Highlights

- During the September quarter, Surefire completed a dual listing on the Frankfurt Stock Exchange under the code GBL.

- A Heads of Agreement was signed with DRA Global to support the Victory Bore Project.

- R&D advancements have achieved vanadium recoveries exceeding 90%, enhancing the project's commercial viability.

- Surefire advanced discussions with Ajlan & Bros. Mining and Metals for investment in the Victory Bore Project.

Surefire Resources NL (ASX:SRN) achieved a significant milestone during the September quarter, completing a dual listing of its ordinary shares on the Frankfurt Stock Exchange (FSE), under the code GBL. This move expanded the company’s international profile and investor base.

The company continued advancing its flagship Victory Bore Project with progress made on mining, beneficiation, and plans for a Saudi processing facility. A Pre-Feasibility Study completed in December last year highlighted promising project economics, including NPV10 of AU$1.7 billion and an internal rate of return of 42%. The project is one of the largest vanadium resources in Australia with a Mineral Resource Estimate (MRE) of 464Mt @ 0.3% V2O5, 5.12% TiO2, 17.7% Fe, and an Ore Reserve of 93Mt@ 0.35% V2O5, 5.2% TiO2, 19.8% Fe, highlights the company.

Furthermore, the company executed a Heads of Agreement with DRA Global for engineering work related to the project.

Key Advances in Victory Bore Project

During the September quarter, Surefire made notable progress in developing a mining and beneficiation operation to produce high-quality magnetite concentrate. This concentrate will be transported to Geraldton Port and shipped to a planned downstream processing facility in Saudi Arabia, where high-purity products will be produced.

Surefire also advanced discussions with key Saudi entities to secure a plant for processing the Victory Bore concentrate. This facility will be crucial in meeting the growing global demand for vanadium and other critical minerals.

A key achievement during the quarter was the execution of a Heads of Agreement (HOA) with DRA Global for a comprehensive engineering services package needed for the project's next stages. The company also made significant headway in logistics, engaging with transport groups to ensure efficient and cost-effective transport of the magnetite concentrate.

The company advanced discussions with Ajlan & Bros. Mining and Metals (Ajlan). Due diligence has been completed by Ajlan, and management continues to engage with the Saudi firm to define the investment structure for the project. The MOU with Ajlan was extended, and a detailed business plan was prepared.

Surefire continued to strengthen its relationships with key Saudi stakeholders, including SABIC and the Ministry of Industry and Mineral Resources, to support its entry into the Saudi market.

The company also made notable progress in its R&D efforts, refining leach testwork to achieve vanadium recoveries exceeding 90%. The company will continue optimising this process to produce physical samples, a critical step toward advancing the project's commercial viability.

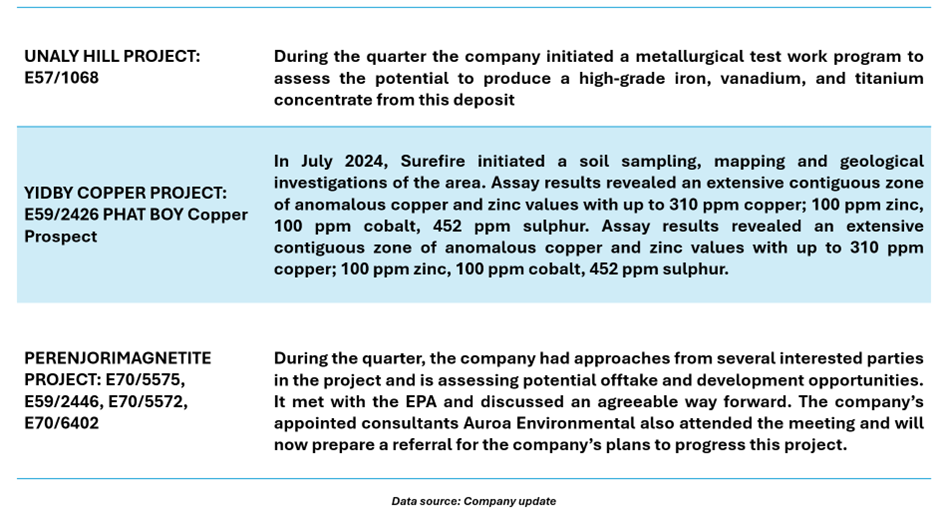

Surefire also conducted exploration activities at its other projects during the quarter.

Subsequent to the quarter end, the company announced plans for maiden drilling at its Phat Boy Copper prospect with the wholly owned Yidby East project in the mid-west of Western Australia. The company plans to drill an initial 11 RC holes to a maximum depth of 200m for a total of 2200m. Additionally, the company defined new priority drill targets at the Yidby Gold Project.

As of 30 September 2024, Surefire's cash reserves stood at AU$917k.

The share price of SRN was AU$0.004 on 06 November 2024.