Highlights

- Raiden has commenced its Phase 2 drilling program at the Vuzel Gold Project.

- The drilling program aims to improve the understanding of the mineralised system and provide insights for future exploration.

- The long-term goal of the program is to define a potentially viable gold resource through a data-driven approach. Should exploration results confirm a viable mineral resource, the project’s positioning near established gold processing facilities could potentially offer a strategic advantage.

- The drilling program has commenced at a time of strong gold prices.

Raiden Resources Limited (ASX:RDN, DAX:YM4) saw its shares rise by 20% to AU$0.006 per share on Thursday morning, following an update on the launch of drilling at the Vuzel Gold Project in Bulgaria. The Phase 2 drilling program at the project aims to assess the extent and continuity of the gold mineralisation encountered during the maiden drill campaign in 2022.

The goal of this program is to deepen the company’s understanding of the mineralised system and gather key insights to inform future exploration at the site.

In the long term, the company aims to define a potentially viable gold resource, with all ongoing exploration efforts driven by data. If the findings confirm the presence of a significant mineral deposit, the company anticipates potential synergies from the project's proximity to third-party processing infrastructure and other deposits, pending additional technical and economic evaluations.

Details of the Phase 2 Drilling Program

The drilling program includes an initial 2,000m of diamond drilling, and its scope may be expanded based on initial results. This campaign targets mineralisation at relatively shallow depths and will incorporate a mix of infill and extensional drilling, guided by insights from previous drilling and recent structural interpretations.

Background of Vuzel Project

In April 2019, Raiden entered into an earn-in agreement for the Project, when gold price was nearly US$1,258/oz.

Data source: Company update

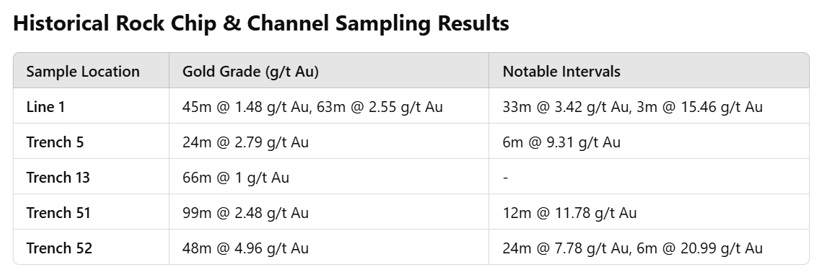

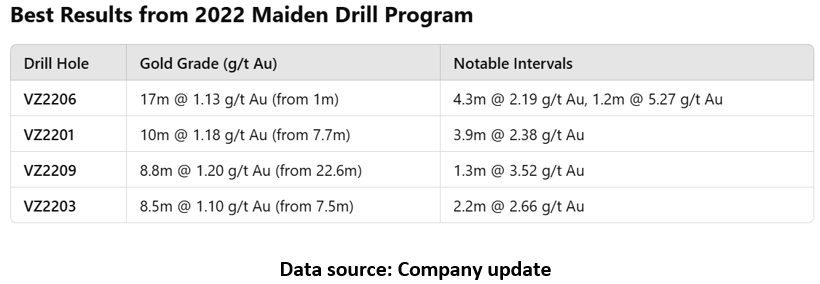

Subsequent field-based exploration in 2021, combined with historical data, set the stage for the maiden drilling program completed in 2022. The program included 11 drill holes covering 1,594.8m and targeted broad, outcropping gold mineralisation zones. The maiden drilling program yielded encouraging results, with all drill holes intersecting significant near-surface mineralisation.

The findings suggest that mineralisation at Vuzel may be part of a large-scale system as evidenced by the significant surface gold values over an extensive strike length and widespread alteration trends. The shallow-dipping to sub-horizontal and near-surface nature of the mineralisation indicates potential for a follow-up drill campaign.

After the conclusion of the maiden drilling, Raiden has refined its structural interpretation of the Vuzel prospect, providing the foundation for the Phase 2 drilling program.

The company believes that the targeted follow-up exploration and strategically designed drilling campaign offer significant opportunities, particularly given the current strength in gold prices.