- Raiden Resources to divest its non-core asset, the Mynras Hill tenement, in the Pilbara region.

- The deal would fetch a cash consideration of AU$75,000 and shares worth AU$125,000 in ASX-listed Askari Metals.

- Shares of RDN jumped more than 17% yesterday during the early hours of trade on the back of the divestment news.

Diversified mineral explorer Raiden Resources Limited (ASX:RDN|DAX:YM4) announced that it had entered into a binding term sheet with Askari Metals (ASX:AS2) for the sale of its Mynras Hill Project. The decision came in the wake of Raiden’s strategy to divest its non-core assets to increase focus on its flagship Mt Sholl Ni-Cu-Co-PGE Project and the Arrow Gold Project.

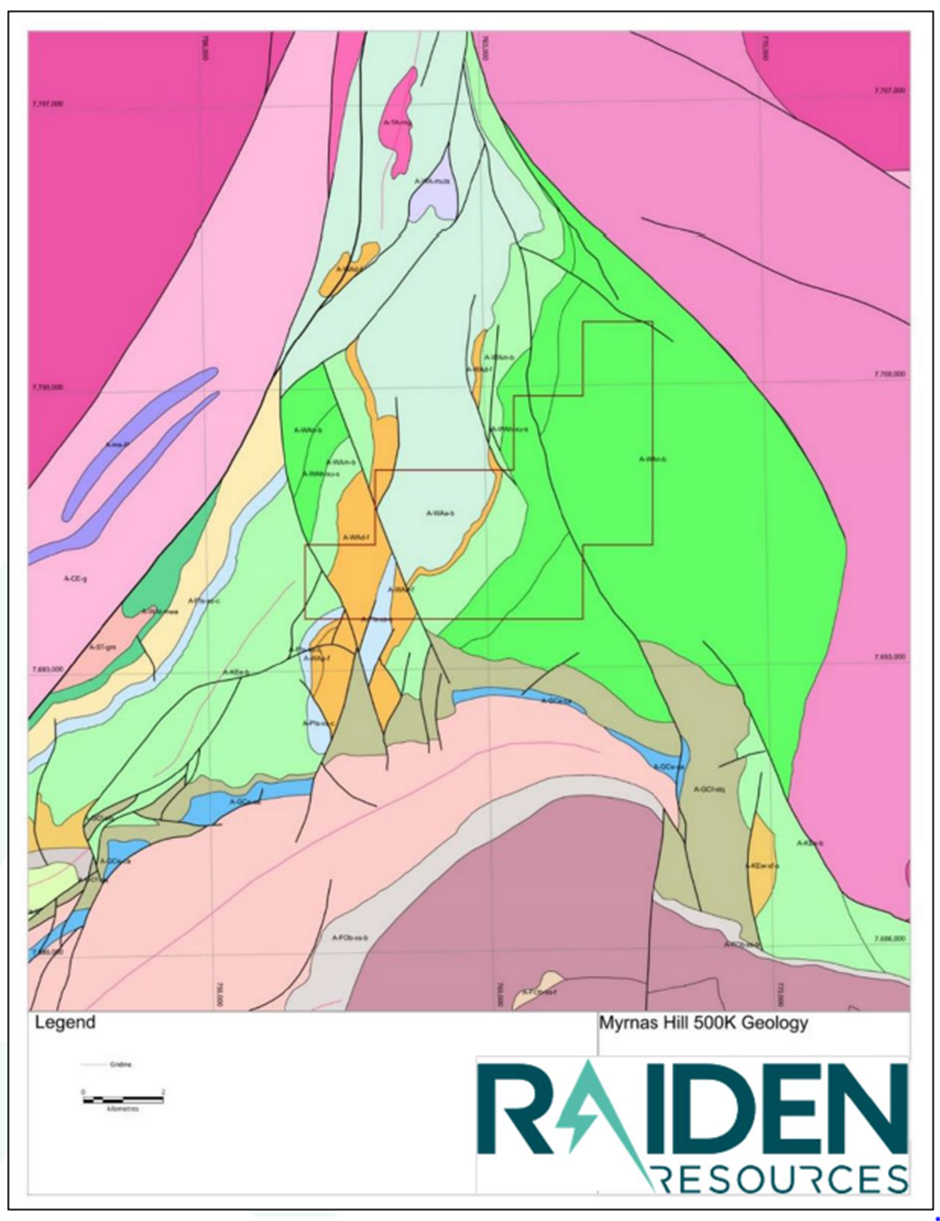

The Mynras Hill Project is a part of the E45/4907 licence and is located in the prolific Pilbara region of Western Australia, covering an area of 50km2.

Project location of Mynas Hill Project (Image source: RDN update, 25 August 2022)

Raiden is engaged in the exploration and development of precious metals, base metals and battery metals. Its flagship, Mt Sholl, is prospective for the nickel, copper, cobalt and platinum group of elements.

The bourse welcomed the latest move from the company, which could be seen in the movement of the company’s share price today. RDN surged 17.7% yesterday and was trading at AU$0.01 a piece on the ASX.

Binding term sheet details

Under the binding term sheet, Askari will acquire a 100% interest in the project. The deal would comprise cash consideration and the allotment of Askari shares to Raiden. Askari has been provided with a time period of five days to conduct due diligence and other legal and technical formalities before sealing the acquisition deal.

The payment terms will include:

- The allotment of AU$125,000 worth of Askari shares at a price equal to the higher of AU$0.45 or 5-day VWAP to be issued immediately prior to the date of Share Consideration is proposed. The allotted shares would have an escrow period of 90 business days from the date of issue.

- A cash consideration of AU$75,000.

Data source: RDN update, 25 August 2022

Divestment of non-core assets to increase focus on Mt Sholl & Arrow projects

The decision to divest the Mynras Hill Project came in the wake of increasing Raiden’s focus on its core projects in the Pilbara region, including the Mt Sholl and Arrow projects. The company has recently announced it will complete a 5-day heritage survey over the Mt Sholl Nickel Project on the 29th August 2022, followed by a 5,000m diamond drill program across the project.

Preparation for the upcoming drilling program over Mt Sholl is going at full throttle and raised AU$1.83 million through placements to fund exploration and development works on Mt Sholl.