Highlights

- Raiden has entered into a transaction with Arrow Minerals for lithium-caesium-tantalum (Li-Cs-Ta) rights over its 100% owned Arrow gold project.

- The Arrow project also has the potential for lithium bearing pegmatites, confirmed by historical li results and neighbouring explorers with defined lithium pegmatites.

- The Arrow project sits 30km on strike from De Grey’s (ASX:DEG) world class hemi gold deposit, so with the acquisition of these rights provides Raiden with interest in all minerals over the tenements.

- The transaction also assists in expanding the company’s lithium portfolio.

Australian mineral explorer Raiden Resources Limited (ASX: RDN / DAX: YM4) has entered into an agreement with Arrow Minerals Limited (ASX: AMD) for an option to either buy 100% of or earn into an 85% position in the lithium-caesium-tantalum rights on the Arrow project.

Data source: Company update

Under the deal, the company can earn-in to the project or acquire 100% interest in the project within three months, by making a cash payment of AU$250k and issuing AU$250k RDN shares to Arrow.

The project lies within a proven lithium-pegmatite district with defined lithium bearing pegmatites hosted in nearby projects. Historic exploration has identified fractionated and fertile granitic intrusions, which could produce Li-Cs-Ta bearing pegmatites, says the company.

Share price surge by over 16%

Triggered by the update, the company’s share price jumped by over 16.6% to trade at AU$0.014 at the time of writing on 7 August 2023.

Details of the transaction terms

As discussed above, Raiden can either earn up to an 85% interest or buy 100% interest of the project rights. If the company chooses the earn-in option, it is required to fulfil certain milestones and expenditure obligations.

Initial option period – For securing a 51% interest in the rights, RDN needs to incur AU$1 million exploration expenditure within three years from the execution of the agreement.

Second option period – For 75%, RDN has to bear AU$2 million exploration expenditure over an additional three-year period and make a cash payment of AU$150,000 or a share payment.

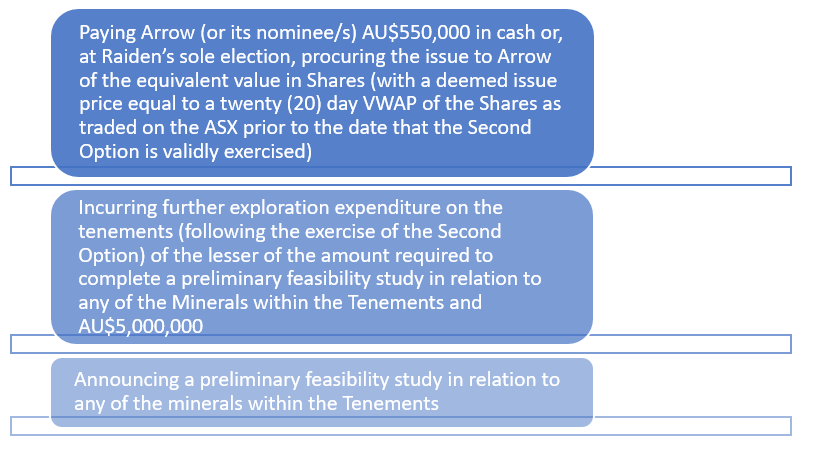

Third option period – RDN can exercise this option at any time during the two-year period commencing from the date of the third earn-in choice is provided for earn into an 85% interest, subject to fulfilment of following conditions –

Data source: Company update