Highlights:

- QX Resources (ASX:QXR) has updated on encouraging indications of significant areas with potential lithium-bearing pegmatites at its Turner River hard rock lithium project.

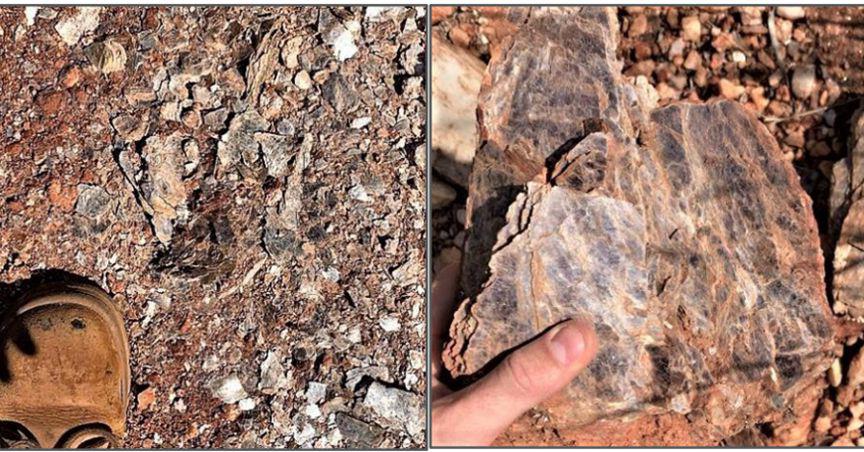

- The pegmatites were seen in drill pads and drill chips at the project.

- The development indicates the potential for a much larger target than previously sampled at surface, highlighted the company.

- So far, QXR has completed 564m via six holes as part of the maiden 1,500m RC drilling program.

- Results are anticipated in six weeks.

In a major development, QX Resources Limited (ASX:QXR) recently observed significant areas with potential lithium-bearing pegmatites at its fully owned Turner River project. The encouraging indications of these pegmatites were noted in drill pads and drill chips at the hard rock-type lithium project.

The indications extend beyond the area with previously reported high-grade rock chip samples of 1.6% Li2O, 1.1% Li2O and 4.9% Li2O.

(Image source: Company update, 15 December 2022)

Drilling indicates pegmatites and potential lithium-rich micas

So far, QXR has completed 564m via six holes of the maiden 1,500m reverse circulation (RC) drilling program at the project, holding close proximity to Mineral Resources’ Wodgina lithium mine.

The drilling operation targets the potential for either of the following:

© 2022 Kalkine Media®, Data source: Company update, 15 December 2022

QXR has intersected pegmatites and potential lithium-rich micas during the drilling campaign over an area of 400m x 300m in four drill “fences” at the project. As per the company, the intersection of pegmatites and potential lithium-rich micas has met the drill program aim.

The results are expected in six weeks.

QXR is also planning to extend the drill program further.

© 2022 Kalkine Media®, Data source: Company update, 15 December 2022

Share price: QXR shares were trading at AU$0.044 midday on 20 December 2022, highlighting an upward movement of 2.325% compared to the previous closing price. Its market capitalisation stood at AU$37.92 million.

Also Read: QX Resources’ (ASX:QXR) September quarter advances lithium exploration journey