Highlights

- Raiden Resources (ASX:RDN) has announced a loyalty option placement for the eligible shareholders.

- The eligible shareholders are entitled to one loyalty option for every five fully paid ordinary shares.

- Loyalty options are priced at AU$0.001 apiece and are planned to be listed.

- The loyalty option placement is fully underwritten by CPS Capital Group Pty Ltd.

- The company expects to raise AU$326,488 before costs.

Dual-listed base metal and gold explorer Raiden Resources Limited (ASX:RDN|DAX:YM4) has announced its intention to pursue a loyalty option placement for eligible shareholders to recognise their support and loyalty.

The loyalty option placement is fully underwritten by CPS Capital Group Pty Ltd, which as per Raiden, is expected to raise ~AU$326,488 before costs (assuming all loyalty options are placed).

Click here to learn about Raiden’s flagship project.

Click here to read about the company’s recent strategic development.

Overview of loyalty option placement

As part of the loyalty option placement, every shareholder is entitled to one loyalty option for every five fully paid ordinary shares at an issue price of AU$0.001 per loyalty option.

Also, the rounding would be done to the nearest whole number for shareholders with fractional entitlements. The record date for the loyalty option is 1 November 2022, open for shareholders with registered addresses in Australia or New Zealand.

It would be a non-renounceable entitlement issue which, being not transferable, cannot be bought or sold. The terms would be similar to the recent placement options expiring on 30 November 2024 with AU$0.015 as an exercisable price.

Details of the proceeds to be raised

Raiden has calculated the number of loyalty options as 326,488,426, based on the shares on issue at the announcement date. The placement is expected to raise ~AU$326,488 before costs (assuming all loyalty options are placed), which as per the company, along with the existing cash reserves, will be used towards the cost of the loyalty offer and general working capital.

However, any entitlement not executed will constitute the “shortfall”, which CPS Capital will place as per an underwritten agreement with Raiden.

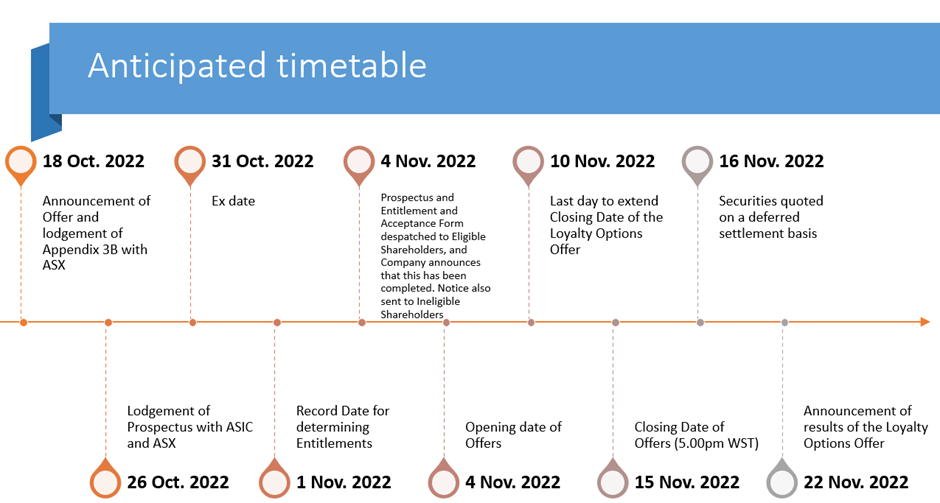

The company will dispatch the loyalty offer prospectus to the eligible shareholders on 4 November 2022 and lodge the prospectus on the ASX on 26 October 2022.

Following is the anticipated timetable:

(Source: © 2022 Kalkine Media®, data source: company’s update)

The options are expected to start trading on the ASX on 23 November 2022.

RDN shares gain over 12%

RDN shares traded at AU$0.009 apiece on 18 October 2022, up more than 12.5% from the last close. The company’s market capitalisation stood at AU$13.05 million.