Highlights

- Surefire Resources has signed a Heads of Agreement (HOA) with HMS Bergbau AG for the offtake of all critical mineral products from the Victory Bore project.

- The HOA will facilitate discussions with Saudi Arabian and European stakeholders for potential project funding.

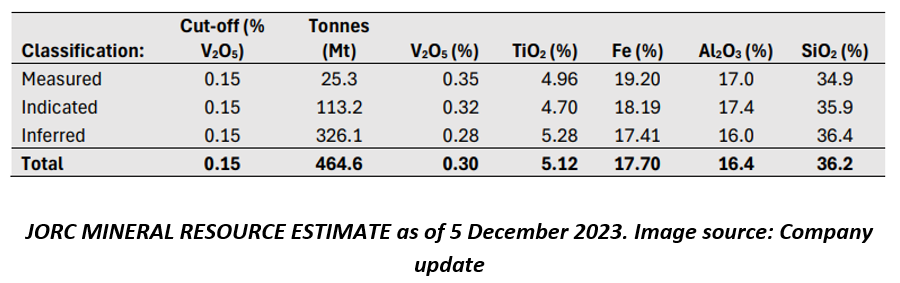

- The Victory Bore deposit holds a JORC-compliant resource of 464Mt.

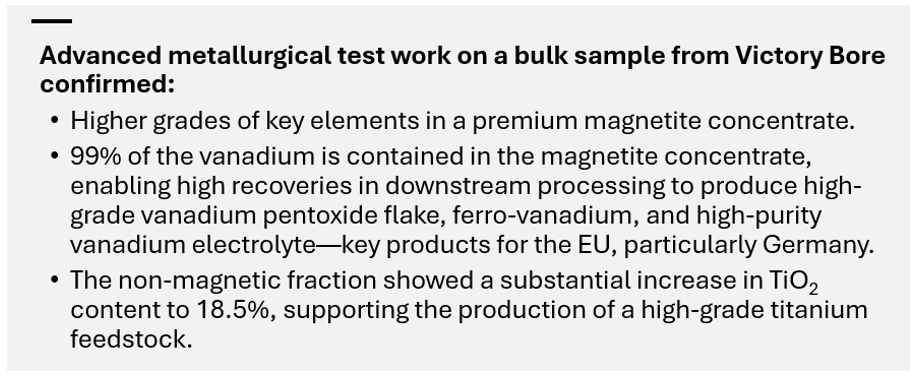

- Metallurgical testing confirmed that 99% of vanadium is concentrated in magnetite, enabling high recoveries for key products like vanadium pentoxide, ferro-vanadium, and vanadium electrolyte.

Surefire Resources NL (ASX:SRN) has executed a Heads of Agreement (HOA) with German firm HMS Bergbau AG (HMS), covering the offtake of all critical mineral products from the company’s wholly owned Victory Bore Critical Minerals Project. The agreement enables both parties to finalise discussions on delivery terms, product quantities and pricing mechanisms.

This significant development supports Surefire’s growth plans and aligns with the German Raw Materials Fund’s requirement for German or EU-based involvement in critical mineral projects. The deal also brings Surefire closer to potential financial backing and market access within Europe.

About HMS Bergbau

Berlin-based HMS Bergbau AG, in operations since 1955, is a well-established commodities supplier. The firm specialises in the international marketing and logistics of dry bulk materials, critical minerals, and raw materials. With operations in key global regions and established connections with major funding groups, HMS is expanding its operations to include commodity production and logistics solutions. The company operates subsidiaries in Singapore, Africa, Dubai, Switzerland, Indonesia and the USA, and holds a significant stake in Botswana-based Maatla Resources (Pty.) Ltd.

In November 2024, HMS approached Surefire to discuss potential offtake agreements for vanadium and titanium from the Victory Bore project.

SRN’s Growing Presence in Germany

Since the formation of the German-Australian Critical Minerals Alliance in April 2023, SRN has been strengthening its position in Germany. In September 2024, Germany launched a €1 billion (AU$1.61 billion) Raw Materials Fund, highlighting its commitment to secure critical mineral supply chains.

The fund, managed by state-owned development bank KfW, aims to reduce Germany’s reliance on high-risk jurisdictions for critical minerals. KfW is a global player in resource project financing and offers numerous financial instruments to projects that use German-sourced equipment or supply products to Germany or the broader EU market.

Victory Bore Project Development

The project hosts a JORC compliant resource of 464Mt @ 0.3% V2O5, 5.12% TiO2, 17.7% Fe, including a JORC Probable Ore Reserve of 93.1Mt @ 0.35% V2O5, 5.2% TiO2, 19.8% Fe. Notably, exploration has only focused on the first 1 km of a 20 km mineralised strike, positioning Victory Bore as one of the world’s largest vanadium-titanium deposits, according to the company’s update.

Data source: Company update

Development Strategy and Product Range

The company’s development strategy includes the establishment of a mining and beneficiation facility at Victory Bore with plans to ship the concentrate to the Kingdom of Saudi Arabia (KSA) for further processing in established industrial centres.

The processing will target production of a diverse range of high-value products, including,

- Vanadium Pentoxide (V₂O₅)

- Vanadium Electrolyte (VE)

- Ferro-Vanadium (FeV)

- Pig Iron

- Ferro-Titanium

- High-Purity Iron Oxide

The strategic agreement between Surefire Resources and HMS Bergbau AG marks a significant step forward in the development of the Victory Bore Critical Minerals Project.

SRN shares were trading at AU$0.003 per share at the time of writing on 11 March 2025.