Summary

- E63/2046 and E63/2048 interpreted along the strike of Boulder Lefroy Fault Zone and the Zuleika Shear

- Dundas Project with minimal historical exploration activities indicates the potential of hosting large scale gold anomalies

- Ulysses South strengthens Shree’s position in the neighbourhood of Golden Chimney project with strong anomalies yet to be tested

- $600,000 exploration tax credit for 2021 income year under the JMEI program, may be transferred to investors and shareholders

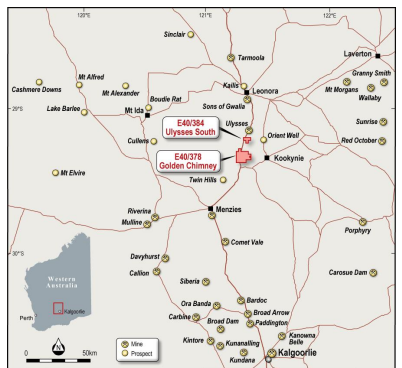

On 15 July 2020, Shree Minerals Ltd (ASX:SHH) announced to the exchanges that the company is applying for the exploration licenses E63/2046 and E63/2048 (Dundas project), located 60 kilometres east of the Norseman in Western Australia. In compliance with Shree’s growth strategy to expand and consolidate its presence in the Leonora Goldfield, the new exploration tenement application was filed for a new ELA E40/384 (Ulysses South).

Dundas Project in the prolific regional setting

The Exploration license applications are in the section of unexplored greenfield ground in the Albany Fraser Belt. The prolific mining province came into the spotlight in 2005, with the discovery of the multi-million-ounce Tropicana gold deposit.

The geophysical surveys, geoscientific and programs related to dating rocks during the 2006-2010 period were undertaken by the Geological Survey of Western Australia indicating the Albany Fraser belt to contain reworked Archaean greenstones.

The Dundas Project is interpreted to be located within the SE extensions of the mineralised Norseman – Wiluna Belt of Archaean Yilgarn Craton comprising of a tectonostratigraphic aggregate of sedimentary, ultramafic and mafic deposit types.

Regional location of the Ulysses South Project Source: Shree Minerals

The Boulder-Lefroy Fault Zone (BLFZ) is widely recognised for the structurally controlled gold deposit districts including Hampton-Boulder-Jubilee (123 t gold contained gold), St Ives (253 t), Golden Mile (1,821 t), Paddington-Broad Arrow (112 t) and Mount Charlotte (219 t). Further, larger gold deposits including Higginsville, Cave Rocks, Frogs Legs, White Foil, Mt Marion occurs across the 180 kilometres extensions to the Zuleika Shear (ZS). Such regional geological setting enhances the potential for the Dundas Project.

The aeromagnetic survey within the tenements has showcased liner features which indicates the Archaean greenstone stratigraphy of mafic, ultramafic or Banded Iron formation rocks.

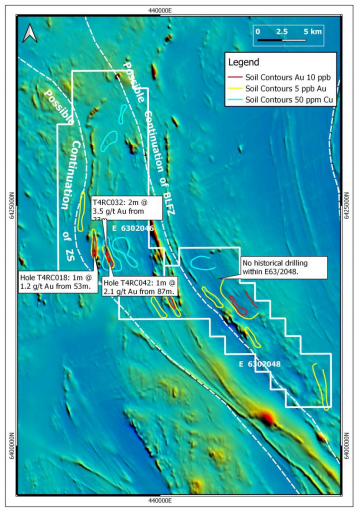

The limited historical exploration activities have been carried out on the outer thin blanket (5-10 metres) of transported cover. Historical auger soil traverses by AngloGold Ashanti (ASX:AGG) and concentrated RAB/RC drilling program by Pan Australian Resources indicates the presence of gold mineralisation within the mafic rocks at the ELA E63/2046.

Some of the historical incepts are as follows-

- T4RC032: 2 metres with 3.5g/t Au, 23 metres downhole

- T4RC042: 1 metre with 2.1g/t Au from 87 metres downhole

- T4RC0018: 1 metre with 1.2g/t Au from 53 metres downhole

AngloGold’s data suggest that the mineralisation is open in all directions with associated Au and Cu soil chemistry, the complete extent of which has not been completely indicated by the limited drilling on the field.

Shree’s tenement applications Source: Shree Minerals

Also, several large geochemical anomalies containing gold with a length of up to 6 kilometres are distributed with a possible association with the interpreted BLFZ in E63/2048 representing high priority targets for Shree minerals.

Shree believes that the new tenements are located within a major structural corridor which contains the world class gold deposits. The presence of prospective mafic rocks and untested geochemical anomalies adjacent to the structure in an underexplored region enhances the prospectivity of the project.

Ulysses South Project

The Ulysses South Project area or E40/384 is located approximately 6 kilometres north of Shree Mineral owned Golden Chimney exploration licence (E40/378) and 15 kilometres from the Ulysses gold mines cluster.

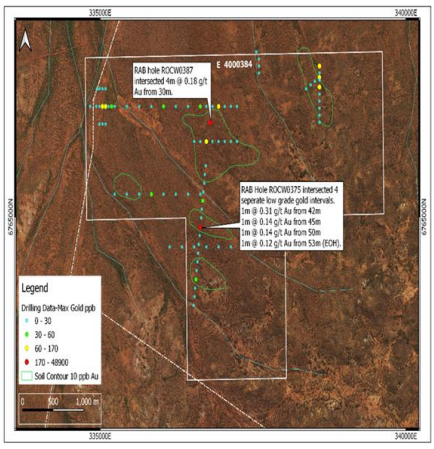

The wholly owned tenement was under exploration in the past by Money Mining (1992-1996), Asarco Pty Ltd (1984-1988), and Consolidated Gold Operations (1995-1996). Aberfoyle in 1995-1996 conducted extensive exploration on the E40/384 through the aeromagnetic interpretation, soil and vacuum drilling and RAB and RC drilling.

Aberfoyle’s soil geochemistry contours and the maximum gold (ppm) in RAB drilling Source: Shree Minerals

RAB drilling at the hole ROCW375 intersected 4 separate gold intervals including-

ROCW0385 – 1 metre with 0.31g/t Au from 42m, 1 metre with 0.14g/t Au from 45m

ROCW0387- 4 metre with 0.18g/t Au from 30m

No further follow up drilling was conducted to check the extent of the mineralisation.

Way Forward

Dundas Project – Upon the granting of the exploration licenses, Shree plans to in-fill AngloGold’s 1km spaced soil sample traverses. An auger powered soil sampling program over the geochemical anomalies to further identify and prioritise drilling targets.

Insights from the low-level aeromagnetic surveys will be utilised to identify and prioritise structural prospects for additional auger work. The prioritised targets will be further explored using RAB and RC drilling.

Ulysses South Project – Shree plans a reconnaissance aircore drilling near and around holes ROCW0375 and ROCW0387. The intersections would further be evaluated by RC drilling.

Junior Minerals Exploration Incentive (JMEI) – Shree Minerals has been successful in its application for the Junior Minerals Exploration Incentive (JMEI). An allocation of $600,000 has been received to create exploration credits for the fiscal year 2021.

The exploration tax credits can be utilised towards capital raising activities and eligible exploration programs. Shree Minerals may further distribute the exploration credits in proportion to their investment values to its Australian resident investors who then would be entitled to a refundable tax offset or a corporate tax entity.

Shree Minerals closed at $0.0060 a share, registering a surge of 20% against the previous close, with a market capitalisation of $3.65 million.

All financial information pertains to Australian dollar unless stated otherwise.