remorse

Following the end of the quarter, the company announced its inaugural JORC 2012-compliant resource estimate for the Remorse Deposit. The estimate outlined inferred resource of 63.5 million tonnes at 30.6% Fe. This marks a significant milestone, transitioning the project from an exploration target to a defined resource and forms the foundation for future development studies and potential mining at the Yalgoo Project.

TEM anticipates further exploration potential as additional drilling and project advancement continue.

Strategic Partnership with Green Steel Developer

TEM signed a Memorandum of Understanding (MOU) with Green Steel and Iron Pty Ltd (GISA), a prospective Mid-West green steel developer. GISA, one of only two entities with commercially proven DRI technologies, plans to construct a AUD 3 billion hot briquette iron processing hub close to TEM's Yalgoo Project.

Capital Raising Initiatives

Subsequent to the reporting period, TEM secured firm commitments to raise AUD 400,000 (before costs) through a placement of 100 million shares at an issue price of AUD 0.004 per share. The placement also includes 25 million free-attaching options exercisable at AUD 0.01 per share, expiring on 31 May 2027.

In addition, TEM plans to launch a non-renounceable entitlement offer to raise approximately AUD 1.469 million, with one attaching option issued for every four new shares subscribed.

Exploration Progress Across Portfolio

During the March 2025 quarter, the company progressed regulatory and technical preparations for upcoming gold exploration across its portfolio, including potential drilling at the Sanity target, which is 2 km south of the Remorse Target. It also completed reconnaissance fieldwork at the Range Project in anticipation of future drilling campaigns.

Outlook for June 2025 Quarter

Looking ahead, TEM is set to advance its exploration activities across its portfolio in the June quarter. A key focus will be on progressing technical studies at the Remorse Deposit, including metallurgical analysis and planning for further drilling. The company also intends to pursue additional exploration work across several promising gold targets.

TEM shares were trading 12.50% higher at AUD 0.004 per share on 09 May 2025.