Highlights

- Revolver Resources has secured a grant of AU$1.3 million under the Critical Minerals and Battery Technology Fund of the Queensland Government.

- The funds will be used to pace up activities at its Dianne Copper Mine Project in NW Queensland.

- RRR expects the lead time to first Cu metal production from a positive recommencement decision to be less than a year.

Revolver Resources Holdings Limited (ASX: RRR) has secured a grant by the Critical Minerals and Battery Technology Fund of the Queensland Government. The AU$1.3 million grant will be directed towards advancing technical and design workstreams on the company’s Dianne Copper Mine Project in NW Queensland, in order to restart mining operations.

The company is currently engaged in commercial talks with potential private investors regarding the acquisition of equity interest(s) in the project. The objective is to secure the necessary funds for the proposed development in a manner that avoids dilution at the corporate level of Revolver, highlights the company update.

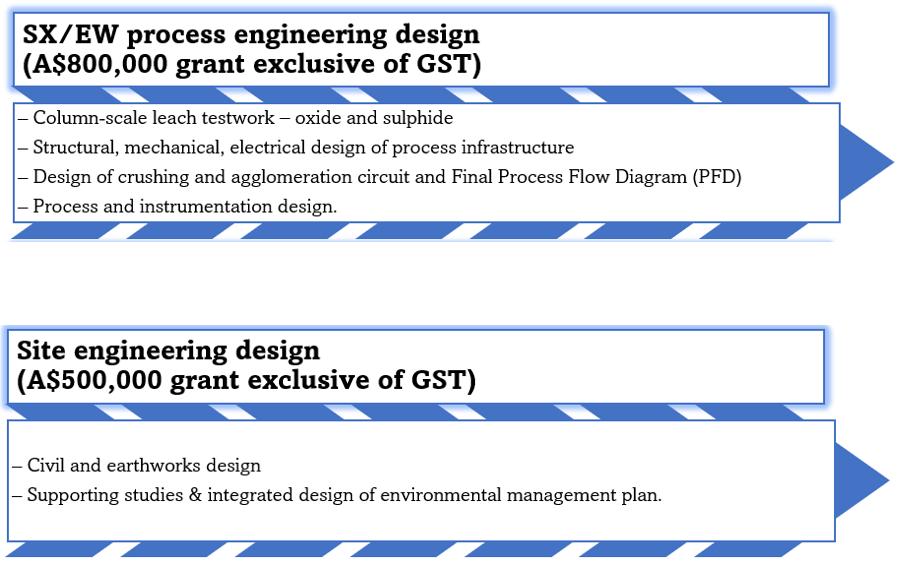

The grant will be utilised to fund an integrated series of technical studies and site-specific engineering designs for the project.

Data source: Company update

According to the company, these critical path workstreams, which are likely to begin in March, would position the Dianne Project for development funding permitting. It would allow RRR to run a high-margin copper mining and processing operation supporting its high-potential exploration initiatives.

RRR expects the lead time to first Cu metal production from a positive recommencement decision to be less than a year.

Purpose of the grant

The Queensland Government has established the Critical Minerals and Battery Technology Fund to empower businesses in Australia for the global competition. The funds allow enhancement in the extraction and processing of critical minerals in Queensland, scaling up development of battery technologies as well as production of precursor or advanced materials in Queensland and pushing forth jobs and economic growth in Queensland.

RRR shares trade higher

RRR share price was noted at AU$0.074 apiece at the time of writing on 23 February 2024, up over 7% from the last close.