Highlights

- A follow-up trenching campaign is planned at the Big Red Gold Project, Queensland.

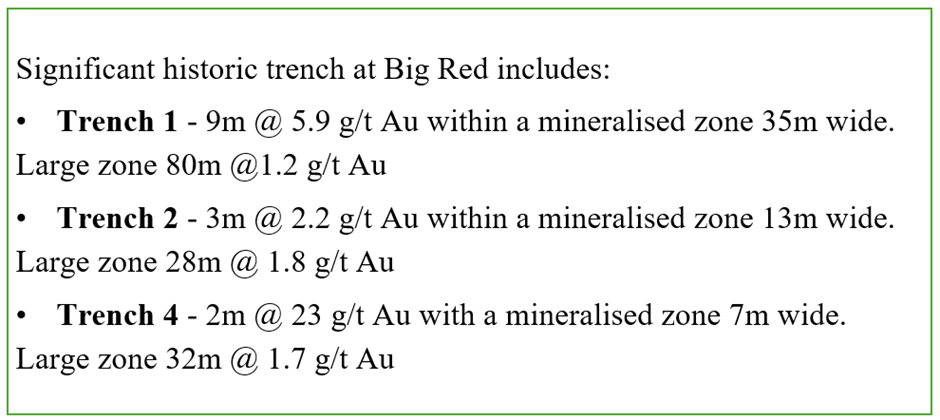

- Previous trenching at Big Red yielded significant high-grade gold results, including 9 metres at 5.9g/t Au.

- A reassessment of the potential of two shuttered open pit gold mines in underway which were last mined at gold prices below A$500/oz.

QX Resources Limited (ASX: QXR) is gearing up for a follow-up trenching program at the Big Red Project in Queensland to extend known high-grade gold mineralisation. Previous trenching at Big Red yielded high-grade gold results, including 9 metres at 5.9 g/t Au and 2m @ 23 g/t Au, with gold mineralisation open along strike potentially for up to 1200 metres.

The trenching is a preliminary stage, being undertaken before drilling, as part of a strategy to reassess the potential to reopen closed open-pit mines and additional drill targets, with the ultimate goal of future gold production.

Furthermore, the company has initiated a reassessment of two shuttered open pit gold mines, Belyando and Lucky Break, within its ground. These mines were closed when the gold price was less than AU$500/oz and now gold prices are seven times higher. Drilling data by previous explorers and QXR outline potential for down dip extensions to known gold mineralised zones and parallel features, along with extensions along strike.

Gold trenching planned at Big Red Project

At the Big Red Project, through new trenching, the company expects to extend the previously encountered two north-east trending elongate gold anomalous zones, which were defined over 650m. These zones might extend up to 1200m in length.

Data source: QXR update

The company believes that the potential of Big Red might be similar to the nearby Twin Hills deposit, which has 1.0Moz (23.1Mt @ 1.5g/t Au), and Lone Sister, which has 0.48Moz (12.5Mt @ 1.2g/t Au).

Reassessment Commences for the Belyando and Lucky Break gold mines

QXR holds approximately 100k hectares of leases in the Drummond Basin of central Queensland. It is an under-developed region with a vast history of ongoing gold mining and an endowment of more than 8.5mn ounces. This region started major gold companies, like Evolution, and is being explored currently nearby by Newmont.

The company’s leases include the Belyando and Lucky Break open pit gold mines, for which the company has commissioned updated resource modelling.

From 1989 to 1993, mining was conducted at Belyando within oxide and transition ore to a depth of around 60m and yielded 85,850 oz Au. From previous drilling, the industry experts confirmed extensions to the northwest, lying within a radiometric anomaly. The company informed that parallel mineralised features might be present as well.

From 1987 to 1988, Lucky Break was mined in the pit, reaching a depth of nearly 15m. During the period, it yielded 90Kt of ore at a diluted head grade of 2.4 g/t Au for almost 6,900 ounces of gold. The work identified extensions down dip and to the north and south. Also, a parallel mineralised feature to the east was revealed within a radiometric anomaly.

After the reassessment, both projects will require updated permitting guidelines.

QXR share price performance

Triggered by the update, QXR shares traded higher by 16% to AU$0.007 apiece at the time of writing in the morning hours on 25 June 2024.